Last Updated: April 2024

In property management, rental property security deposits play a key role in risk mitigation. They serve as a financial buffer against potential tenant-related damages or contractual breaches. Rental property security deposits not only provide a safety net for landlords, but also encourage tenants to adhere to lease terms and maintain the property. When it comes to managing rental properties, properly handling security deposits is of key importance to safeguard the property and promote healthy landlord-tenant relationships.

4 Main Types of Security Deposits

Rental Unit Deposit

This is the most common type of security deposit, often equivalent to one or two months’ rent, intended to cover any potential damage to the property or unpaid rent.

Pet Deposit

Specifically for tenants with pets, this deposit is meant to cover any potential damages caused by the pet to the rental property.

Access Device Deposit

A smaller deposit that covers the cost of replacing keys, garage door openers, and other access devices such as FOBs if they are lost or not returned at the end of the lease.

Furniture Deposit

If the rental unit is delivered already furnished, this deposit is to cover any potential damage to the furniture that was included to the tenant.

Rental Property Security Deposit Best Practices

The collection, handling, and management of security deposits are vital components of effective rental property management. Following best practices not only ensures legal compliance but also helps maintain a positive landlord-tenant relationship. Below are several best practices when it comes to rental property security deposits:

Understanding Local Laws

Each state has specific regulations regarding security deposits, including the maximum amount you can charge, where the funds should be kept, when and how the deposit should be returned, and what deductions can be made. Ensure you are fully aware and compliant with these laws.

Clear Communication with Tenants

Clearly outline in the lease agreement the purpose of the security deposit, the amount, conditions for its return, and any circumstances that may lead to deductions. This helps avoid misunderstandings and disputes down the line.

Proper Storage of Security Deposits

Many states require landlords to store security deposits in a separate, interest-bearing account. This keeps tenant funds separate from your personal or business accounts, and allows for any interest earned to be paid to the tenant if required by law.

Document Property Condition

Conduct a thorough inspection of the property before the tenant moves in and document the condition with photographs and a detailed checklist. Repeat this process when the tenant moves out to assess any potential damages beyond normal wear and tear.

Prompt Return of Security Deposits

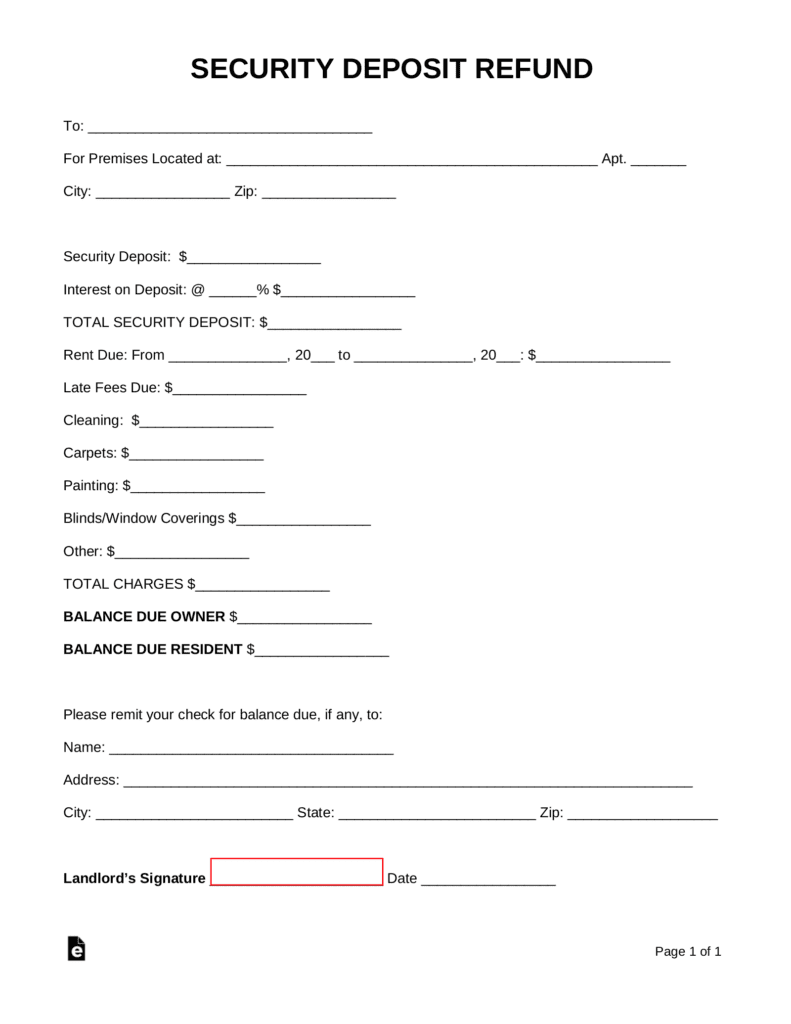

After the lease term, promptly inspect the property, calculate any deductions if necessary, and return the remaining security deposit within the time frame stipulated by your state’s law. Provide a detailed, itemized receipt for any deductions.

