Last Updated: January 2024

Renting out your old home or starting your investing career with single family houses is a great way to break into the world of rental real estate. With an estimated 25 million single family home renters in the United states, it is no surprise that single family houses are one of the most stable and low-risk types of rental investments. Below we take a deep dive into everything you need to know about single family rental properties.

On This Page

- What is a Single Family Rental (SFR)?

- Single Family Characteristics

- Single Family Rental (SFR) Investing

- Single Family Rental (SFR) Finance

- Marketing Single Family Rentals (SFR)

- Managing Single Family Rentals (SFR)

- Single Family Rental (SFR) Law

- Single Family Rental (SFR) Construction

- Single Family Rental (SFR) FAQ

What is a Single Family Rental (SFR)?

Single Family Rental Definition

A Single Family Rental (SFR) Property is a stand alone detached structure that is usually on its own lot with a yard and garage, which is rented out to tenants for the purpose of tenant dwelling and landlord profit.

Single Family Rentals Explained

Single Family Rentals (SFR) are like the houses you often see in suburban neighborhoods, but instead of being owned by the occupants, they’re rented out. These homes are standalone, meaning they don’t share walls with neighboring units like in an apartment complex. Many families and individuals choose SFRs because they offer the feel and space of a private home, including features like a backyard or garage. Renting a single family house provides tenants with the sought after homey experience, without the long-term commitment or high costs of buying and owning. For rental property investors, it’s a way to generate income from a single dwelling that requires less management oversight when compared to a multifamily apartment.

Single Family Characteristics

Single family rental homes offer distinct features that set them apart from other types of rental properties. These unique characteristics provide both unique benefits and challenges to landlords and tenants, however, understanding what these different characteristics are can help investors make informed decisions on whether or not the single family rental rentals are a good fit for them.

Privacy

These homes offer tenants a private living space without shared walls or floors.

Yard Space

Most come with private yards, providing outdoor space for recreation and gardening.

Location

Typically situated in residential neighborhoods, offering a community feel.

Size & Layout

Generally offer more space and rooms than apartments, catering to families.

Maintenance

Tenants often have more responsibilities, including lawn care or minor repairs, depending on the lease.

Parking

Most have private driveways or garages, ensuring easier parking solutions for tenants.

Longer Leases

SFR tenants tend to stay longer, leading to reduced turnover for landlords.

Customizable

Tenants might have more flexibility to personalize or decorate the space, subject to the lease terms.

Higher Rent

Given the added space and amenities, they can command higher rents than typical apartment units.

Utilities

Tenants usually handle their own utility contracts, giving them responsibility over usage & costs.

Single Family Rental (SFR) Investing

Single Family Investing Strategies

Single family rental investing strategies offer a diverse landscape for those keen on leveraging the real estate market for growth and passive income. From hands-on landlords, to equity investors, there’s a fit for every investor’s appetite and expertise. Each approach comes with its unique set of rewards and challenges, necessitating comprehensive research and understanding.

Institutional Investor Single Family Rental Properties

Single Family Build to Rent Communities

The “Single Family Build-to-Rent” (BTR) community concept has emerged as a groundbreaking trend in the real estate sector. Rather than traditional approaches of developing single-family homes for sale, these communities are designed expressly for renters, combining the benefits of individual living spaces with shared amenities.

Top 5 Largest Single Family Rental (SFR) Companies in 2024

The single-family rental market in the U.S. has witnessed significant growth over the past decade, with several large single family rental companies have redefined the dynamics of this asset class. Their size and influence not only shape market trends but also impact rental standards and practices nationwide.

