Last Updated: April 2024

As an overlooked industry for many decades, self storage is now a highly sought after investment property due to its low operational overhead and high customer demand. Storage facilities range from outdoor warehouses to multi-story climate controlled indoor facilities. Below we take a deep dive into everything you need to know about self storage properties.

What is Self Storage?

Self Storage Definition

Self storage is the business of renting storage space, also known as “storage units,” to tenants, usually on a short-term basis. Self-storage tenants can include businesses and individuals

Self Storage Real Estate Explained

Self-storage is an industry that focuses on providing storage space for rent, usually on a short-term basis. Self-storage facilities offer a variety of unit sizes for rent, including specialty spots that can accommodate vehicles like cars, RVs, and boats. Rental periods for self-storage facilities are usually month-to-month, giving owners a great deal of flexibility compared to other commercial investment types. There are now over 50,000 self-storage facilities in the United States, with a total of over 2.3 billion square feet of storage space. Self-storage can be an excellent solution for people or businesses who need a place to store their belongings but don’t have the space in their home or business.

10 Types of Self Storage Properties

Storage is a ubiquitous term that has several types of sub-classes within it. Each has its own unique characteristics, which we explore below:

24-Hour Self Storage

24-hour self storage facilities give self storage tenants the ability to access their unit 24/7, usually 365 days a year. This storage type is valuable for people who work odd hours or those who may need to access whatever is being stored at a moment’s notice.

Business Self Storage

Many tenants in the self-storage niche are actually businesses. Prospective business storage tenants range from small to large businesses, storing a wide variety of items, from retail goods to business equipment and beyond. Many business tenants will also seek out 24-hour storage due to the ability to access goods and materials 24/7, 365, as business demand requires.

Climate-Controlled Self Storage

Climate-controlled storage units are designed to maintain a consistent temperature and humidity level inside the unit, which helps to protect your belongings from the elements. Most units are kept between 55 and 85 degrees Fahrenheit and have humidity levels between 30 and 50 percent. Some of the items that benefit from climate-controlled storage include furniture, electronics, musical instruments, artwork, photographs, antiques, books, and more.

Drive-Up Self Storage

Drive-up self-storage units are just like regular storage units, with the key difference that they’re located outside so that users can drive their cars right up to the door. This makes loading and unloading belongings a breeze, and users don’t have to worry about lugging their things up and down stairs or dealing with elevator access.

Military-Focused Self Storage

One of the hallmarks of military life is the fact that families must be able to pack up and ship out at a moment’s notice. Military families may utilize military-focused self storage to help make this process easier and more economical. Military families use this type of storage in a variety of moving and relocation-related situations, including Permanent Change of Station Storage, Temporary Duty Storage, and Temporary Additional Duty Storage.

Portable Container Self Storage

Portable container self storage has dramatically increased in popularity over the last decade or so. With a traditional storage model, your items are stored in a centrally located facility that you visit when you need to access your unit. Portable container self storage such as PODS, flips that model on its head. Instead, the storage company delivers the unit to your home or business, where you can store items as you wish. After the container is full, the company will bring it to whatever location you choose. This self storage type is great for moves or business relocations.

Vehicle Self Storage

Vehicle self storage facilities are among the most popular storage options used by consumers. As homes trend smaller and rent and home values go up, many vehicle owners simply do not have the space to keep their secondary cars, boats, RVs, ATVs, and other vehicles on hand. Business owners also utilize vehicle storage, from auto dealerships with an excess of cars to a boat repair shop that needs a place to store their latest project or even a storage space for a propeller plane or jet. Vehicle storage facilities range from a luxury indoor collector car facility such as Westside Collector Car Storage in Los Angeles, to simple unpaved outdoor lots, or a combination of both.

