Last Updated: April 2024

Parking lots can seem pretty boring to the untrained eye, but they can be a lucrative investment for the savvy investor. They range from a simple unpaved dirt lot in a densely populated area, to a multi-level structure located near an airport with a shuttle service and automated parking-space counters. Below we take a deep dive into everything you need to know about parking properties.

What are Parking Properties?

Parking Property Definition

A parking property (also called a parking lot, car lot, or car park) is a piece of land that is primarily used for short to medium term parking of motor vehicles (cars, trucks, etc.). This can include both public and private parking lots.

Parking Lots Explained

The fundamental idea behind parking lots is to generate revenue by renting space for people to park vehicles. Parking lots differ from self storage rental properties in that they are generally intended to be used for short to medium term parking. They range in complexity from a simple open lot, to a multi-story structure with automated space counting technologies. Successful parking properties are often found in dense areas where there is limited parking available. Revenues are dependent on the local demographics and type of property. A simple paved lot will have minimal overhead, however a garage with automated payment processing and parking management systems will have significantly different overhead costs.

7 Types of Parking Facilities

Parking facilities all serve the same purpose (a place to temporarily park your car), but they vary by type and each type has its own unique characteristics. We explore the most common types of parking lots below:

Surface Lot

A surface parking lot is a site, or a portion of a site, that is used for ground-level off street parking of vehicles located on ground-level, and is usually not covered by a structure. A surface parking lot may be owned by an investor, private individual, business, or government entity. These lots often sit in busy downtown areas, near transit lines or commercial districts. They can be gated or monitored electronically, and cars are either parked by drivers or valets.

Parking Garage

A parking garage, also known as a car park, is a structure that is specifically built for off-street vehicle parking. Parking garages are usually built near high-traffic areas, such as retail shopping centers, office buildings, and stadiums. They typically have multiple levels and may include features such as electric vehicle charging stations and car wash facilities.

Parking garages are an essential part of many cities and towns, as they provide a convenient and safe place to leave vehicles. They can also help to reduce traffic congestion and pollution, as people are less likely to drive around looking for a parking spot. In some cases, parking garages may also offer discounts or other incentives to encourage people to use them or monthly or yearly rentals of spots to specific customers, particularly in high-density cities like NYC and San Francisco.

Types of Parking Garages

Single Level Parking Garage

These are very similar to your standard parking lot, with the added bonus of protection from the weather. They typically have a floor-to-floor height from the ground to the second level of roughly 10.5 to 11.5 feet. They’re typically best utilized in low-traffic, low density areas.

Multistory Parking Garage

These structures rise above ground and can be several stories tall while housing thousands of cars. While designs vary, the most common layout is various levels with ramps to move from one level to another. These are more well-suited to high traffic areas, particularly those attached to large businesses like malls or airports.

Underground Parking Garages

In many areas, there is not enough space above ground to create sufficient parking. Underground lots fill this need, whereby there are several subterranean floors of parking below ground. These types of parking garages usually reside underneath large structures and require sufficient ventilation systems for the enclosed spaces.

