Last Updated: February 2024

With the price of housing continually rising, the concept of house hacking has been steadily growing in popularity. The concept simply involves renting out part of your home to generate income. Similar to the BRRRR investing method, this type of real estate investment strategy has been around for decades, however it only recently received its trendy name. Below we take a deep dive into the house hacking rental real estate investing method.

What is House Hacking?

House Hacking Definition

House Hacking is a rental real estate investing strategy that involves renting part of the property out to generate income. House hacking has historically been the process of buying a multifamily property, living in one unit and renting out the others so that the tenants pay the owner’s mortgage. Recently this concept has expanded into other creative areas such as individual room rentals, parking space rentals, and even ADUs.

House Hacking Strategy

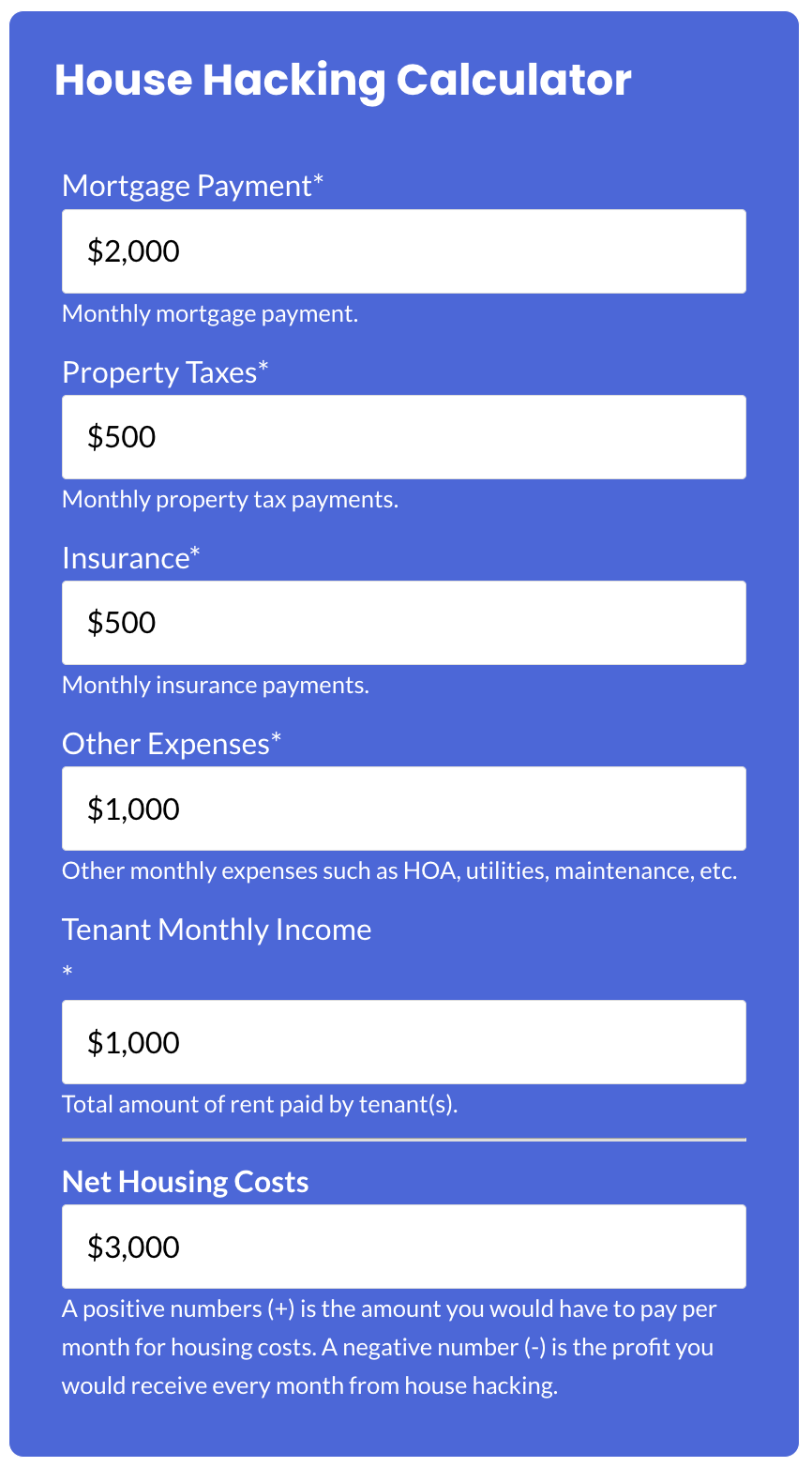

The strategy behind this approach to rental real estate investing involves an investor using a piece of real estate to generate rental income and/or reduce their living expenses at the same time. The goal of house hacking is to leverage the rental income from the other units to cover the mortgage, property taxes, property insurance and other property expenses, while simultaneously building equity in the property over time. By reducing overhead and/or their living expenses and generating income, investors can increase their cash flow and build long-term wealth through real estate.

House Hacking Pro Tips

1.Choose the Right Property: Search and find a property that is ideally located, has a layout that is conducive to house hacking, and meets your specific needs. Consider factors such as the number of units, square footage, and potential rental income.

2.Screen Tenants Carefully: As a house hacker, you will be sharing living space with tenants, so it’s important to select tenants who are respectful, responsible, and compatible with your lifestyle.

3.Manage the Property Effectively: Effective management involves responding promptly to tenant concerns, maintaining the property in good condition, and keeping accurate records of income and expenses.

What Type of Property to House Hack?

House hacking can be done on a variety of property types, but the most common ones are spare bedrooms of a single family house and multifamily properties such as duplexes, triplexes, and fourplexes. Other types of properties to house hack include:

- Spare bedrooms to roommates or short term vacation rental guests

- Accessory Dwelling Units (ADUs)

- Indoor and/or outdoor storage space rentals

- Parking and vehicle storage space rentals

- Mobile home rentals on a piece of land

Top 6 Ways to House Hack

