Last Updated: December 2023

Commercial real estate financing, also called “CRE financing”, is a type of rental property loan that is used to purchase or refinance commercial properties. CRE financing is typically used by investors or businesses that are looking to purchase or lease property for their business operations, or as a way for individuals, investors, and businesses to leverage property equity to raise capital. There are a variety of commercial real estate financing options available, but which one is best for a given property depends on a variety of factors, including the type of property being purchased, the amount of money that is being borrowed, the creditworthiness of the borrower, and several other variables.

CRE Loan Defintion

CRE loans, also known as commercial real estate loans, are mortgages secured by a lien on a commercial property. Commercial real estate assets include income-producing office buildings, retail space, warehouses, and other types of property used for business purposes.

CRE Loans Explained

Although they may seem a bit mysterious at first, but CRE loans are generally very similar to multifamily loans with several differences. One of the main differences about this type of mortgage loan, is that it is secured by a lien on a commercial, rather than residential, property – commercial in this case meaning income-producing. Commercial real estate (CRE) refers to any income-producing real estate, including office buildings, shopping centers, warehouses, and apartments. Check out our Commercial property guide for more information. Aside from the physical property being different, loan-to-value ratios on a typical CRE loan are lower than that of a residential mortgage. This means that CRE lenders are generally more conservative in their lending. That said, CRE loans can be quite complex, and the terms can vary significantly from one lender to the next.

How Do Commercial Real Estate Loans Work?

The CRE loan process first begins with a loan application, which is then followed by a loan underwriting process. During loan underwriting, the lender will review the loan application and supporting documentation to determine whether the loan meets its guidelines.

Assuming the loan is approved, the lender will issue a loan commitment letter. The loan commitment letter outlines the terms and conditions of the loan. The borrower will then have a certain amount of time to close the loan. At closing, the borrower has to provide the lender with specific documentation, including a promissory note, deed of trust, and loan agreement.

They’ll also be responsible for paying closing costs. Once the loan closes, the borrower will make monthly payments to the lender, typically including the loan interest, principal, and escrow payments. The borrower is also responsible for paying any property taxes or commercial property insurance costs.

Commercial Real Estate Debt Structures

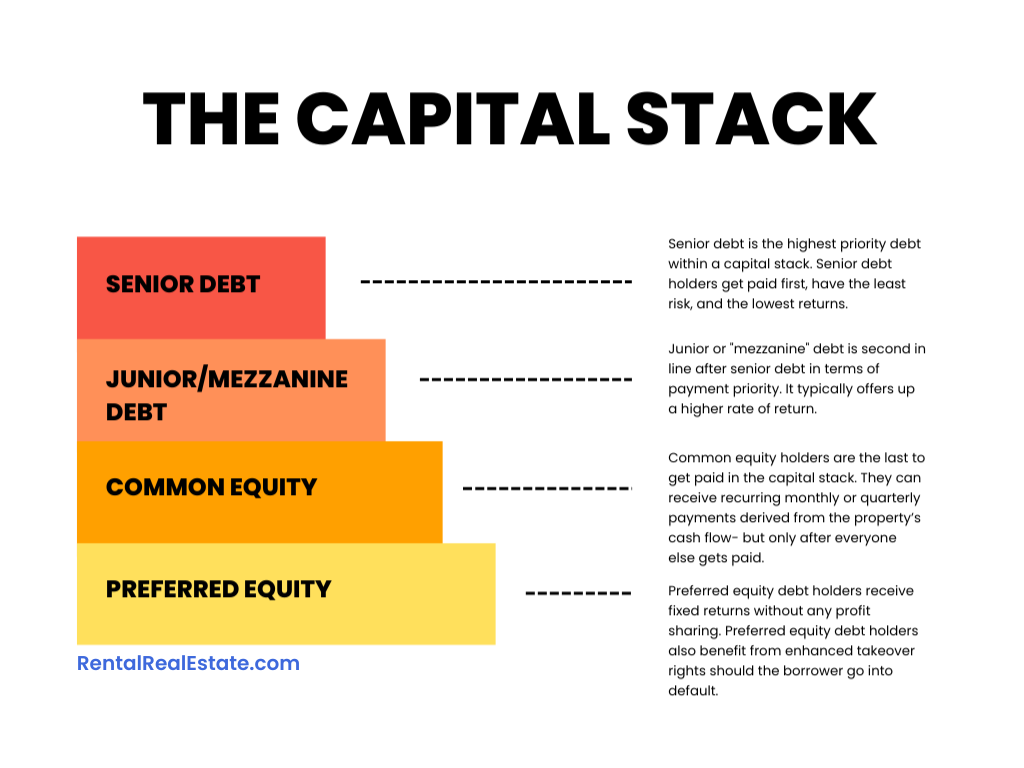

In commercial real estate financing, a “capital stack” refers to the order in which different types of financing are arranged. A commercial real estate loan capital stack ranks the seniority of different sources of capital, with the most senior sources of capital being at the top of the stack and the most junior sources of capital at the bottom. The highest or “senior” source of capital in a capital stack is typically debt, which is also the cheapest source of capital. This is because debt is typically repaid before any other source of capital in a real estate transaction.