Cold Storage

Cold storage units are designed to regulate temperature at low levels, making them ideal for perishable goods such as food products, flowers, and certain medical supplies. This type of self-storage offers a controlled environment that ensures items are kept fresh and in optimal conditions, preventing spoilage and degradation. Investors interested in cold storage should note the increased costs associated with maintaining the necessary equipment and the importance of consistent power supply. Due to the perishable nature of items typically stored here, these units are often in demand by businesses that require reliable and efficient cold chain logistics.

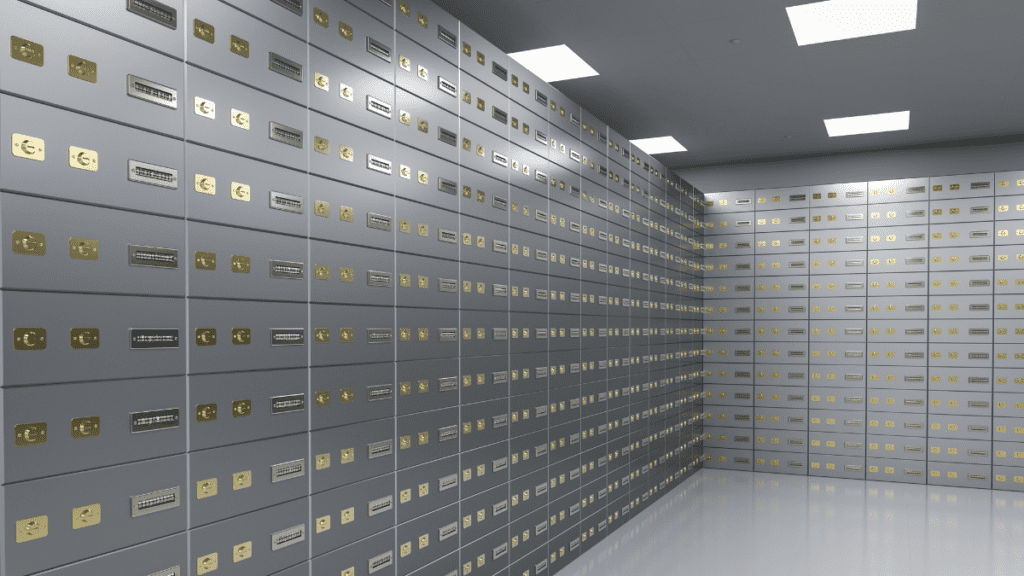

Vault Storage

Vault storage provides an ultra-secure environment, specifically tailored to safeguard valuable items like precious metals, jewelry, important legal documents, and family heirlooms. These units are fortified with advanced security features, including biometric access, surveillance systems, and often 24/7 monitoring. For investors, vault storage offers a premium service, attracting clientele who are willing to pay a higher price for peace of mind. Additionally, insurance considerations for vault storage properties can be unique, as they house items of significant value.

