Vacancy rates can be an extremely useful metric to assess rental properties. They serves as a barometer that indicates the percentage of unoccupied units within a property, portfolio, or broader market. This metric not only reflects the demand for rental spaces but also influences strategic decisions on pricing and property improvements. By closely monitoring the vacancy rate, stakeholders can make informed choices how to increase occupancy and maximize returns.

Calculate Rental Property Vacancy Rate

Please input the required fields (*) below to calculate a property or portfolio’s vacancy rate.

This calculator is meant for educational purposes only. The calculation generated from the calculator does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.

Understanding Vacancy Rates – Good vs Bad

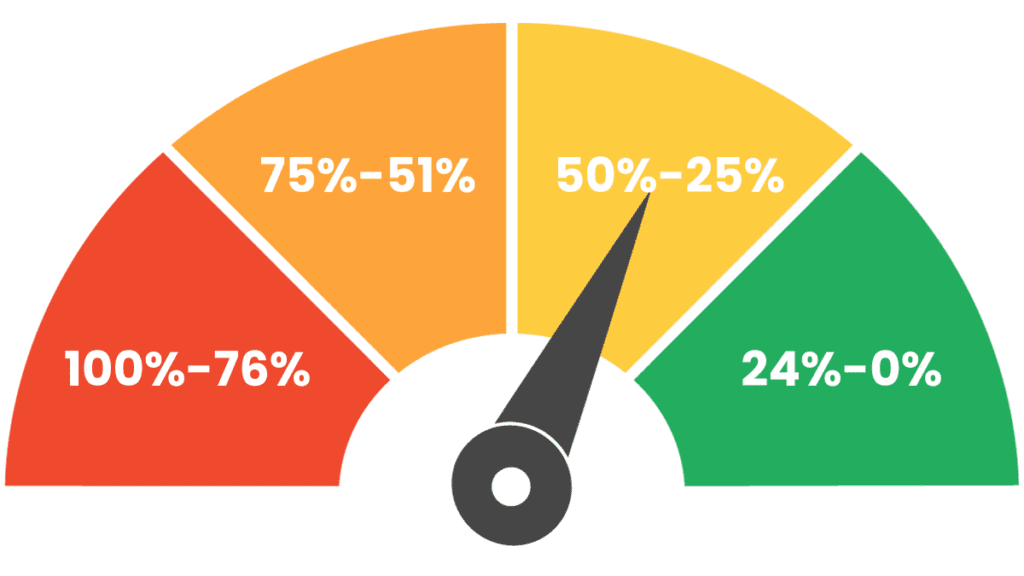

It is important to keep in mind that vacancy rates can be highly subjective to each property type and market. Vacancy rates range on a scale from 0%-100%. Below we take a look at the comparisons to better understand what a higher number vs lower number could imply.

| High “Bad” Vacancy Rate | Low “Good” Vacancy Rate |

|---|---|

| Reduced rental income due to unoccupied units | Steady and consistent rental income |

| Increased marketing expenses to attract tenants | Lower marketing expenses due to higher demand |

| Potentially indicates overpriced rent or less desirable area | Indicates competitive pricing or a desirable location |

| Higher likelihood of property wear and tear (from frequent tenant turnover) | Steady, long-term tenants leading to reduced wear and tear |

| May result in lower resale value of the property | Generally contributes to a higher property resale value |

Rental Property Vacancy Rate Formulas

There are 3 industry standard vacancy rates for rental properties. Market Vacancy rate is usually an average of a given area, whereas Physical Vacancy Rate and Economic Vacancy rate can be calculated by the mathematical formulas noted below.

3 Types of Vacancy Rate

Physical Vacancy Rate

Physical vacancy rate is the amount of time a rental property remained vacant in a year.

Physical Vacancy Rate = Number of Days Vacant1 ∕ 365 Days per Year

- Number of Days Vacant – This is the number of days within a year, that a there has been a vacancy

Economic Vacancy Rate

Economic vacancy rate is the total gross potential rent of the property that’s been lost within a year.

Economic Vacancy Rate (%) = Lost Rental Income1 ∕ Gross Potential Income2

- Loss Rental Income – Loss Rental Income refers to the income that was not realized through having vacancy. It can be calculated by subtracting Total Potential Rental Income (Income that the property would generate if all units were rented at market rates without any concessions) – Actual Rental Income (Income that the property actually generates, considering vacancies, concessions, and uncollected rents).

- Gross Potential Income – This is the income that the property would generate if all units were rented at market rates without any concessions.

Market Vacancy Rate

Market vacancy refers to the percentage of unoccupied rental units in a specific real estate market or area, compared to the total number of available rental units. This number is usually derived from crowdsourced data within a given market.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Vacancy Rate Resources

What is Vacancy Rate?

Vacancy rate is a metric that quantifies the proportion of properties that are unoccupied in a specific area or portfolio over a set period. It serves as a key metric for investors and property managers, reflecting the demand for rental space and indicating the potential for rental income.

Rental Property Vacancy Rate FAQ

Why is a High Vacancy Rate Concerning for a Rental Property?

A high vacancy rate is concerning because it signifies potential lost rental income, suggests there might be issues with the property or its pricing, and can indicate low demand or oversupply in the market.

How to Reduce Vacancy Rates?

Using rental property calculators like the one on this page can help you with the first step of reducing vacancy rates – understand your current vacancy rate percentage. Once you have a benchmark number to start with, you can use this number to track your progress while implementing strategies such as ensuring competitive pricing, maintaining and upgrading properties regularly, marketing effectively, offering incentives or promotions, and providing excellent tenant service and communication.

Is a Zero Percent Vacancy Rate Considered Ideal for a Rental Property?

While a zero percent vacancy rate means full occupancy, it might also suggest that rents could be below market rates; some level of vacancy is natural, and having a slight buffer can allow for regular property maintenance and unit renovation upgrades.