Maintaining Good Records

Keep meticulous records of all transactions related to the security deposit, including receipts for any repair work done that was deducted from the deposit. This can provide essential documentation if a dispute arises later.

20 Common Security Deposit Deductions

When managing rental properties, it’s crucial to know what costs can be lawfully deducted from a tenant’s security deposit. These deductions, however, should only cover damages beyond normal wear and tear, unpaid rent, or other agreement violations. Below are 20 of the most common security deposit deductions:

- Unpaid Rent: If a tenant leaves without paying the last month’s rent payment, this can be deducted from the deposit.

- Late Fees: Unpaid late fees stipulated in the lease agreement can also be deducted.

- Cleaning Costs: If the property is not left as clean as it was at move-in, professional cleaning costs can be deducted.

- Pet Damage: Damages caused by a tenant’s pet, such as scratched floors or stained carpets, are deductible.

- Excessive Wear and Tear: This includes damage beyond normal use, like large holes in walls, broken tiles, or significant carpet stains.

- Broken Windows: The cost of replacing windows broken by the tenant can be deducted.

- Missing or Damaged Fixtures: If fixtures like lights, blinds, laundry appliances, or other appliances are missing or damaged, you can deduct replacement costs.

- Unapproved Paint or Wallpaper: If a tenant paints walls or alters the wall surfaces without permission, you can deduct the cost to restore them.

- Pest Extermination: If a tenant’s lifestyle causes a pest infestation, extermination costs can be deducted.

- Missing Keys: The cost of replacing keys or rekeying locks can be deducted if keys aren’t returned.

- Damage from Smoking: If the lease prohibits smoking and there’s smoke damage, cleaning or repair costs can be deducted.

- Unpermitted Repairs: If a tenant made unauthorized repairs or alterations, you can deduct the cost to reverse them.

- Lawn Maintenance: If the tenant was responsible for maintaining the yard and failed to do so, you can deduct landscaping costs.

- Trash Removal: The cost to remove abandoned property or excessive trash can be deducted.

- Broken Doors: If a tenant leaves broken or damaged doors, the repair or replacement cost is deductible.

- Appliance Repair or Replacement: Damage to rental property kitchen appliances such as refrigerators due to misuse can be deducted.

- Water Damage: If a tenant’s negligence caused water damage, repair costs can be deducted.

- Unfinished Lease Obligations: If a tenant breaks the lease early, some states allow landlords to deduct unpaid rent for the remainder of the lease term.

- Unpaid Utility Bills: If utilities were the tenant’s responsibility and they left bills unpaid, these can be deducted.

- Property Abandonment Costs: If a tenant abandons the property, you can deduct costs associated with legal proceedings or re-renting the property.

