Last Updated: April 2024

Tenant improvements in commercial rental properties involve customizing or upgrading rental spaces to meet the specific needs and preferences of tenants. These enhancements, ranging from minor aesthetic changes to major structural alterations, play a crucial role in optimizing the functionality and appeal of commercial spaces. The process of tenant improvements requires careful consideration of budgeting, design, legal compliance, and sustainability.

What are Tenant Improvements (TI)?

Tenant Improvement Definition

Tenant improvements, commonly referred to as simply “TI” or leasehold improvements, are modifications made to rental premises in order to customize the space for the specific needs of a tenant. These rental property construction improvements can include changes to walls, floors, ceilings, lighting, and other interior components, and are usually undertaken before or during a tenant’s occupancy.

Tenant Improvements Explained

Tenant improvements refer to changes or upgrades made to a rented space, such as an office, retail store, or other commercial property. These changes are tailored to meet the specific needs and preferences of the tenant, or the business renting the space. Common improvements include constructing new walls, laying down new flooring, and installing updated lighting systems. Additional enhancements might involve adding custom shelving, painting, or fitting out specific areas for unique business needs. Before any work begins, the tenant and landlord must come to an agreement on what changes will be made. This agreement ensures that both parties are clear about the scope and nature of the improvements. Such enhancements are essential for making the rented space more functional, attractive, and suitable for the tenant’s business operations.

What are Tenant Improvement Allowances (TIA)?

A tenant improvement allowance (also called TIA) is a set amount of money provided by a landlord to cover or offset the costs of renovations and improvements a tenant makes to a leased space. It is usually expressed in a per-square-foot or total dollar sum. This allowance is typically negotiated as part of a commercial lease agreement and is used to customize the space to suit the tenant’s specific business needs. The exact amount of the allowance varies based on factors such as the length of the lease, the condition of the property, and market standards.

How Do You Calculate Tenant Improvement Allowances?

Try Out Our Tenant Improvement Allowance Calculator →

100% Free – No Sign Up Required

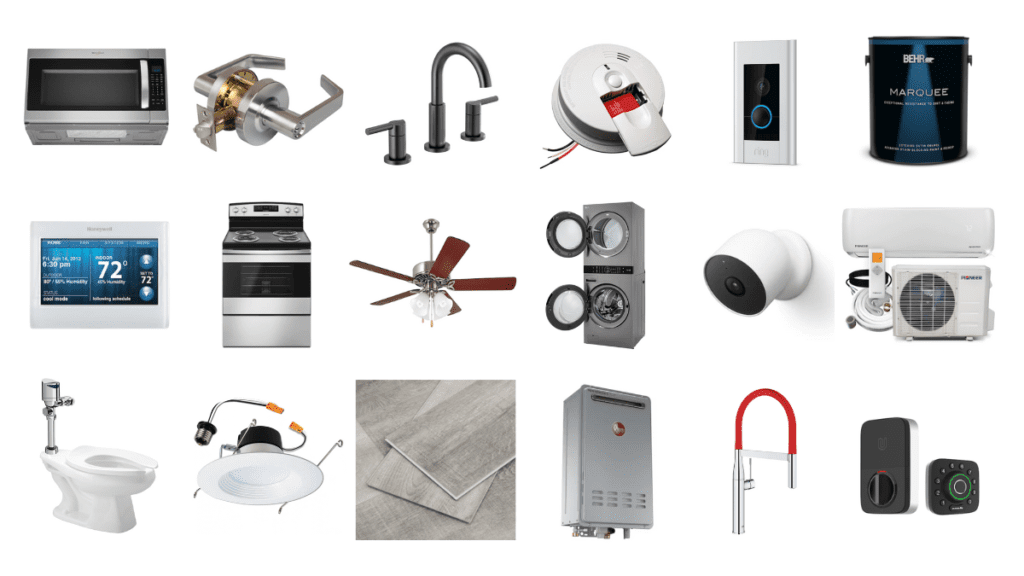

What Does TI Cover?

Tenant improvements typically cover a range of expenses associated with customizing a commercial rental space to suit a tenant’s specific needs. This includes hard costs like construction work, electrical and plumbing upgrades, flooring, and built-in fixtures. It also encompasses soft costs such as design and architectural fees, permits, legal expenses, and project management costs. If a Landlord provides a tenant improvement allowance, they will typically define upfront what the tenant improvement allowance can be spent on.

Hard Costs

Hard costs refer to the direct, tangible expenses associated with the physical construction and alteration of a leased space. Hard costs are generally accepted, as they are the result of improvements that will be left behind once the tenant leaves, which could be a direct benefit to the landlord. These costs often include:

- Demolition and removal of existing structures.

- Construction of new walls or partitions.

- Electrical wiring and lighting fixtures installation.

- Plumbing work, including new fixtures or reconfiguration.

- Flooring installation or replacement.

- Ceiling repairs or modifications.

- Painting and wall finishes.

- HVAC (Heating, Ventilation, and Air Conditioning) system upgrades.

- Installation of doors and windows.

- Built-in cabinetry and custom shelving.

Soft Costs

Soft costs are the indirect expenses not directly tied to physical construction, but essential for project completion and compliance. Soft costs may not be as directly beneficial to the Landlord, but are a necessary part of the build-out process (such as a construction management fee). These costs often include:

- Architectural and design fees.

- Engineering consultation fees.

- Legal expenses, including lease review and negotiation.

- Permitting and licensing costs.

- Project management and oversight fees.

