Last Updated: April 2024

Property management fees vary depending on the services offered, but are generally charged in similar ways across the industry. A property management company will typically either charge a fixed price, percentage basis, or a hybrid combination of the two. In addition to this ongoing fee, most property management companies require a contract period to start (e.g. 1 year term) and can add on a la carte fees for additional services performed such as a setup fee, cancellation fee, maintenance fees, renewals fees, etc.

5 Main Types of Property Management Fee Structures

Property management companies usually structure their fees in one of three main ways: Fixed Fee, Percentage Based, or Cost Plus. We take a look at each type below:

1. Fixed Fee

Fixed fee (also called flat fee) is a common fee structure found in property management where the management fee is a fixed dollar amount, usually paid on a monthly basis. The amount is typically based on property type, square footage, and property management services provided. For example, the national average flat rate fee to manage a single-family home is approximately $125 per month, however, these rates can vary depending on your local market and property type. While it is nice for landlords to have a fixed budget for property management expenses, the drawback to this type of pricing is that the fee is usually required to be paid regardless of the property’s vacancy status.

2. Percentage Based

Percentage based is a common fee structure found in property management where the fee is based on a percentage of the rent. This is the most common type of fee structure in property management. The average fee is 4% – 15% of monthly rent. This large variance in this range is due to the economies of scale pricing model (i.e. pricing is discounted proportionately for the larger the property and more units you have under contract with them). The rate to manage 1 unit might be on the higher end around 12%, whereas the rate to manage hundreds of units could be on the lower end around 4%.

Within the percentage based property management pricing model, it is important to note that this type of fee structure can be calculated off of “rent due” or “rent collected”. Each way can have drastically different outcomes on the total amount of fees property manager will have to pay, as we take a look at each below:

3. Rent Due

Rent due is when the percentage of rent calculated for the property management fee is based on the total amount of rent due per month. As an example, a property with 4 rental units each priced at $1,000 per month would be $4,000 in gross monthly rent; at a 6% management fee would be $240 total monthly management fee ($4,000*6%). The concern with this type of fee structure is that fees are still billed even when units are vacant or tenant’s are not paying rent.

4. Rent Collected

Rent collected is when the percentage of rent calculated for the property management fee is based on the total amount of rent “actually collected”. As an example, a 4 rental unit rental property with each unit priced at $1,000 per month, however, 1 unit is vacant and 1 unit is not paying rent. In this case the gross monthly “rent collected” would be $2,000; at a 6% management fee would be $120 total monthly management fee ($2,000*6%). This is a more favorable option for rental property owners, as you are only paying fees on actual revenue being brought in, and also incentivizes the property management company to lease up vacancies and quickly deal with non-paying tenants.

5. Cost Plus

Cost plus (also called hybrid) is a property management fee structure that combines both the flat fee and percentage of rent collected pricing structures. An example of this pricing structure would be a flat $100 monthly management fee, plus 4% of monthly rents. This type or pricing is preferable to landlords who prefer a balance in pricing, while seeking to get the highest rent as possible. In cost plus pricing structures, it is common for additional services to be billed separately. These additional services can include charges such as a setup fee, cancellation fee, extra maintenance fees, renewals fees, etc.

Average Rental Property Management Fee Cost (%)

How Much Does Property Management Cost?

9%*

*Percentage of Gross Rents Collected. Average is based on United States

The average property management fee for a rental property is approximately 9% (and falls between 6% – 12%) of gross rents collected. This fee can vary depending on several factors such as location, size of the property, type of rental property, and the services included in the management fee. It’s important to note that while a higher management fee may seem like a negative, it may include more comprehensive services such as marketing, tenant screening, rent collection, maintenance and repairs, and more. On the other hand, a lower management fee may provide fewer services or may require additional fees for certain services.

