Last Updated: February 2024

In order to better evaluate and compare the investment potential of commercial properties, they are often classified into three categories: Class A, Class B, and Class C. Each commercial real estate classification is distinguished by factors like location, building quality, age, and commercial tenant profiles, enabling investors to make informed decisions that align with their risk tolerance, investment objectives, and management preferences.

3 Main Types of Commercial Real Estate Classifications

The “Class A” Classification

Class A commercial properties represent the highest quality assets within a given market, often characterized by prime locations, prestigious architecture, state-of-the-art facilities, and exceptional management. These properties attract high-profile tenants and command premium rental rates due to their superior construction, advanced technological infrastructure, and modern amenities. Class A buildings generally provide a stable income stream and lower vacancy rates, making them a popular choice among institutional investors and real estate investment trusts (REITs).

Class A Commercial Real Estate Example

Imagine a gleaming skyscraper in the heart of New York’s financial district, home to prestigious firms and tech start-ups, or a luxury apartment complex nestled in a chic neighborhood of San Francisco, complete with a gym, pool, and 24/7 concierge service.

This is the epitome of a “Class A” property—prime location, modern amenities, strong tenant appeal, and high-quality construction. Although they offer potential for excellent returns due to high rental demand, investors should bear in mind the significant initial investment, ongoing upkeep, and competitive market these properties command.

How to Recognize a Class A Property

- Prime Location: Class A properties are typically located in highly desirable areas, like the city center or upscale neighborhoods.

- Recent Construction or Renovation: These properties are often new or have undergone extensive, recent renovations.

- High-quality Construction and Design: Class A properties exhibit superior construction and architectural design, often with high-end finishes.

- Luxury Amenities: They usually feature amenities like concierge services, fitness centers, pools, or private parking structures.

- High Rent Rates: Due to their superior quality and location, Class A properties command the highest rents in their markets.

- Strong Tenant Demand: They attract high-income or prestige tenants, such as successful professionals, high-end retailers, or reputable corporations.

- Professional Management: Class A properties are typically managed by professional property management companies.

The “Class B” Classification

Class B commercial properties, while not as prestigious as Class A, still offer investors a solid investment property opportunity. These properties are typically older, with moderate building quality and a reasonable level of maintenance. Class B properties are often situated in good but not prime locations, attracting a diverse range of tenants with varying credit quality. Investors frequently target Class B assets for value-add strategies, as they can be renovated or repositioned to improve rental rates and increase overall asset value.

Class B Commercial Real Estate Example

Imagine a 15 to 25-year-old multi-family apartment building in an established, safe neighborhood, perhaps a few miles from a city’s downtown. The building is well-maintained, offers standard amenities like a simple gym or outdoor space, but lacks the luxury finishings of a Class A property.

This exemplifies a “Class B” property—good location, older yet solid construction, and appeal to middle-income tenants. For investors, Class B properties present a balance of moderate investment cost, stable rental income, and potential for value-add improvements.

How to Recognize a Class B Property

- Good Location: Class B properties are often located in good, but not necessarily prime areas of a city or town.

- Older Construction: These properties are usually older, typically 10 to 30 years, but still maintain a sound structural integrity.

- Average Amenities: Class B properties feature standard amenities without the luxury extras, like a small fitness center or outdoor common areas.

- Moderate Rent Rates: They command moderate rents and target middle-income tenants.

- Stable Tenant Demand: Class B properties typically have a stable tenant base, but may not draw the same level of demand as Class A properties.

- Potential for Value-add Improvements: Investors often see an opportunity for upgrades that can increase the property’s value and rent rates.

- May or May Not Have Professional Management: Class B properties might be managed by professional firms, but it’s not uncommon to find owner-operators managing these properties.

The “Class C” Classification

Class C commercial properties are the lowest tier in the commercial real estate classification system. These properties are usually older buildings that require significant renovation and maintenance to remain competitive in the market. Class C assets are typically located in less desirable areas, with limited access to transportation, amenities, and other conveniences. Despite their lower quality and higher risk profile, Class C properties can offer investors higher cap rates and the potential for substantial value creation through targeted improvements and strategic repositioning.

Class C Commercial Real Estate Example

Picture a modest motel in a smaller town or an older suburb, with dated decor and basic amenities such as clean rooms and free parking, but nothing extravagant like a pool or fitness center. The hospitality property has been around for over 30 years and caters to travelers looking for budget-friendly accommodations.

This epitomizes a “Class C” property—located in less prime areas, aging with limited features, and appealing to lower-income or cost-conscious clientele. For investors, Class C properties offer lower acquisition costs, potential for significant improvements, but a possibly challenging tenant base and ongoing maintenance issues.

How to Recognize a Class C Property

- Less Desirable Location: Class C properties are typically found in less desirable or lower-income areas.

- Aged Construction: These properties are often 30+ years old and may show signs of deferred maintenance.

- Basic Amenities: Class C properties offer basic amenities, often lacking the modern conveniences found in higher class properties.

- Lower Rent Rates: They command lower rents due to their age, location, and lack of amenities.

- Lower-Income Tenant Base: Class C properties typically cater to lower-income tenants.

- Needs Improvement: These properties usually require significant improvements or renovations.