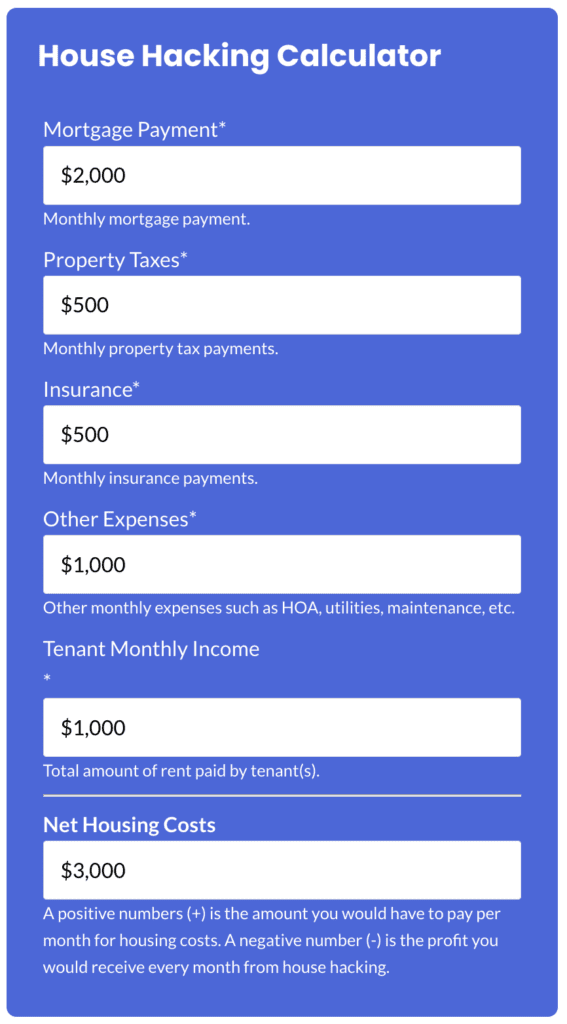

Try Our House Hacking Calculator →

100% Free – No Sign Up Required

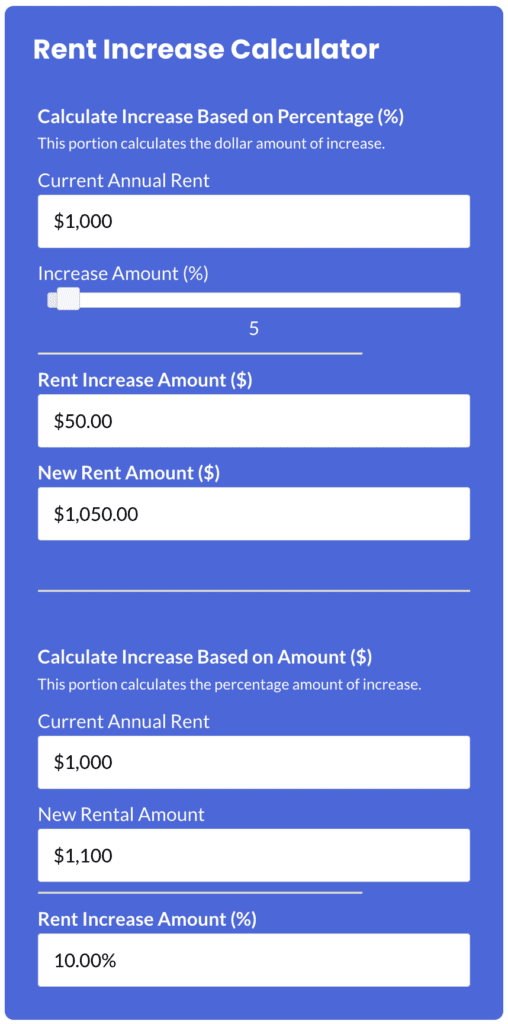

Try Our Rent Increase Calculator →

100% Free – No Sign Up Required

Single Family Rental (SFR) Finance

Single Family Rental Property Loans

Aside from your own home, securing a loan on a single family house is among the most obtainable types of investment real estate loans to get. A common beginner strategy is to get an “owner occupied” conventional loan, then live in it for a period of time, and rent it out afterwards. Keep in mind that there are limits to the amount of these loans once can have, as your portfolio of single family homes grows.

Single Family Rental Insurance

Single-family rental (SFR) insurance provides financial protection for both landlords and tenants in rental housing situations. For landlords, this insurance typically covers property damage, liability risks, and potential loss of rental income. Tenants can benefit from renter’s insurance, which covers personal property liability in case of injuries or damages caused to others, if the rental property becomes uninhabitable.