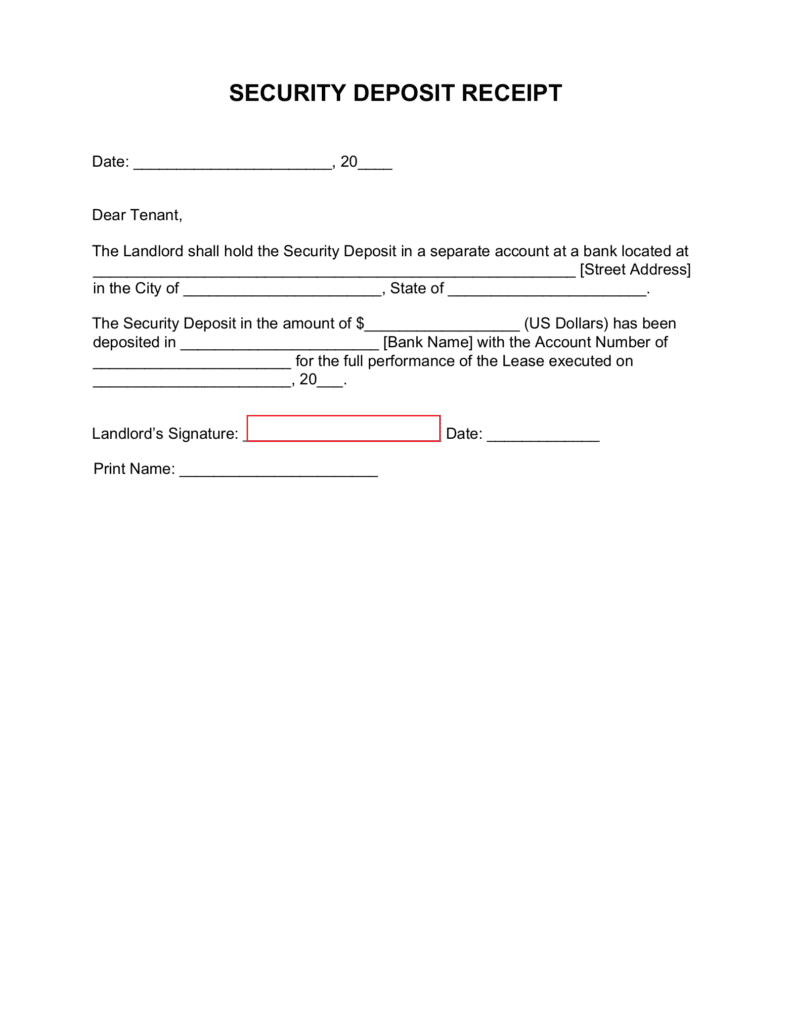

Common Rental Property Security Deposit Forms

Rental property management demands a keen understanding of the necessary documentation, especially when it comes to security deposits. These forms are crucial for protecting both landlords and tenants and range from detailed condition reports to return receipts. Below are 2 of the most common forms used in handling rental property security deposits:

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Security Deposit Insurance

Rental property security deposit insurance is an alternative to traditional cash deposits that provides landlords with coverage for potential damages while reducing upfront costs for tenants. This type of insurance can streamline the move-in process and alleviate financial burdens, making it an attractive option for both parties involved in a leasing agreement.

Rental Property Security Deposit FAQ

What are Rental Property Security Deposits?

A security deposit is a sum of money paid by a tenant to a landlord at the start of a lease agreement. This deposit acts as a financial safeguard for the landlord, covering potential property damages, unpaid rent, or other obligations not met by the tenant during the lease term. Once the lease ends, this deposit is typically returned to the tenant, less any deductions such as property damage or unpaid balances.

How Long Do Landlords Have to Refund Security Deposits?

Rental property owners and managers across the United States are all subject to time limitations to return any security deposit refunds, where applicable. Below is a list of the maximum time periods allowed for each state to return the deposit to the tenant:

- AL – 60 days

- AK – 14 days

- AZ – 14 days

- AR – 60 days

- CA – 21 days

- CO – 1 month

- CT – 15 days

- DE – 20 days

- FL – 15 days

- GA – 30 days

- HI – 14 days

- ID – 21 days

- IL – 30 days

- IN – 45 days

- IA – 30 days

- KS – 30 days

- KY – 60 days

- LA – 1 month

- ME – 21 or 30 days

- MD – 45 days

- MA – 30 days

- MI – 30 days

- MN – 3 weeks

- MS – 45 days

- MO – 30 days

- MT – 10 days

- NE – 14 days

- NV – 30 days

- NH – 30 days

- NJ – 30 days

- NM – 30 days

- NY – 14 days

- NC – 30 days

- ND – 30 days

- OH – 30 days

- OK – 45 days

- OR – 31 days

- PA – 30 days

- RI – 20 days

- SC – 30 days

- SD – 2 weeks

- TN – 30 days

- TX – 30 days

- UT – 30 days

- VT – 14 days

- VA – 45 days

- WA – 21 days

- WV – 60 or 45 days

- WI – 21 days

- WY – 30 or 15 days

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

How Much to Charge for Security Deposit?

Deciding how much to charge for a security deposit often depends on local laws and market conditions. The industry standard is to typically charge between one or two months’ rent, but some states have regulations that cap the maximum amount a landlord can charge. It’s also prudent to consider the risk associated with each tenant, such as their credit history and rental references. High-risk tenants might warrant a higher security deposit within legal limits. Always ensure that the amount charged respects local and state laws, and is fair and justifiable given the condition and value of the property.

How Much are Commercial Real Estate Rental Security Deposits?

Commercial real estate rental security deposits can vary significantly based on a range of factors. Generally, commercial landlords often request a security deposit equivalent to one to three months’ rent. However, this can increase depending on the tenant’s creditworthiness, the length of the lease, and the condition of the property. Importantly, the lease terms, local market conditions, and commercial property laws can also greatly influence the deposit amount. Always conduct thorough due diligence and consult a real estate professional or attorney to understand the specifics for your region and property type.

More Property Management Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.