Fixed Rate vs Percentage vs Cost Plus

Now that we’ve taken an in depth look at each type of property management pricing structure, let’s compare all 3 main types in an easy to understand chart below.

| Fixed Rate | Percentage (%) | Cost Plus | |

|---|---|---|---|

| Pros | • Easier to Understand Pricing • Consistent for Budgeting Purposes | • Increased Motivation to Increase Rents • Paid Based off of Performance | • Increased Motivation to Increase Rents and Lease Up • Balanced Average Pricing |

| Cons | • Less Incentive to Increase Rents • Can Overpay During Vacancies | • Amount Can Fluctuate With Vacancies • Possibility to Pay More Than Fixed Rate | • Can Overpay During Vacancies • Can Overpay for Additional Services |

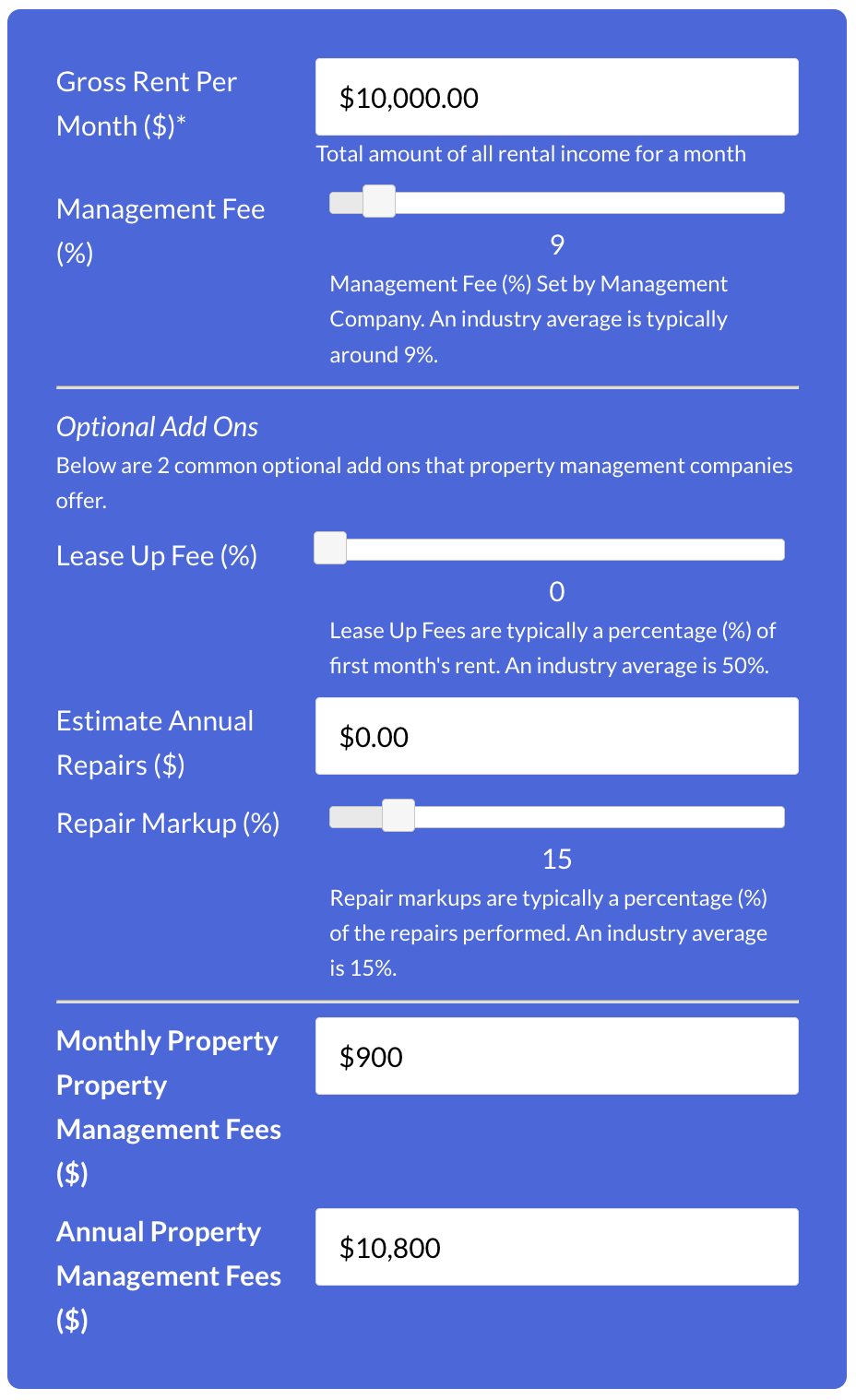

Try Our

Property Management

Fee Calculator →

100% Free – No Sign Up Required

20 Types of Additional Property Management Fees

In addition to the three main types of property management fee structures, property management companies have developed many additional fees based on various services. We take a look at the most common ones below:

Onboarding Fee

An onboarding fee, or a setup fee, is a one-time fee charged for setting up the accounts of new tenants. This fee covers overhead costs such as administration, property condition inspection, and welcome materials to be used by the tenant in the future. While it is a fee common throughout the industry, not all companies charge it. The price usually ranges between $200-$500.