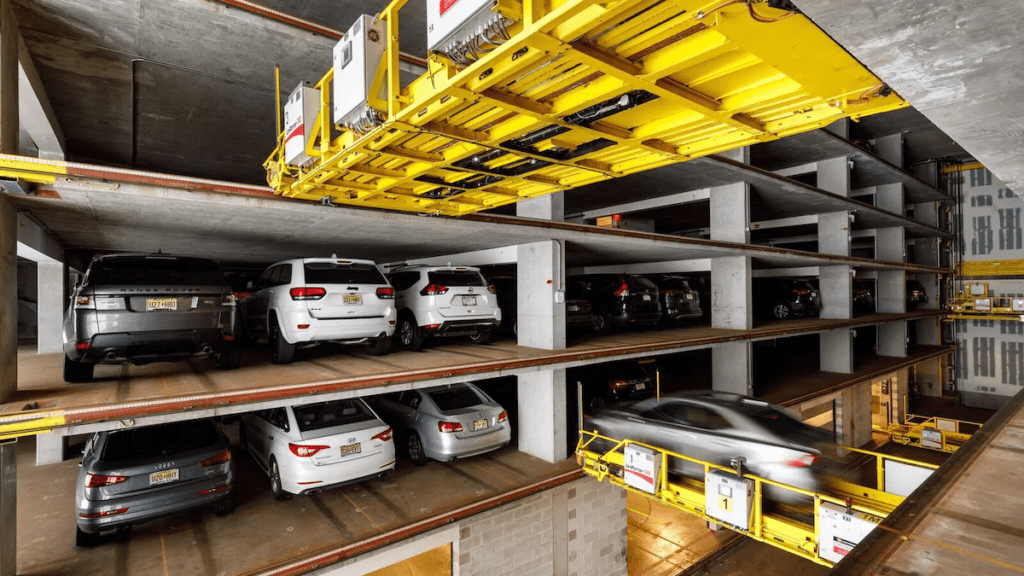

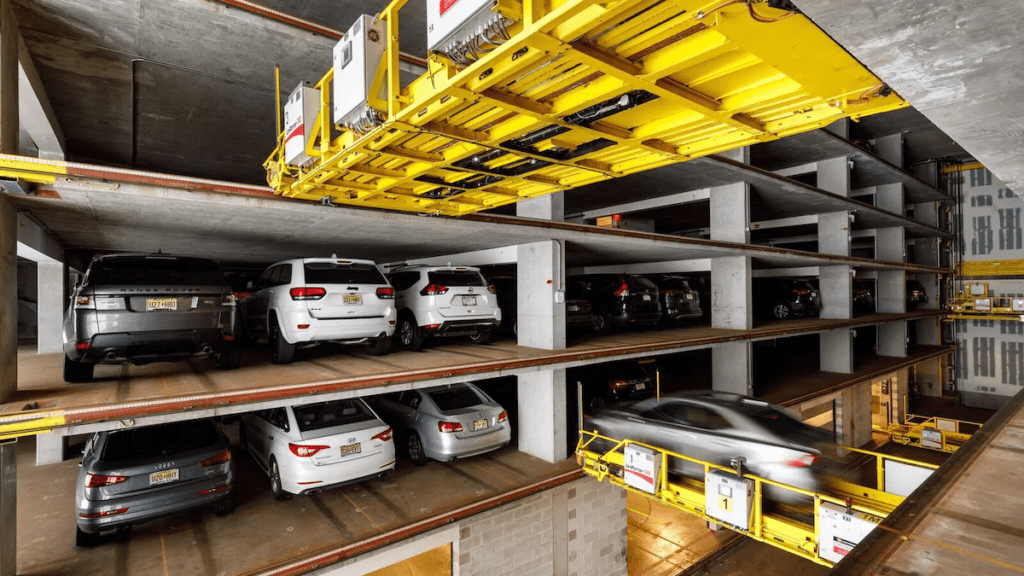

Automated Parking Systems

Automated parking systems (APS) are automated, and/or robotic, parking garages that are growing in popularity to utilize valuable building-space while increasing parking ease and efficiency. Robotic systems move cars throughout a structure to the next available spot, which can be horizontal or vertical, depending on space considerations and user needs.

