Last Updated: April 2024

Rent is the financial lifeblood for rental properties. Establishing fair and competitive rental prices and effectively collecting rent are cornerstones of property management. When rental property rent payments are aligned with property amenities and local market trends, the perfect environment for profitability and tenant satisfaction is achieved. Smart rental real estate operators leverage technology into their rent payments. From online real estate data tools to help to more accurately price market rent, to payment apps that dramatically reduce late or missed payments.

25 Rent Payment Collection Techniques

There are many ways to effectively collect rent from tenants, with methods ranging from traditional physical payments to advanced digital payment platforms. Selecting the right method for your specific rental property can increase efficiency and enhance tenant convenience. Below are the 15 most popular rent collection methods:

- Checks: The original and most common rent payment method, but requires manual processing and handling physical paper checks.

- Rent Payment Services: Companies like PayRent or ClearNow can handle the process for both landlord and tenant.

- Bank Transfers: Direct transfers from the tenant’s bank account to the landlord’s can easily be done with most major banks.

- Mobile Payment Apps: Mobile payment apps such as Venmo, Zelle, or Cash App allow for easy transfers (subject to processing fees).

- Credit or Debit Card Payments: Convenient option for tenants, but is subject to processing fees for landlords.

- PayPal: A widely used and trusted online payment system (subject to processing fees).

- Money Orders: Secure but requires physical exchange and bank deposit of actual money order.

- Cash Payments: Though immediate, this method lacks a digital transaction record and is risky.

- Automatic Withdrawals: Auto-debit arrangements with the tenant’s bank.

- Direct Deposit from Employer: Rent is deducted from the tenant’s paycheck and sent directly to the landlord.

- E-Check or ACH Payments: Electronic checks or Automated Clearing House (ACH) payments can be made online.

- Property Management Software: Most property management software programs now include rent collection features.

- Dropbox: A physical secured box where tenants can drop off payments, but requires manual collection and recording.

- Mail: A place where tenants can mail checks or money orders, though this has risk of delays or lost mail.

- In-Person Collection: The landlord visits the tenant to collect rent, though this is time-consuming and less common with current technologies.

- Wire Transfers: Though usually involving a fee from the sender, this can be a secure method of direct bank-to-bank transfer.

- Mobile Banking Apps: Some banks offer their own mobile apps for direct transfers between accounts within the same bank.

- Cryptocurrency: Cryptocurrency payments can be fast, traceable and instantly converted back to a local currency if needed.

- Retail Cash Services: Services like PayNearMe allow tenants to pay in cash at local participating retail locations, with the funds then electronically transferred to the landlord.

- Certified Check or Cashier’s Check: These pre-funded checks guarantee the availability of the funds.

- Third-Party Payment Processors: Services like Stripe allow for card payments and can be integrated with rental property accounting softwares.

- Escrow Accounts: In certain situations, such as a dispute over repairs, rent may be paid into an escrow account until the issue is resolved.

- Landlord’s Website: If the landlord has set up their own property management business with a website, the website can be used to accept rent payments directly.

- Rental Kiosk: An automated payment kiosk at the rental office or onsite property, which may accept credit/debit cards, cash, or checks.

- Rent Payment Services – Companies such as Flex pay rent on the first and allow tenants to make payments at your own pace.

Rent Collection Methods Compared

Each type of rent collection method has its advantages and disadvantages. We take a look at the pros and cons of the most commonly used methods below.

| Payment Methods | Pros | Cons |

|---|---|---|

| Cash | – Immediate payment – No processing fees | – Security risk (theft) – Harder to track and provide a paper trail- Counterfeit risks |

| Check | – Traditional and familiar for many – Provides a paper trail | – Risk of bounced checks – Delayed processing – Potential for loss or theft in mail |

| Bank Transfers | – Direct and quick transfer – Digital record of transaction | – Potential fees – Requires sharing bank details |

| Online Portals | – Convenient for tenants- Automated records – Recurring payments setup | – May involve processing fees – Dependence on internet access |

| Apps (e.g., Venmo, PayPal) | – Quick and mobile-friendly – Widely used and accepted | – Transaction fees – Less professional – May have limits on transaction amounts |

| Direct Deposit | – Automated and consistent – Reduces manual intervention | – Initial setup required – Changing bank accounts can disrupt the process |

| eChecks | – Electronic version of traditional checks – Safer than paper checks | – Processing delays – Potential fees |

| Credit Card Payments | – Potential for rewards for tenants – Immediate transaction confirmation | – High processing fees – Risk of chargebacks |

