Last Updated: April 2024

Rental real estate is all about generating profits from cash flowing investment rental properties. In order to successfully generate a profit, investors should have an understanding on the topic of rental real estate finance, which covers many sub-topics ranging from mortgages, taxes, investing, financial analysis, and more. Below we take a deep dive into these main topics that make up rental real estate finance.

Rental Real Estate Investments

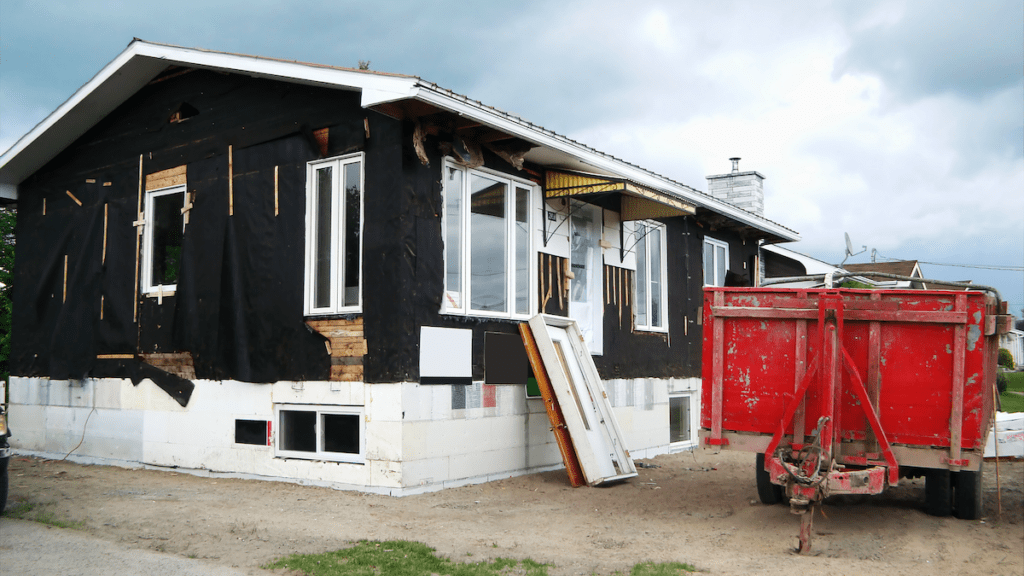

Investing in rental real estate now stretches far beyond the common thought of purchasing an apartment or renting out your old single family house. While that method still works very good, not everyone wants to nor can afford to invest the large amounts of time and capital needed to successfully undertake a rental property remodel project. Thanks to the rise of the internet and stock market, new and creative ways to invest in rental real estate have risen in popularity and accessibility. Nowadays, almost anyone can start investing with publicly traded real estate stocks on their phone, or even participate in a syndication deal to get in on a large rental property investment previously out of reach.

Financing and Mortgages

Purchasing a rental property requires a lot of capital. With investment property prices in the hundreds of thousands or even millions of dollars, it is very common for investors to use financing (i.e. a mortgage loan) to acquire an asset. By utilizing a mortgage, investors are also able to capitalize on the benefit of “leverage” but using borrowed money at a reasonable interest rate, to generate more money. Many different types of mortgage products exist, serving different rental property types and purposes.

Rental Property Taxes

Rental property taxes are a major financial component of governmental tax system and individual taxpayers. In the United States, taxes are applied to rental properties in the form of a State Property Tax (if applicable) and Federal Income Tax on profits from income. While rental property income must be claimed on your taxes, there are many deductions provided to rental real estate investors that can greatly reduce the income tax obligations on your profits.

Rental Property Insurance

Insurance is not only an expense, but often a requirement in real estate investing. Rental property insurance is specifically designed to protect landlords, their properties, and the tenants residing in them. Rental property insurance policies typically provide coverage for damage to the dwelling and personal property, as well as accidental injuries that can occur on the property.

Real Estate Finance Software

Rental Property Accounting Software

Rental property accounting software helps property owners, property managers, and tenants track rent payments, property expenses, and other real estate related accounting.

Investment Management Software

Real estate investment management software is used for financial management, investment strategy planning and asset analytics of investment real estate portfolios.

Top Real Estate Finance Tools

Top Real Estate Finance Companies

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Rental Real Estate Finance News

- CoStar Group Acquiring Matterport Spatial Property Data Company in $1.6 Billion Deal

- Blackstone Acquiring Multifamily Owner AIR Communities for $10 Billion

- Property Meld and Lula Launch ‘Vendor Nexus’ Program

Real Estate Finance Calculators

Other Rental Real Estate Topics

Deal Analysis & Underwriting

Real estate investments are expensive endeavors that require thorough rental property analysis. Underwriting activities can range from investor proformas on profit potential, to lender assessments of investor creditworthiness. Advanced analysis also includes determining cash flows, cap rates, cash-on-cash returns (COC), Tax Consequences, and more.

Appraisal & Valuation

Rental real estate appraisal and valuation are extremely important steps in any rental property transaction, as well as an important tool for real estate investors to possess when buying, selling and seeking financing. Appraisals are performed by licensed professionals who determine accurate values based on both a physical inspection and comparable market data.

Operations & Budgeting

Operating a rental property is the same as operating a regular business. It requires setting budgets and monitoring operational costs in order to ensure there is profitability for the owners. When done correctly, stringent financial management often equates to higher property valuations and easier financing approvals. Other rental property operational factors include occupancy, tenant creditworthiness, maintenance expenses, and more.

Financial Statements

Rental property financial statements help landlords, investors, and property management companies understand the financial health and performance of how well a rental property is doing. These reports provide a summarized and detailed snapshot of a property’s financial health by tracking income, expenses, assets, and liabilities over time.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Real Estate Finance FAQ

What is Rental Real Estate Finance?

Rental real estate finance is the broad subject of all financial related topics when it comes to rental properties, such as financing, taxes, deal analysis, appraisals, budgeting, and more.

What is the Best Way to Invest in Rental Real Estate?

The best way to invest in rental real estate generally falls under 2 categories: actively buying real estate, or passively investing in real estate and its related activities. Active real estate refers to purchasing properties directly to rent out. Alternatively, passive real estate refers to making financial investments in things such as in real estate stocks, syndications, mortgage notes and other hands-off real estate investment vehicles. Choosing among these 2 categories will depend on your unique individual investor preferences.

What are Real Estate Finance Jobs?

A career in the real estate finance sector can be a great opportunity for those who enjoy the financial and economic perspectives of real estate. Real estate finance jobs range from corporate back-office analysis, to in-person loan consultations. These types of real estate jobs can also be a great pathway to becoming knowledgeable about how real estate financial markets work to build and grow your own portfolio.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal and/or financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.