Valet Parking

Valet parking stands out as a premium service in the realm of parking lot real estate, often associated with luxury establishments, upscale events, or areas with limited parking. Unlike traditional parking facilities, valet parking requires operational management, as attendants are responsible for vehicle retrieval and storage. From an investment perspective, these lots can command higher pricing due to the convenience and personalized service offered to patrons. However, it’s crucial for investors to factor in additional costs, such as liability insurance and staffing. Strategically located valet parking, especially in high-demand urban areas or at elite venues, can offer investors a distinctive edge in the competitive parking lot real estate market.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Parking Lot Rental Property News

- CoStar Group Acquiring Matterport Spatial Property Data Company in $1.6 Billion Deal

- Blackstone Acquiring Multifamily Owner AIR Communities for $10 Billion

- Property Meld and Lula Launch ‘Vendor Nexus’ Program

4 Components of a Parking Lot

Parking lots are more than just open spaces for vehicles; they are intricately designed and managed facilities that prioritize user experience and efficiency. Key components work cohesively to ensure smooth operations, from the moment a vehicle enters to the time it exits. Below we explore the 4 fundamental elements that shape the dynamics of a parking lot.

Layout

The layout of a parking lot determines the efficient flow of vehicles and maximizes space usage, factoring in elements like parking stalls, traffic lanes, and pedestrian walkways. A well-designed layout can enhance user experience, reduce chances of accidents, and optimize the number of vehicles the lot can accommodate.

Access Control

Access control ensures that only authorized vehicles can enter or exit the parking facility, commonly achieved through gates, barriers, and ticketing systems. Implementing effective access control can reduce unauthorized use, manage traffic flow, and even contribute to the revenue stream if it’s a paid facility.

Payments

The payment system in a parking lot can range from traditional cashier booths to automated pay stations or even digital apps, catering to short-term or long-term parking users. Streamlined and diverse payment options not only enhance user convenience but also facilitate quicker turnover and potentially increase revenue.

Security

Security measures in parking lots, such as surveillance cameras, patrolling guards, and emergency call stations, are crucial to deter theft, vandalism, and other potential threats. Providing a safe environment for both vehicles and users enhances the lot’s reputation and can be a decisive factor for patrons choosing where to park.

Parking Property Management

Since each property is different, how to manage a parking lot property will depend on various aspects such as its size, type, and location. In recent years, the simplicity of parking rental properties have brought about much automation in terms of payment and space tracking. Having a property management company that is both tech savvy and can handle the unique circumstances of your lot will greatly contribute to both increased customers and profitability.

Top Parking Real Estate Tools

Parking Real Estate Investing

Parking Lot Investing Strategies

Investing in parking lot real estate taps into the ever-present demand for vehicle storage. These properties often require lower maintenance and overall simpler asset management. With various types available, there’s diversity in investment choices tailored to different budgets and risk appetites. The value and revenue potential of such investments are influenced by factors like location, accessibility, and local infrastructure.

Financing Parking Property Purchases

Financing parking lot properties is a crucial step for investors eyeing this real estate asset class. Traditional lenders, like banks, often provide loans for such acquisitions, but the terms and interest rates may vary based on the property type, be it surface lots or parking garages. Additionally, private lenders or real estate investment groups can be alternative sources of funding, especially for larger or more complex projects.

Top Parking Companies 2024

The parking real estate sector is a specialized and vital part of urban infrastructure, dealing with the development and management of parking facilities. The largest parking companies in this field play an important role in addressing the demand for efficient and accessible parking solutions in densely populated areas and commercial centers. Beyond mere vehicle storage, these companies are increasingly focusing on the integration of multi-purpose spaces, adapting to the evolving needs of modern cities and their inhabitants.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Parking Lot Rental Calculators

Parking Lot FAQ

What is the History of Parking Lots?

As it can be assumed, parking lots only date back to the introduction of motor vehicles – specifically the Ford Model T that was first introduced en masse in the early 1900’s. This period of American society saw the first wave of motor vehicles introduced to the general public. At the turn of the 20th century, without any type of formal parking rules, cars were being left unattended on public streets and started becoming a major problem for densely populated cities. After urban planners took hold of the issue in the 1920’s, modern style parking lots emerged that were owned and managed by private commercial and retail associations, or owned by public entities and maintained by private operators. To this day, parking lots are still owned and operated by a mix of both public and private operators to facilitate commercial enterprise.

More Types of Rental Real Estate

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal and/or financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.