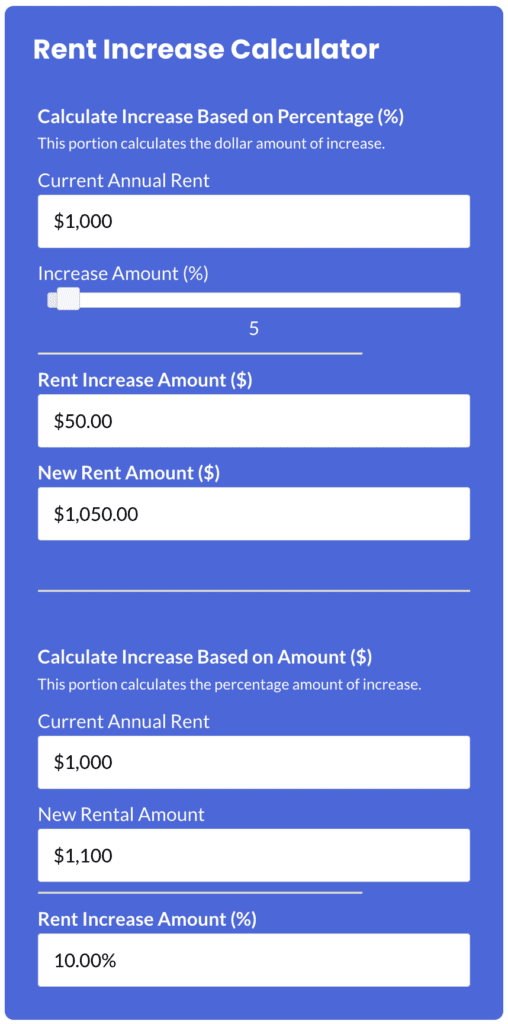

How to Raise Rent?

Raising rent requires a delicate balance of economic factors and landlord-tenant relations. Raising rent too much can adversely affect the marketability of your rental property, while too little can hurt the property’s financial bottom line. A fist step to take when raising rent is to check local landlord-tenant laws, as some jurisdictions have rent control or rent stabilization laws that limit the amount of a rent increase. A typical annual increase of 3-6% is standard, but can depend on local market conditions. As a courtesy to the tenants and sometimes legally required, provide tenants with sufficient advance notice of usually 30-60 days, depending on local laws.

Try Our

Rent Increase

Calculator →

100% Free – No Sign Up Required

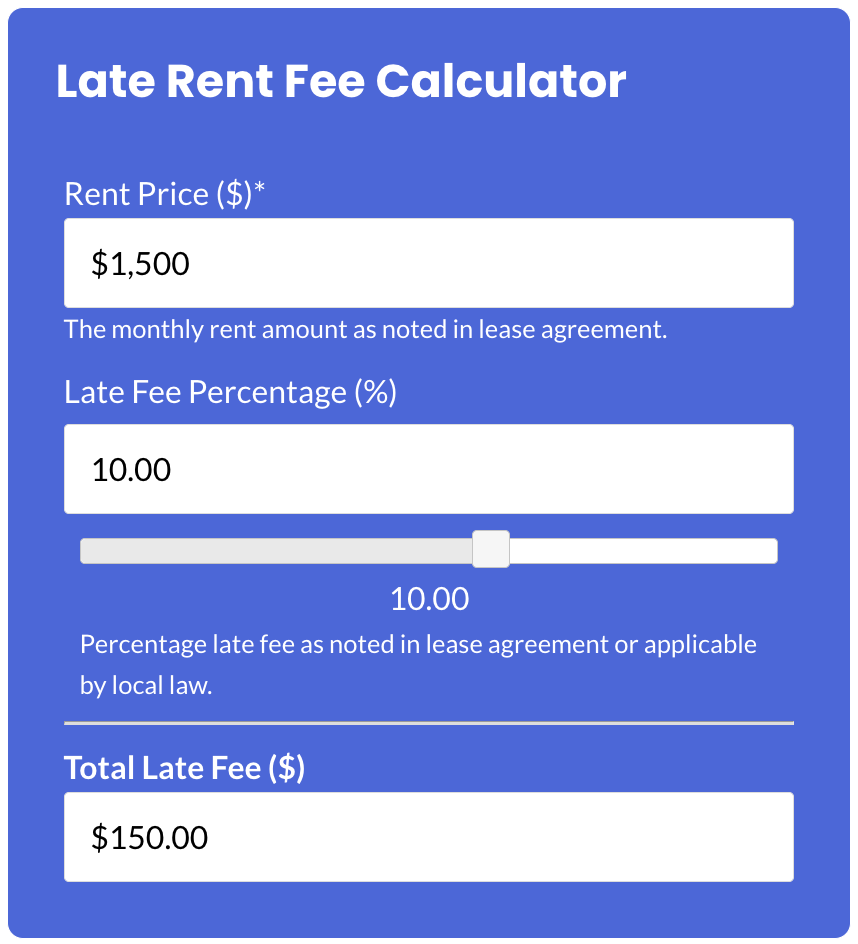

Late Rent Fees

Late rent fees are additional charges that landlords may impose on tenants who fail to pay their rent on time, as stipulated in the lease agreement. These fees are intended to incentivize timely payments and compensate landlords for the inconvenience of delayed rent collection. However, the enforceability and amount of late fees are subject to local and state regulations.