Lease-Up Fee

A lease-up fee (also called tenant placement fee) is the one-time charge for finding and placing a new tenant. This fee covers all of the back end work such as property showings, applicant screenings, and compiling lease paperwork for signing. A lease up fee can be a flat fee or a percentage of the first month’s rent. The price is typically either a fixed amount or percentage of the first-month’s rent (50% to 100%).

Advertising & Marketing Fee

Advertising and marketing fees are applied when property management companies advertise a vacant rental property to fill. Much of this fee could simply be the property management company trying to recoup some of their expenditures since physical signage and advertising on some third party listing platforms can quickly add up. The amount of this fee can vary based on many different factors and is mostly dependent upon the type of rental property, advertising requirements and frequency of ads to be ran.

Lease Renewal Fee

A lease renewal fee can occur when a tenant’s lease comes up for renewal and the property manager has to renegotiate and administer the new lease agreement. This fee helps cover the human capital efforts to negotiate updated terms and draft lease renewal documents for signature. Due to inflation, rental rates are typically escalated upon renewals, so the fee usually becomes a net-positive for owners over the course of the term. The price for lease renewal fees is typically 25-50% of the first month’s rent in the new term.

Utility Setup Fee

Transition periods between tenants often involve transferring or setting up utilities. This fee is for the administrative effort to ensure utilities are appropriately handled, avoiding any disruptions for incoming tenants. Whether it’s water, electricity, or internet services, this fee ensures a smooth transition and continuous services for residents.

Tenant Background Check Fee

Before renting out a property, it’s crucial to understand the tenant’s history. This fee covers the costs of running background and credit checks on prospective tenants. These checks ensure that the tenants are reliable, have a clean record, and are financially stable. A thorough vetting process minimizes potential risks for landlords.

Early Termination Fee

While most fees are geared toward tenants, early termination fees are put in place to ensure that landlords uphold their part of the agreement by continuing with the property management services throughout the duration of the contract term. Should a property owner wish to discontinue services prematurely, they may be charged an early termination fee. Depending on the terms of the rental contract, this fee can range from a nominal flat fee, to several months of management fees or even legal action for breach of contract.

Bill Payment Fees

Bill payment fees are sometimes charged by property management companies for handling the payment of bills related to the property, such as utilities, insurance, and taxes. This fee is either a fixed amount per bill paid or a percentage of the total bills paid. While not always charged separately, it’s important to understand whether this cost is included in your overall management fee. It provides a convenience for property owners, as the property manager ensures all bills are paid timely, avoiding potential penalties or service interruptions.

Reserve Fund Fee

This fee pertains to a sum set aside for unforeseen property-related expenses. It acts as a safety net, ensuring there are funds readily available for sudden repairs or emergencies. Property management companies may request this upfront to facilitate quicker action in the event of unexpected issues. It’s a way to safeguard both the tenant’s experience and the property’s condition.

On-call Service Fee

An on-call service fee is levied for addressing property-related concerns outside standard business hours. This might include emergency repairs or tenant issues that require immediate attention. It compensates the management company for the inconvenience and additional resources used during off-hours. Tenants can rely on prompt service, knowing there’s support available at any time.

Repair and Maintenance Fee

Maintenance fees covers the cost of inevitable maintenance expenses. This fee can be based a variety of different structures: percentage of the overall maintenance cost (e.g. 10% of a $1,500 emergency plumbing repair), a la carte fixed pricing per type of service (e.g. $150 per clogged toilet), or vendor pricing plus markup (e.g. $1,500 plumbing updates + 10% markup). Property management companies usually have in-house maintenance personnel, as well as trusted vendors that ideally can satisfactorily complete the job at a reasonable market rate.

Inspection Fee

Inspection fees are fees charged for sending out personnel to physically inspect a rental property. Rental properties should be routinely inspected inside and out annually at a bare minimum; potentially more frequent depending on a property’s age and location. Some full service companies include regular inspections as a part of their management fee, while a partial service property management agreement may charge the additional fee. Inspection results should always be forwarded to the property owner including a detailed inspection report, photos or videos, and any potential recommendations.

