Last Updated: January 2024

Buying or selling a rental property is often thought to be a complex and challenging process, but with proper planning and understanding of rental property marketing, it doesn’t have to be. The process of buying or selling a rental property involves the coordination of many different components that need to fall into place in order to successfully close a sale.

Types of Rental Property Sales

Residential Rental Property Sales

Residential rental property sales, whether buying or selling, requires in-depth market analysis and strategic financial planning. For buyers, it involves selecting the right property, understanding financing options, and anticipating tenant demand, while sellers must focus on optimizing property value, navigating legal complexities, and effectively marketing the property.

Commercial Real Estate Sales

Buying and selling commercial real estate is a complex process that requires a deep understanding of market trends, property valuation, and investment strategies. Buyers analyze factors like location, potential rental yield, and property type to ensure a profitable investment. Sellers, focus on optimizing the property’s value, crafting favorable transaction terms, and employing effective marketing tactics.

How to Buy a Rental Property?

Buying a rental property is an exciting and lucrative endeavor that requires significant planning before making the final purchase. Many steps need to be completed beforehand include assessing financial viability, investment analysis, and much more.

How to Sell a Rental Property?

Selling a rental property should be an event that is strategically planned out beforehand. The process requires careful analysis of the property before listing it, as well ass skillfully navigating negotiations. However, when done correctly, a sale can generate significant financial profits.

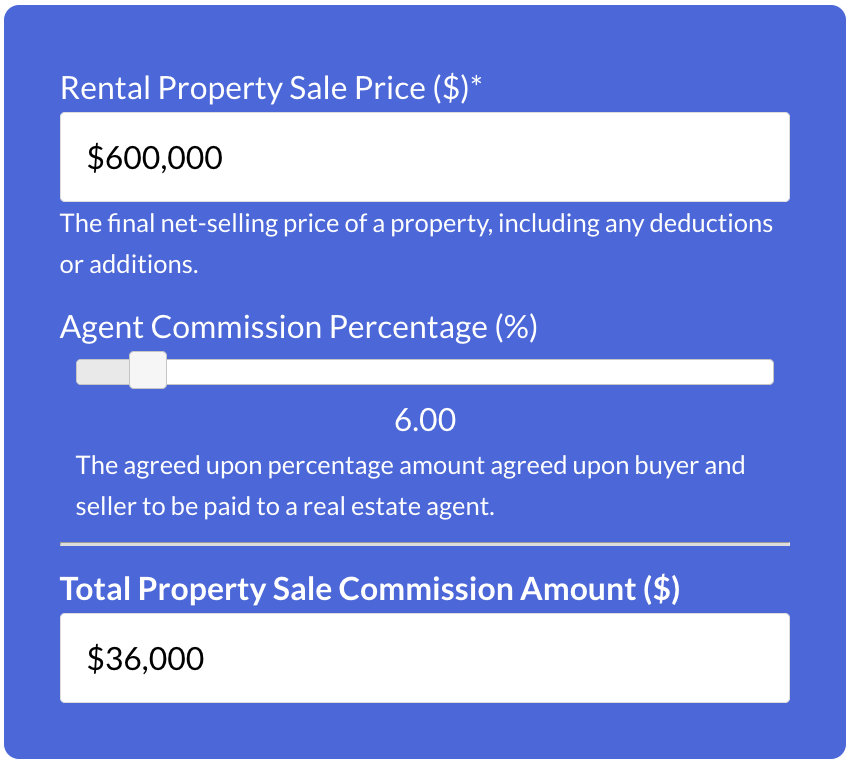

Try Our Rental Property Sale Commission Calculator →

100% Free – No Sign Up Required

Using a Real Estate Agent to Buy or Sell a Rental Property

Using a real estate agent to buy or sell a rental property can be a smart choice for landlords, whether they have a residential or commercial property. Rental real estate agents provide valuable assistance with many aspects such as marketing a property for sale, finding new properties for sale, and helping investors negotiate contract terms.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Best Websites to Buy and Sell Rental Properties Online

The search to buy and sell rental properties is now done almost exclusively online. Online real estate listing websites have millions of listings with properties available to buy or sell. These websites are typically free for potential buyers to browse, but most charge the property owner a fee to list their property on the site. If you hire a real estate agent, they usually syndicate it across many platforms at no additional charge.

Rental Property Sales FAQ

When is the Best Time to Buy a Rental Property?

The best time to buy a rental property is when a buyer has financial stability, favorable market conditions (see more below) and their investment goals align with the likelihood of positive rental income and future appreciation potential of the property. Achieving these prerequisites, requires consideration of many factors such as the local real estate market, macro economic conditions, and personal financials . In general, buying a rental property during a buyer’s market, which is when there are more properties available for sale than there are buyers, can provide more bargaining power and potentially lower purchase prices. Additionally, when interest rates are low, buyers may be able to secure more favorable financing terms.

When is the Best Time to Sell a Rental Property?

The best time to sell a rental property is when it aligns with the owner’s financial situation, investment goals, and the current market conditions. If you need the capital right away then as soon as possible is probably the most logical timing. If you are not in a rush to sell, then strategically timing when to sell can help maximize profits. In general, selling a rental property during a seller’s market, when there are more buyers than available properties, can provide greater demand and potentially higher sales prices. Additionally, when interest rates are low, buyers may be more motivated to purchase a property, which can create more competition among buyers.

Taxes When Selling a Rental Property

Tax implications are an important consideration when selling a rental property. Owners must understand the tax laws that apply to the sale of rental properties and the potential tax liabilities that may arise. Depending on the circumstances, owners may be subject to capital gains tax, depreciation recapture tax, or other taxes associated with the sale of rental property. However, owners may also be eligible for tax benefits such as deductions for expenses related to the sale or a 1031 exchange, which allows owners to defer taxes by reinvesting the proceeds from the sale into a similar property. It’s important to consult with a tax professional to fully understand the tax implications of selling a rental property and to explore any potential tax benefits.

Selling a Rental Property With Existing Tenants

Selling a rental property with existing tenants can be a delicate process that requires careful consideration and planning. Owners must balance their desire to sell the property, along with the tenants’ right to peaceful enjoyment of their living space. It’s important to understand the legal rights and obligations of both parties before listing the property. Owners must give tenants proper notice before showings and respect their privacy during the sales process. Additionally, owners must disclose any information about the sale and any changes that may impact the tenants, such as new owners or rent increases. By communicating clearly and transparently with tenants, owners can successfully navigate the process of selling a rental property with existing tenants.

Should you Sell a Rental Property For Sale by Owner (FSBO)?

Deciding to sell a rental property as For Sale by Owner (FSBO) can be a tempting option for those looking to save on commission fees. However, it is important to consider the time, effort, and expertise required to successfully sell a property without a real estate agent. Owners must be willing to handle all aspects of the sales process, including accurately pricing the property, marketing it effectively, and skillfully negotiating with potential buyers. This requires a strong understanding of the local real estate market, real estate law, and effective sales strategies. For those with the necessary skills and experience, selling a rental property FSBO can be a viable option. However, for those who are unfamiliar with the sales process or lack the time and resources to devote to it, working with a real estate agent is usually the safer and more effective choice.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.