Last Updated: April 2024

Global real estate as a whole is a vast $320+ Billion dollar industry. If you are not keen on getting hands-on with rental properties (Think: Tenants, Toilets, Trash), investing in publicly traded real estate companies is a great option for investors looking to gain exposure to the real estate industry without the hassle. Since real estate is an extremely broad category, investors have countless options of companies to invest in through the stock market.

3 Main Types of Real Estate Stocks

In real estate stock investing, there are 3 main ways to invest. From real estate industry company stocks, to REITs (Real Estate Investment Trusts), there are vehicles for all types of investors. We take a look at each type below:

Real Estate Industry Company Stocks

Real estate industry company stock investing represents companies engaged in activities that serve the real estate industry. These companies typically do not own properties, but provide valuable products and services to those that do.

REITs (Real Estate Investment Trust)

REIT Investing represents companies that own, operate, or finance income-producing real estate properties, offering investors an opportunity to invest in a diversified portfolio of properties without the hassle of direct property ownership.

Real Estate ETFs (Exchange Traded Fund)

Real estate ETF Investing involves investment vehicles that track and provide exposure to a diversified portfolio of publicly traded real estate companies, including Real Estate Investment Trusts (REITs) and property management firms.

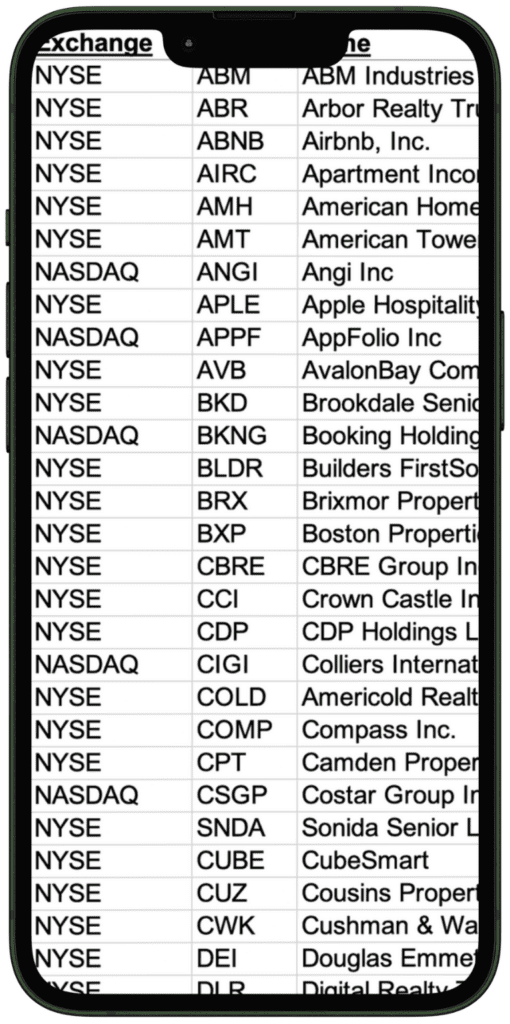

Top 20 Real Estate Stocks

There are many real estate stocks available to investors. Our curated list below includes all of the major stocks in the real estate industry, including their ticker symbol, company name, industry sector, and type of security (e.g. REIT, ETF, etc.).

Have a suggestion for this list? Contact Us for consideration.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

100+ List of Top Rental Real Estate Stocks

FREE $80.00 (Retail Value)

Our Researched and Hand curated List of Top Publicly Traded Rental Real Estate Stocks

What is Real Estate Stock Investing?

Real estate stock investing encompasses buying shares of companies involved in various aspects of the real estate sector, including Real Estate Investment Trusts (REITs), real estate ETFs, and stocks of companies providing real estate services or support.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Real Estate Stock Investing FAQ

Which is Better to Invest in – Physical Real Estate or Real Estate Stocks?

The decision to invest in physical real estate or real estate stocks depends on an individual’s financial goals, risk tolerance, capital availability, and desired level of involvement. Physical real estate offers tangible assets and potential rental income, but it also requires significant capital upfront and hands-on management. In contrast, real estate stocks provide liquidity, diversification, and a way to invest in real estate with less capital, but requires a thorough understanding of real estate finance and can be subject to market volatility. While both can offer attractive returns, they come with distinct risks, benefits, and responsibilities. Ultimately, the best choice hinges on personal preferences, expertise, and investment horizon.

| Criteria | Physical Real Estate | Real Estate Stocks |

|---|---|---|

| Initial Investment | High (down payment, closing costs) | Lower (cost of shares) |

| Liquidity | Low (time-consuming to sell property) | High (stocks can be sold quickly) |

| Income Source | Rental income | Dividends, capital appreciation |

| Management | Hands-on (unless using a property manager) | Passive (no direct property management) |

| Diversification | Limited to specific properties/locations | Broad exposure to various properties/sectors |

| Leverage | Can use mortgages to buy properties | Limited to trading on margin |

| Tax Benefits | Depreciation, mortgage interest deductions | Qualified dividends (for some REITs) |

| Volatility | Generally stable but can have regional fluctuations | Subject to stock market volatility |

| Long-term Appreciation | Property value growth | Stock value growth |

| Barriers to Entry | Higher (credit checks, property maintenance knowledge) | Lower (basic understanding of stock market) |

More Types Real Estate Investments

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.