Single Family Rental Rent Prices

Determining the right rent price for single-family rentals is both an art and a science, balancing market demands with the property’s unique features. As the single-family rental market grows, understanding how to accurately price these rental homes can be the difference between prolonged vacancies and securing long-term, satisfied tenants. Setting an optimal fair market rent price ensures both competitive returns for landlords and perceived value for renters.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Single Family Rental News

- CoStar Group Acquiring Matterport Spatial Property Data Company in $1.6 Billion Deal

- Blackstone Acquiring Multifamily Owner AIR Communities for $10 Billion

- Property Meld and Lula Launch ‘Vendor Nexus’ Program

Marketing Single Family Rentals (SFR)

Buy and Sell Single Family Rental Properties

Buying and selling single-family houses are real estate transactions that involve a combination of homeowners, investors, and renters. Purchasing a single-family house to lease out involves acquiring a residential property for investment purposes, while selling a single family rental property entails transferring ownership to a new buyer who could use it for either personal or investment use.

Single Family Listing Websites

Real estate listing websites that list single family homes attract millions of visitors every year and streamline the buying, selling, and renting process. Single family investors and tenants can review many properties in a short period of time from the comfort of their home.

Single Family Rental Leasing

Single family rental leasing involves renting out single family homes to tenants, in order to generate a steady income stream while also providing a flexible living arrangement for the occupants.

Rental Real Estate Agents

Rental real estate agents serve as essential facilitators of income property transactions. They possess and leverage their expertise to help property owners, tenants, and investors navigate the buying, selling, and leasing process.

Managing Single Family Rentals (SFR)

Managing one or a few single family homes is among the easiest of all types of rental real estate asset classes since you only need to deal with one tenant and one structure. If it is a newer construction structure then maintenance issues will generally be less frequent than those of an older property. If you decide to build up a large portfolio of single family homes, this is where management can get more complicated. Each home (property) requires its own mortgage, landlord insurance policy, property tax payments, and accounting records, and keeping track of all these accounts can become difficult to manage.

Single Family Rental (SFR) Law

Singe Family Rental Property Documents

Documents used in single-family rental properties encompass a range of legal and formal paperwork to ensure smooth tenancy and compliance with legal standards. The primary document is the residential lease agreement, which details the terms of the rental arrangement. Additionally, various letters and notices, such as rent increase notices, lease renewal letters, and notices of lease violation, are essential for landlord-tenant communication and documentation between landlords and tenants.

Single Family Landlord Tenant Law

Single family rental landlord-tenant law encompasses the legal framework governing the relationship between landlords and tenants in the context of single-family home rentals. These laws vary by state and locality, covering a wide range of topics such as lease agreements, security deposits, rent control, tenant rights, and eviction procedures. They are designed to protect both parties by setting clear guidelines for rental practices, ensuring fair treatment, and providing mechanisms for resolving disputes.

Single Family Rental (SFR) Construction

Renovating Single Family Rental Properties

Renovating single-family rental properties involves updating and improving the property to enhance its appeal, functionality, and value. These renovations can range from cosmetic updates, like hiring a painter and installing new flooring, to major overhauls involving structural repairs, kitchen or bathroom remodels, and energy-efficient upgrades. Effective renovations not only attract and retain tenants but can also lead to increased rental income and property value, making them a strategic investment for landlords and property investors.

Single Family Rental Property Maintenance

Maintaining single-family rental (SFR) properties is an important aspect of property management, involving regular upkeep, repairs, and inspections to ensure the property remains safe, functional, and appealing. Effective maintenance includes addressing tenant requests promptly, conducting routine preventive measures, and upgrading essential systems like plumbing, electrical, and HVAC. Good property maintenance not only enhances tenant satisfaction and retention but also preserves the property’s value and helps avoid more costly repairs in the future.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Single Family Rental (SFR) FAQ

What are the Best Markets for Single Family Rentals?

The US landscape for single-family rentals is vast and varied, with certain markets offering exceptional opportunities for investors based on growth, demand, and return on investment. As the appeal of single-family rentals surges, pinpointing the best markets is extremely important for maximizing profitability and minimizing risk. However, what’s considered “best” can vary based on an investor’s goals, budget, and investment timeline. below we take a look at the 3 Steps to Determining the Best Markets for Single-Family Rental Investments:

1. Analyze Economic and Population Trends

- Look for areas with steady job growth, low unemployment rates, and a rising population. Markets with a robust economic foundation tend to attract and retain renters.

- Consider cities with emerging industries, educational institutions, or significant infrastructure projects on the horizon.