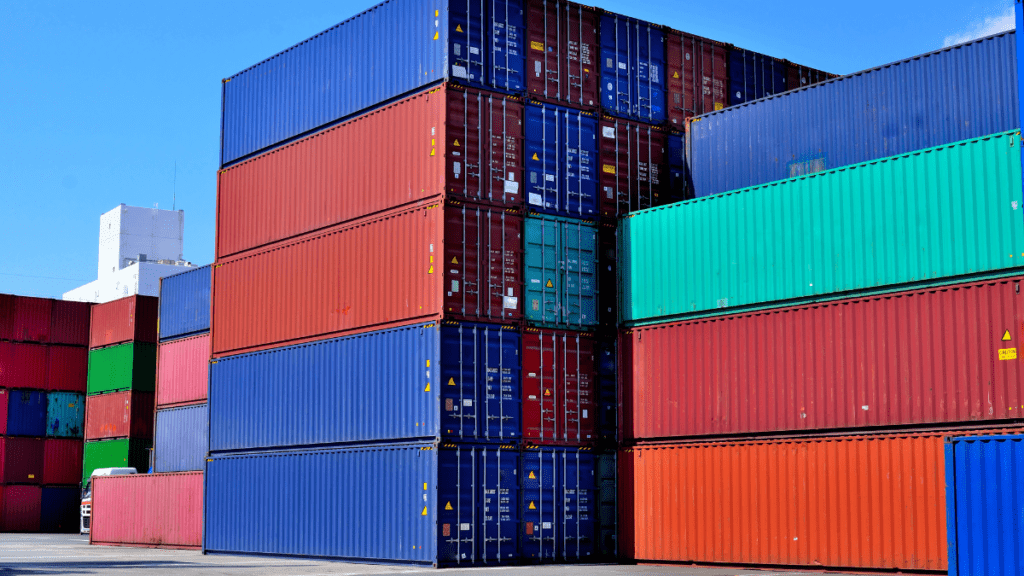

Container Storage

Containerized storage leverages traditional shipping containers, repurposed as standalone storage units, often seen in container yards or large open spaces. These rugged containers are weatherproof, providing a durable and versatile storage solution suitable for both personal and business use. Investors can benefit from the modularity of containerized storage, as containers can be added or removed based on demand, offering scalability. While they may not offer the climate control of indoor facilities, their robustness and flexibility make them a popular choice, especially in areas where space is abundant.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Self Storage Rental Property News

- CoStar Group Acquiring Matterport Spatial Property Data Company in $1.6 Billion Deal

- Blackstone Acquiring Multifamily Owner AIR Communities for $10 Billion

- Property Meld and Lula Launch ‘Vendor Nexus’ Program

Self Storage Property Management

If you are wondering how to manage a self storage property, look no further. Various aspects of the property such as its size, type, and location will determine the amount of complexity of management required, however with the right approach and an understanding of the fundamentals of the business, you can successfully manage your self-storage facility – or hire the best possible person or company for the job.

Top Self Storage Real Estate Tools

Self Storage Property Investing

Self Storage Investing Strategies

Investing in self-storage real estate has emerged as a lucrative asset class for those seeking diversified and resilient income streams. Self-storage facilities offer unique value by providing tailored storage solutions such as indoor, outdoor, vehicle, business, and more. Investors are drawn to the sector because of its defensive nature during economic downturns and generally lower maintenance costs compared to other real estate categories, making them an attractive option for long-term investment.

Financing Self Storage Purchases

Financing a self-storage property requires a deep understanding of commercial real estate finance and the unique attributes of the self-storage sector. Traditional commercial loans such as Small Business Administration (SBA) loans are common avenues to secure capital for purchasing these facilities. The type of self-storage property, be it drive-up, indoor climate-controlled, vehicle storage, or portable container storage, can influence the loan terms, interest rates, and the down payment required.

Top 5 Largest Self Storage Companies

The self-storage sector is a significant and growing segment of the real estate market, catering to the increasing demand for personal and business storage solutions. The largest self storage companies operating in this industry specialize in offering secure, accessible, and variously sized storage units to accommodate a wide range of customer needs, from individual belongings to large-scale business inventory. These firms are characterized by their strategic location choices, ensuring easy access for clients, and often incorporating advanced security and climate control features to protect stored items.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Self Storage Calculators

Self Storage FAQ

What is the History of Self Storage?

The basic concept of public self storage for rent is speculated to date back to over 6,000 years ago in China, where people would store their possessions in clay pots that were then stored in guarded underground pits for a fee. Fast forward to present day, and the modern version of self storage in the united states started coming to be in the early 1900’s. Two brothers (Martin Bekins and John Bekins) from Omaha Nebraska, started storing goods or help people move them across the state. As business grew, they moved to Los Angeles to start facilitating cross country moves. In 1906, the brothers built the Bekins Warehouse and later expanded these across southern California. In the 1950’s larger self-storage facilities as we see them today started to pop up across the US and have continued to grow and evolve.

More Types of Rental Real Estate

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal and/or financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.