After the senior source comes equity, which is typically the most expensive source of capital. This is because equity holders are typically last in line to receive any proceeds from a real estate transaction. The capital stack can also include mezzanine financing, which is a type of debt that ranks between senior debt and equity. Mezzanine financing is typically more expensive than senior debt but less expensive than equity.

Using a capital stack is important in rental property finance. It helps real estate developers and investors understand how different sources of financing are arranged in a real estate transaction. It is also critical that investors and CRE professionals understand the relative cost of different sources of capital in a capital stack.

1. Senior Debt

Senior debt is the highest priority debt within a capital stack. This means that senior debt lenders get paid before other investors collect their return on investment. In the CRE space, senior debt often makes up 75% of the total cost of a project and most is held by mortgage lenders or other debt holders that have the highest claim to a given asset. This number will vary based on several factors, including a building’s risk profile, stage of the current business cycle, buyer’s credit history, and other deal-specific criteria. The most important thing to know about senior debt is that it is the best-secured position within a capital stack due to its ability to retain the property as collateral in the event of a default. The only downside to this privileged position is that returns are typically lower than other layers in the capital stack.

2. Junior Debt/Mezzanine Debt

After senior debt payments and any operating expenses, the excess cash from a deal will go towards servicing the mezzanine, or “Junior,” debt. This means that it is second in line after senior debt in terms of payment priority and where it sits on the capital stack. Think of mezzanine debt as similar to the HELOC or second mortgage you might take out on your residence. Since it stands second in line after senior debt, it typically offers up a higher rate of return- just like how your primary mortgage will often have a lower interest rate than your second line of credit.

3. Preferred Equity

Preferred equity is a somewhat amorphous term and has changed in meaning since the last housing crisis in 2008. It was once used to describe a capital type that shares similarities with common equity, with additional payment rights on top. These days, and partially due to changes made after the 2008 crash, preferred equity now works similarly to subordinate debt, receiving fixed returns without any profit sharing. Preferred equity debt holders also benefit from enhanced takeover rights should the borrower go into default.

4. Common Equity

Common equity holders are the last to get paid in the capital stack. They’re paid out after senior, mezzanine, and preferred equity holders have received their promised returns. In the right situation, common equity holders can receive recurring monthly, or more often, quarterly, payments derived from the property’s cash flow- but only after everyone else gets paid. While common equity holders hold the riskiest position in the capital stack, they’re also likely to see the highest returns should everything go smoothly with the deal. They generally receive payment in the form of a preferred return, paid out of available cash flow after all other creditor loan servicing has been made. Common equity holders also participate in property cash distributions, if any are available. Should the property exceed expectations, common equity investors generally have no limit on their potential for returns.

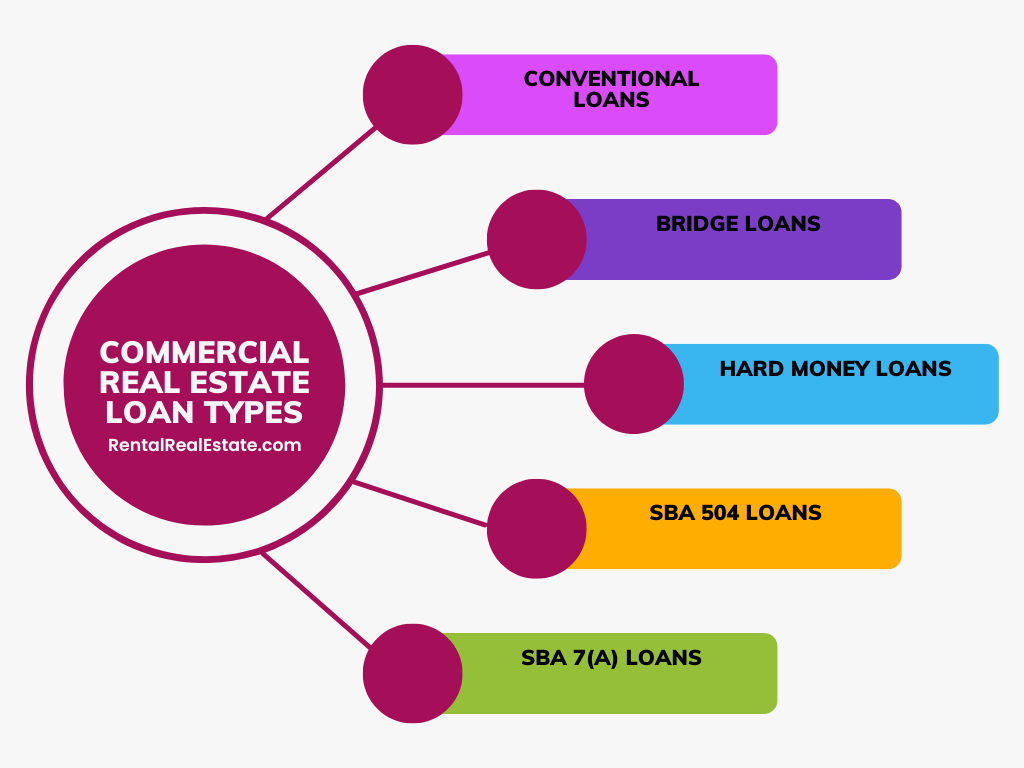

Commercial Real Estate Loan Types

Understanding the different types of commercial real estate loans is key to successfully understanding the CRE loan process. Whether you’re an investor seeking capital to acquire a value-add multifamily asset, a developer looking for funds to break ground on a new hotel property, or a mortgage broker or commercial lender, properly understanding the different types of loans can drastically boost your probability of success.