Try Our

Late Fee

← Calculator

100% Free – No Sign Up Required

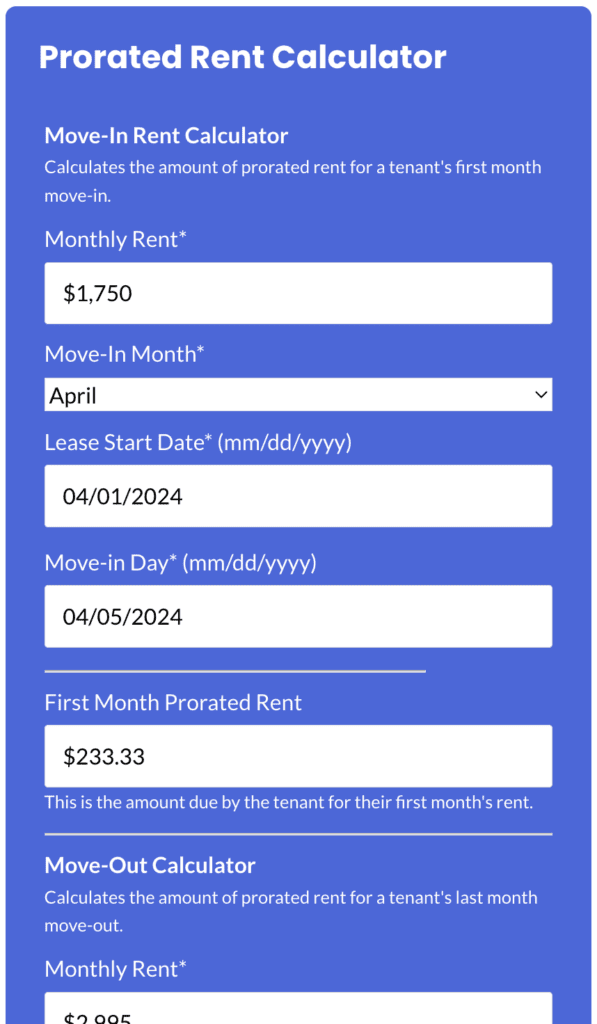

How to Prorate Rent?

Prorated rent is a term used in the rental property industry, that refers to the amount of rent that a tenant proportionally pays for partial month occupancy. This occurs when a tenant moves in or out of a rental property at times other than the beginning or end of the month. You can calculate the amount prorated rent by determining the daily rent cost and multiplying it by the number of days the tenant will occupy the property in that month. Prorated rent ensures a fair and equitable financial arrangement, reflecting the exact duration of the tenant’s stay in the property.

Try Our

Prorated

Rent

Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Rent Collection Software

Rent payment and collection software simplifies the process of managing rent transactions by enabling electronic payments, automating invoicing, and tracking payment histories in real-time. This technology enhances convenience for tenants and landlords, ensuring timely payments and minimizing administrative tasks.

What is Rent (Payment)?

Rent (Payment) Defintion

Rent refers to the periodic payment made by tenants to landlords in return for the right to occupy and use a rental property. This payment is usually agreed upon in a lease or rental agreement, which specifies the amount of rent, its due date, and other relevant terms.

How Do Rent Payments Work?

Rent functions as a contractually obligated payment from a tenant to a landlord in exchange for the use of a property. The specifics of this transaction, including the amount, due date, and any late fees, are outlined in a lease or rental agreement. Rent is usually due at the start of each monthly period (on the 1st each month), and late payments or failure to pay can result in late fees or eviction. Rent amounts are usually fixed for the term of the lease, but can be adjusted at lease renewal (subject to any local regulations) and also usually increase annually to account for inflation.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Property Rent Payment FAQ

How Much to Charge for Rent?

Setting a price to rent your rental property involves careful consideration of several factors. A good place to begin is by analyzing comparable units in your area (size, amenities, location) to understand the current market rate. If it is a commercial property, consider the commercial classification – Class A, Class B, or Class C. This can usually be done by checking online property listings websites, as well using rent estimate software tools. Be sure to account for your property’s specific attributes like renovations or unique features that could justify a higher rent. Lastly, factor in your operating expenses, desired profit margins, and the potential vacancy rate to ensure the set rent yields a satisfactory return on your investment.

How Much is Average Rent in the United States?

The exact average rent data varies greatly by type of the rental property, location, local housing regulations, and various economic and real estate market factors. Historical trends show that the average rent for residential rental properties in the U.S. generally increases year over year. These resources provide data on national, state, and local rent averages, offering insights into the current rental market landscape.

Are There Limits to How Much I Can Raise Rental Property Rent Payments?

Yes, there are typically limits to how much rent can be raised. These limits are often governed by local and state landlord tenant laws, which may include rent control regulations or guidelines for acceptable percentage increases. It’s essential to research and comply with these legal requirements to avoid legal repercussions and maintain good tenant relationships. Additionally, market conditions and the standard rates in your area can influence how much you can feasibly raise rent without risking an increase in vacancy rates.

More Property Management Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.