House hacking is relatively straightforward in terms of how to get started. The strategy covers a broad choice of options to hack a residential property. Below we take a look at some of the most common ways to house hack.

Rent Out Rooms

Whether you rent an apartment or own a single family home, renting out spare rooms can help hack your housing expense or even help you build equity in your home. Renting out rooms can be longer term such as roommates, or short-term such as on platforms such as AirBnb. This type of house hacking is great if you are open to living with strangers or just starting out in rental real estate.

Multifamily Properties

If you are able to afford purchasing a multifamily property such as a duplex, triplex or fourplex, a popular house hacking method is to live in one of the units and rent out the others. An example of this would be to purchase a duplex, and live in one of the units while renting out the other. Not only can this help subsidize your living costs, but might also provide a net-positive monthly cash flow.

Build an ADU

An ADU (Accessory Dwelling Unit) is a secondary housing unit on a single-family or multifamily residential lot. Homeowners with a detached garage or a basement with a separate entrance could convert these existing spaces into a rental unit, or if space permits in a backyard, build an entirely new structure. ADUs need to follow a permitting process and be approved by the local building jurisdictions, but can be much more cost effective and quicker to build than a traditional structure.

Rent Out Extra Space

Perhaps you have plenty of land to rent out in the back of your home, or you live in the dense city and have a spare parking space that’s highly desirable. This method of house hacking is less demanding than other types, as you are essentially just providing storage. It is best practice to always put any type of rental agreement in writing, as well as check local zoning regulations and/or HOA rules beforehand.

Live-In Flip

Fix and flips are another type of real estate investment strategy, but “live-in flips” supercharge this investing method by taking it a step further. Houses that are being flipped usually take time to rehab, all the while the investor has to pay carrying costs to own it (i.e. mortgage payments). Live-in flips are when the investor lives in the house while it is undergoing rehab; assuming that it or a portion of it is at least livable.

Vacation Rental

Vacation rental house hacking involves using a portion of your residence, such as an attic, guest suite, or separate wing, as a short-term vacation rental property listed on platforms like Airbnb or VRBO. This approach allows you to capitalize on the growing market for vacation rentals, especially in tourist-friendly or high-demand areas. By offering unique and well-furnished spaces, you can attract a steady stream of guests, generating significant income.