- Absence of Professional Management: Class C properties are often managed by the owners rather than professional property management companies.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Commercial Real Estate Class Definition

Class A

Class B

Class C

Commercial real estate class refers to the categorization of properties based on factors such as location, construction quality, and amenities.

“Class A” properties are top-tier, located in prime areas, and boast high-quality construction and amenities. “Class B” properties, while still desirable, may be older, situated in less prime locations, and lack the high-end amenities of Class A. “Class C” properties are typically older, located in less desirable areas, and require more maintenance, but can offer potential for improvement and higher returns for investors.

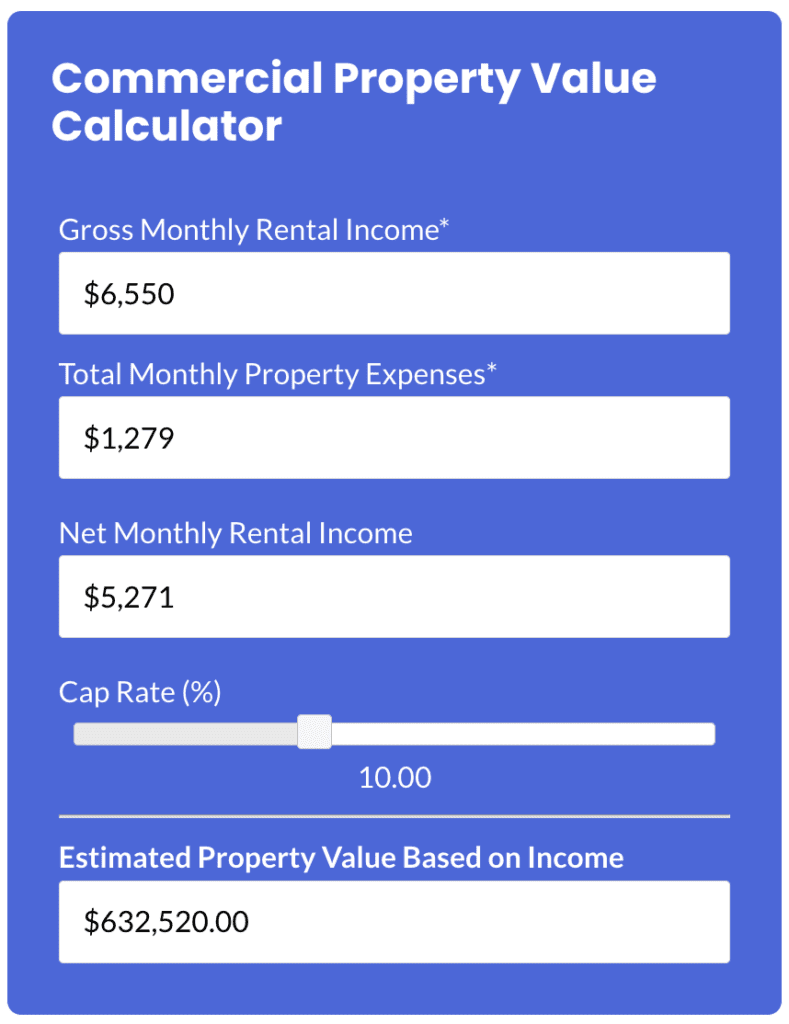

Try Out Our Commercial Property Valuation Calculator →

100% Free – No Sign Up Required

Commercial Real Estate Classification FAQ

Why are Commercial Real Estate Classifications Important?

Property classes are essential in comparing rental properties as they provide a benchmark for quality, location, and potential returns. For instance, a Class A property signals prime location and quality, but with high acquisition costs and potential for lower yields. Conversely, a Class C property may present more risk due to location or tenant base, but offer high potential returns through property improvements. Whether it is a Class A retail property, or a Class C industrial building, understanding these classes helps investors align their investment strategy, risk tolerance, and return expectations with the right properties.

What is the Difference Between Class A vs Class B?

Class A and Class B properties differ primarily in quality, location, and potential returns. Class A properties are top-tier, located in desirable areas, and offer high-end amenities, attracting high-income tenants, but usually require a significant investment. Class B properties are older, located in good but not prime areas, and have fewer luxury amenities, catering to middle-income tenants. While Class B properties may offer a lower initial investment and greater potential for value-add improvements, they typically yield lower rents compared to Class A properties.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

What is the Difference Between Class B vs Class C?

Class B and Class C properties diverge primarily in age, location, amenities, and tenant base. Class B properties, though older, are usually in decent locations, offer some amenities, and attract middle-income tenants, resulting in a balanced investment and reasonable returns. Class C properties, however, are older still, located in less desirable areas, lack updated amenities, and generally cater to lower-income tenants. While they require a smaller upfront investment and have room for value-add improvements, Class C properties can present more risk due to potential higher vacancy rates and ongoing maintenance issues.

Is There a Class D or Class F of Real Estate?

The standard real estate classifications are Class A, Class B, and Class C. While there’s no universally accepted Class D or Class F in real estate, some industry professionals use “Class D” unofficially to refer to properties in distressed areas with high vacancy rates, significant deferred maintenance, and high crime rates. These properties are typically seen as highly risky investments. However, it’s important to note that classification definitions can vary by market and some investors may use different systems.

More Commercial Real Estate Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.