- Environmental assessments or studies.

- Insurance during the construction phase.

- Utility setup or transfer fees.

- Marketing or branding expenses related to the space.

- Technology and software costs for design and project management.

What Does TI Not Cover?

Landlords are typically hesitant to allocate tenant improvement (TI) allowances for expenses that are highly specific to a tenant’s individual business needs, especially if these improvements do not add lasting value to the property. This includes enhancements that are not permanent or do not appeal to future tenants, as they do not offer a long-term benefit to the landlord. However, in certain cases to attract and retain tenants, landlords may agree to use a small portion of the TI allowance for such expenses.

Examples of Costs Generally Not Covered by TI:

- Personalized or Branded Furniture: Customized furniture that reflects the tenant’s brand or aesthetic.

- Specialized Electronic Equipment: Specific tech devices unique to the tenant’s operations.

- Custom Data Cabling: Unique data and communication wiring that isn’t standard for the building.

- Moving Expenses: Costs associated with relocating the tenant’s business to the property.

- Unique Decor and Art: Personalized decorations or art pieces that reflect the tenant’s brand.

- Temporary Structures: Any non-permanent installations that are specific to the tenant’s use.

- Business-Specific Appliances: Equipment unique to the tenant’s industry or operational needs.

- Exterior and Interior Signage: Signage that specifically advertises or brands the tenant’s business.

- Custom IT Infrastructure: Proprietary technology setups that aren’t standard for other tenants.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Tenant Improvement Space Design

In comparison to the arduous task of rental property development, tenant improvements allow tenants to modify existing spaces to meet their specific needs. The design process of these spaces requires a careful balance of understanding the tenant’s unique business requirements, ensuring the space remains flexible for future changes, and adhering strictly to relevant regulations and building codes. Mastery in these areas results in a space that is not only functional and efficient but also aligns with the long-term objectives of both the tenant and the landlord.

Understanding Tenant Needs

The foundation of effective tenant improvement design lies in comprehensively understanding the tenant’s operational needs and goals. This includes assessing their business type, employee workflow, customer interaction, and any specific industry requirements. A design that resonates with these needs not only enhances functionality but also contributes to the tenant’s business success.

Flexibility and Scalability

Designing for flexibility and scalability is pivotal in accommodating the evolving nature of businesses. This approach ensures that the space can be easily adapted or expanded in the future, without significant disruptions or additional costs. Incorporating elements like modular furniture and versatile layout plans are key strategies in achieving this adaptability.

Compliance with Regulations

Adhering to regulatory compliance is a non-negotiable aspect of tenant improvement design. It involves ensuring the design meets local building codes, safety standards, and accessibility requirements, such as those outlined in the Americans with Disabilities Act (ADA). A compliant design not only ensures legal adherence but also guarantees a safe and accessible environment for all users.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Tenant Improvement FAQ

Who Completes a Tenant Improvement Build-Out?

In commercial tenant improvements, the build-out is typically completed by contractors hired either by the landlord or the tenant, depending on the terms of the lease agreement. The landlord often oversees major structural changes or improvements that affect the building’s core and shell, ensuring consistency with the building’s overall standards. Meanwhile, tenants may hire their own contractors for specific, customized work within their leased space, particularly for alterations tailored to their unique business needs. The choice of contractor and the division of responsibilities should be clearly outlined in the lease agreement to avoid any confusion during the build-out process.

How to Negotiate TI for Landlord?

When negotiating tenant improvements (TI) as a landlord, it’s important to aim for a balance between minimizing costs and ensuring a satisfactory agreement for both parties. The primary goal for landlords should be to manage expenses effectively while also considering the tenant’s needs. Key strategies during these negotiations include:

- Cost Management: Strive to minimize the extent of tenant improvements and any rent abatement periods to protect the financial interests of the property owner.

- Regulatory Compliance and Transparency: Ensure that the tenant secures all necessary permits and provides a detailed plan of the proposed build-out, maintaining clear communication throughout the process.

- Project Oversight: Retain a level of control over the build-out process to ensure that the work aligns with the property’s standards and long-term value.

How to Negotiate TI for Tenant?

When negotiating tenant improvements (TI) as a tenant, it’s important to advocate for your business’s specific needs while maintaining a balance with what is economically feasible for the landlord. To achieve a favorable outcome, tenants should:

- Aim for Adequate Allowance: Strive to secure a TI allowance that fully covers the cost of the planned improvements, ensuring that the space meets your business’s operational requirements without excessive out-of-pocket expenses.

- Control Over the Build-Out: Negotiate for a significant degree of control over the build-out process. This includes selecting contractors, overseeing the project timeline, and ensuring the improvements align with your business’s specific needs.

Alternatives to a Tenant Improvement Allowance – Rent Abatement

In situations where a landlord is reluctant to provide a tenant improvement (TI) allowance, an alternative strategy is to negotiate for a rent abatement. Rent abatement involves granting the tenant a period during which they are exempt from paying rent, effectively reducing their overall leasing costs. This arrangement can be particularly advantageous for tenants, as it provides financial relief that can be redirected towards funding their own improvements. Essentially, rent abatement acts as a form of indirect support for tenant improvements, offering a compromise that benefits both parties – tenants receive a financial buffer to manage improvement costs, while landlords can avoid the direct expense of a TI allowance. It’s important for tenants to clearly understand the terms of the rent abatement, including its duration and any conditions attached, to ensure it effectively offsets their improvement expenses.

More Rental Property Construction Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal and/or financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.