2. Evaluate Real Estate Market Dynamics

- Research markets with a good balance of affordable property prices and rising rents. High property values might diminish your ROI, whereas low rental demand can lead to vacancies.

- Examine historical data to understand market resilience during economic downturns, and consider potential for property appreciation over time.

3. Assess Local Regulatory Environment:

- Understand local landlord-tenant laws, which can heavily influence the ease of property management and potential profitability.

- Investigate potential changes in property taxes, future development plans in the area, and any impending regulations that might impact the rental market, positively or negatively.

What is the Different Between Single Family Rentals vs Multifamily?

When it comes to rental properties, both single-family homes and multifamily properties present distinct advantages and challenges for investors and tenants. While single-family rentals offer a private and home-like environment, multifamily properties can provide scalability and increased social interactions. Making a choice between the two requires an understanding of their unique features and how they align with individual investment or living preferences.

| Characteristic | Single Family Rental Home | Multifamily Property |

|---|---|---|

| Privacy | High privacy without shared walls, floors, or ceilings. | Might have shared walls, which could mean less privacy. |

| Maintenance Responsibility | Often falls on the tenant for things like lawn care or minor repairs. | Typically handled by property management; tenants have fewer duties. |

| Investment Scale | Investors purchase individual properties. | Investors can acquire multiple units in one transaction. |

| Community Feel | Located in residential neighborhoods with a community atmosphere. | Built-in community, often with communal areas like gyms or lounges. |

| Rent Potential | Higher rent due to individual amenities like private yards. | Might be lower per unit, but total income can be higher due to multiple units. |

| Management | Can be simpler if owning just a few, but scattered properties may complicate management. | Often centralized management, especially in larger complexes. |

| Tenant Turnover | Typically lower; families or long-term renters prefer these. | Might be higher due to the transient nature of many tenants. |

| Amenities | Generally limited to the property’s own features. | Often have shared amenities like swimming pools, gyms, or laundry facilities. |

| Initial Investment | Can be lower as investors buy one property at a time. | Typically higher due to the purchase of several units at once. |

| Utility Contracts | Tenants usually handle their own individual contracts. | Might have shared utilities or bulk contracts handled by management. |

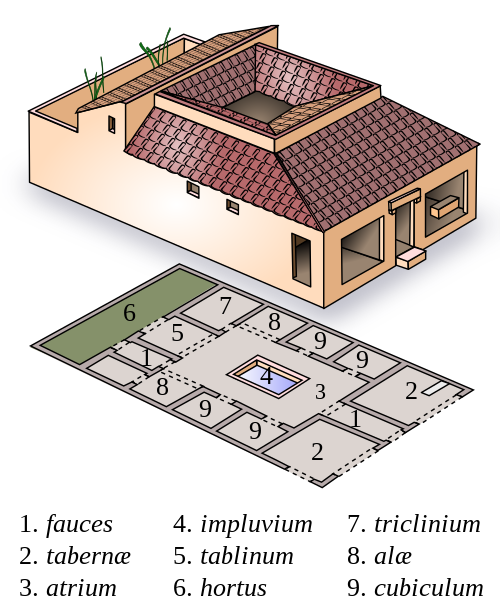

What is the History of Single Family Rentals?

The practice of renting out houses has been around for thousands of years, dating back to ancient civilizations such as Greece and Rome. In ancient Rome, for example, the concept of the “domus” or private residence was common, and wealthy families would often rent out their extra space to tenants. During the Middle Ages in Europe, renting out property became a more common practice, as the feudal system made land ownership a privilege reserved for the nobility. The lower classes, including merchants and artisans, would rent homes and workshops from their landlords. In the 18th and 19th centuries, the Industrial Revolution led to urbanization and the growth of cities, which in turn led to an increase in the demand for rental housing. The concept of present day landlords began to emerge as entrepreneurial individuals began to buy up properties and rent them out to the growing population of urban workers. In the United States, renting out houses became increasingly common during the 20th century, as the country experienced a post-World War II housing boom and a rise in suburbanization. Renting out single family houses is still a popular housing option for many people who would rather not live in a multifamily apartment, as well as entrepreneurial individuals looking to build wealth.

More Types of Rental Real Estate

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal and/or financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.