Try Our

House

Hacking

Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

House Hacking Tools and Resources

Financing a House Hack

Securing a favorable mortgage to purchase your house hack investment property provides an important foundation, as it can directly impact cash flow potential, return on investment, and the overall financial success of the investment.

House Hacking Marketing

Buying the right property, leasing to the right tenants, and knowing when to sell are all important considerations for real estate investors looking to implement a successful house hacking strategy, as they impact the potential profitability and long-term success of the investment.

House Hacking Tenant Screening

Understanding proper tenant screening tools and best processes is a critical step in the house hacking process, as it helps investors select responsible and reliable tenants who will respect the property and contribute to the success of the investment.

House Hacking Tenant Laws

Understanding landlord tenant law such as the local rules and what types of documents to use, is crucial for house hacking investors to ensure compliance with regulations, maintain a professional relationship, and protect their legal and financial interests.

Pros & Cons of House Hacking

While there are several benefits to investing in rental real estate by house hacking, there are also some potential drawbacks that investors should be aware of. We take a look at the pros and cons of both below.

Pros of House Hacking

- Gain Landlord Experience – House hacking can be a great entry into the world of rental real estate and being a landlord. Being a landlord requires knowing a little about many different areas such as real estate finance, landlord tenant law, construction, and customer service.

- Cash Flow – As one of the primary motivators for house hacking, the extra income generated can help with a myriad of things. From pay down mortgage payments, providing extra spending money, or even to invest in more rental properties.

- Easier Financing – This one is a subtle but important key to rental property mortgages. If you apply for a mortgage for a rental property and live in one of the units, then the property is viewed as “owner-occupied” which typically unlocks better rates and terms.

Cons of House Hacking

- Lack of Tenant Privacy – This is one of the biggest drawbacks to this type of investing method. At the end of the day, it is important to remember that the rental is a business. However, it will sometimes be difficult to act like a landlord, over acting like a friend; especially when you are at home and have to resolve a difficult situation.

- Not Scalable – Since you only need one home, you are limited to the scalability of this type of investing venture. Having 4 or 5 house hacks simply does not make financial sense. Conversely, house hacking along with other types of real estate investing such as multiple buy and hold rental properties can definitely be a powerful investment strategy to build wealth.

- Property Management – Even if it is just 1 room, you are now a landlord and responsible for the property. This ranges the full scope of duties required by property managers from ensuring everything is working properly, to pursuing disciplinary actions on late rent payments.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

House Hacking FAQ

How to Setup Expenses such as Internet, Repairs, etc. in House Hacking?

Setting up expenses like internet, repairs, and other utilities in house hacking requires a strategic approach to ensure fairness and efficiency. For shared utilities like internet, it’s common to include these costs in the rent, or alternatively, divide the bill equally among all residents, including yourself, to maintain transparency. For repairs and maintenance, it’s advisable to establish a reserve fund by setting aside a percentage of the monthly rental income, which can be used to cover these expenses without impacting your personal finances, ensuring that the property remains in good condition and responsive to tenant needs.

How to Handle Maintenance When House Hacking?

When house hacking, it’s essential to establish a proactive maintenance plan to keep the property in good condition and respond quickly to tenant needs. This involves setting aside a portion of rental income for routine maintenance and potential repairs, and deciding whether to handle repairs personally or hire professionals. Effective communication with tenants is key, as is establishing clear procedures for reporting maintenance issues, to ensure timely and efficient resolution of any problems.

What Impact Does House Hacking Have on My Personal Privacy and Lifestyle?

House hacking can significantly impact personal privacy and lifestyle, as sharing a property with tenants means less personal space and potential noise and interruptions. It requires a balance between being accessible to tenants for any issues and setting boundaries to maintain your own privacy and lifestyle. Clear rules and respectful communication with tenants can help manage this balance, but it’s important to be prepared for a change in your living environment, especially if you’re accustomed to living alone.

More Rental Real Estate Investments

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.