HOA Coordination Fee

Managing properties within a Homeowner Association (HOA) requires added coordination and communication. This fee covers the effort to ensure property compliance with HOA rules, attending HOA meetings, and addressing any related concerns. It streamlines the relationship between property managers, homeowners, and the HOA. By handling this complex interface, the management company ensures that homeowners remain in good standing with their associations.

Technology Fee

To efficiently manage properties, many companies leverage specialized software and technology platforms. The technology fee helps cover the costs associated with these tools, ensuring tenants and landlords have a seamless experience. This could range from digital rent payment systems to maintenance request portals. Investing in these tools brings efficiency, but also incurs costs which are covered by this fee.

Late Payment Fee

Late payment fees (commonly just called late fees) are fees billed directly to tenants for rent or other billable charges that are paid after the contractual due date. Late fees are great motivators to incentivize tenants to pay on time and also another revenue source for property managers and landlords. Note that late fees don’t necessarily go straight to the property owner, as some property management companies retain between 25% – 50% of late fee income collected as compensation for having to chase after the tenants to collect unpaid rent.

Eviction Fees

Property management companies can often take care of the entire rental property eviction process for a fee. Some companies may handle evictions in-house, while others may contract it to a local law firm. Eviction fees can be billed as a flat initial fee (e.g. $500) plus any additional court and legal fees, hourly fees for court appearances (e.g. $25-$100 per hour), or an all-in fixed amount (e.g. $2,000). If a property owner was awarded a judgment in court, collections agencies and attorneys generally charge a collections fee between 20% – 50% of the money collected.

Pet Fee Administration

Properties allowing pets often have additional considerations like potential damages or nuisances. This fee relates to the added administration efforts of managing pet deposits, pet rents, or any pet-related incidents. It ensures that while tenants enjoy the benefits of pet ownership, any related issues are preemptively addressed. This keeps properties in good condition and ensures all residents enjoy a peaceful living environment.

Project Management Fee

When a property undergoes significant improvements or renovations, overseeing the project requires specialized skills and additional time. This fee compensates the property management company for planning, executing, and monitoring such projects. Whether it’s a kitchen renovation or an addition to the property, this fee ensures projects are completed to a high standard. It takes the hassle out of major undertakings, ensuring they are managed professionally and efficiently.

Document Preparation Fee

Over the course of property management, various documents need preparation, whether it’s lease agreements, notices to tenants, or property condition reports. This fee compensates for the time and expertise required to draft, review, and distribute these important documents. Proper documentation is essential for clarity and legal protection, making this service invaluable.

Key Holding Fee

Especially relevant for high-turnover properties or vacation rentals, this fee pertains to the safekeeping and management of property keys. Whether it’s ensuring spare keys are available, overseeing key handovers, or managing digital access codes, this fee covers the associated responsibilities. Proper key management ensures security, accessibility, and convenience for both tenants and landlords.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Property Management Fee FAQ

What are Property Management Fees?

Property management fees (also called leasing fees) are fees that property owners pay property management companies to ensure that their property is properly operated and maintained. They are usually paid on a monthly basis and can range from ongoing management fees, to one-time service specific fees.

Can Property Management Fees be Negotiated?

Yes, property management fees can sometimes be negotiated. However, this depends on the management company and the services they provide. Some companies may be willing to negotiate their fees, especially if you have multiple properties for them to manage. It’s always worth having a discussion about fees and services to ensure you’re getting the best value for your money.

Residential vs Commercial Management Fees

Different types of rental properties require different responsibilities that need to be compensated accordingly. Residential property management is usually more labor intensive but is also prone to greater competition. Commercial property management might be less labor intensive, but requires specialized knowledge of the commercial properties and comes with higher stakes since commercial tenants are savvy business owners.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

What Services are Included in Property Management Fees?

The services included in the property management fee can vary but typically include rent collection, tenant screening, handling tenant issues and complaints, arranging for property maintenance and repairs, conducting regular property inspections, and managing any legal issues or eviction proceedings.

How to Determine the ROI of Property Management Costs?

Property Management ROI Calculation

Benefits – Cost of Services = Cost of Savings

Cost of Savings / Cost of Services = ROI (Return on Investment) of Property Management

To determine the return on investment (ROI) of property management costs, you first need to quantify the monetary benefits you gain from the service. These can include higher occupancy rates, less time spent on management tasks, reduced repair and maintenance costs, and fewer legal issues. Then, subtract the total costs of property management from these financial gains, and divide the result by the total costs to get the ROI. This gives you a percentage that represents the efficiency of your investment in property management.

More Property Management Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.