Conventional Commercial Real Estate Loans

Conventional commercial loans should be very familiar to anyone who has purchased a home using a traditional residential mortgage, albeit with shorter terms than your standard 30-year mortgage. These loans are among the most popular options for investors, developers, and other real estate professionals looking to raise capital via or for a commercial property. Conventional commercial loans are similar to what you’d get when purchasing a single-family home but often with shorter terms. A large portion of commercial real estate investors still purchase property using traditional, fixed-rate mortgages.

Conventional Commercial Loan Terms

Most lenders will require a minimum 25% down payment for a conventional loan. In return, borrowers get a fixed-rate mortgage ranging between 5 to 30 years, although most borrowers tend to opt for loans between 5 and 10 years, owing to the nature of the commercial real estate space. Like a residential mortgage, lenders will order an appraisal to determine the property’s value. However, with conventional commercial loans, borrowers must also provide property financial statements. Lenders will review the financials before extending credit to ensure that the property’s existing rents/cash flow can safely support the debt service.

What Borrowers Use Conventional Commercial Loans?

Conventional fixed-rate mortgages are often used by investors wanting to acquire an occupied, existing asset with positive cash flow. You’ll need good credit to get a conventional loan, typically above 700 points or higher. While the requirements are somewhat stringent, borrowers will benefit from low-cost capital compared to other loan types.

Commercial Real Estate Bridge Loans

Commercial bridge loans are short-term real estate loans used to purchase commercial property prior to refinancing to a long-term mortgage at a later date. Commercial bridge loans are usually made by hard money lenders but can also be made by private lenders, banks, and credit unions.

Commercial Bridge Loan Terms

Bridge loans tend to carry higher interest rates than most permanent loan types, mainly because of their short-term nature and higher risk potential. Commercial real estate bridge loans are designed to provide somewhere between 6 and 12 months’ worth of financing prior to repayment. Their rates tend to be around 50 and 200 basis points higher than a standard, fixed-rate mortgage, with that number being determined by the particulars of the property, borrower, and lender.

How Borrowers Use Commercial Bridge Loans?

The main advantage of a commercial bridge loan is that it allows the borrower to purchase a property fast without having to go through the lengthy process of applying for a traditional mortgage. This can be a benefit for borrowers who are trying to take advantage of a good deal on a property before it gets away. Another benefit offered by commercial bridge loans is that they can be easier to qualify for than a traditional mortgage, mainly because the loan is secured by the property rather than the borrower’s credit history. As a result, borrowers with less-than-perfect credit can still qualify for a loan.

Commercial Hard Money Real Estate Loans

Commercial hard money loans are a specific type of asset-based loan financing, by which a borrower receives funds that are secured by a piece of property. Hard money loans are typically given out by real estate companies or private investors and are often used by firms or individuals without access to more traditional forms of borrowed capital.

Commercial Hard Money Loan Terms

Hard money loans typically have loan terms between 3 and 36 months. They also tend to have the highest interest rates out of all major commercial real estate loan categories. Interest rates for hard money loans sit between 10 and 20% – significantly higher than most conventional loans. But that doesn’t mean hard money loans are useless – far from it.

How To Use Commercial Hard Money Loans?

Borrowers leverage hard money real estate loans when they need money fast, and have a plan to pay it back fast- you don’t want to take out a long-term hard money loan. They have the potential to be a fantastic source of short-term capital when investors need flexibility or they need to move fast on a deal. For instance, your average loan approval takes between 30 and 60 days if you apply at a typical lender. You can have that same loan in as little as a week with a hard money lender.

Commercial Real Estate SBA 504 Loans

An SBA 504 real estate loan is a government-backed loan available to small businesses fo r the purchase of commercial real estate. SBA 504 loans are available through participating lenders and are partially guaranteed by the Small Business Administration (SBA).

SBA 504 Loan Terms

The SBA 504 Loan Program is designed to help small businesses purchase or construct owner-occupied commercial real estate at a fixed rate. They are available through participating lenders and are partially guaranteed by the SBA.

When used to purchase commercial real estate assets, loan terms tend to sit around 20 years. If the loan is used to buy equipment, like an HVAC system or security system, the average loan term is around 10 years. Interest rates range between 3.5% and 5%, though they may increase as the Fed hikes interest rates. One thing to keep in mind, to qualify for a SBA 504 loan, the owner needs to occupy at least 51% of the property.

How Borrowers Use SBA 504 Loans

504 loans are available to small business owners to help them finance the purchase, renovation, or construction of commercial real estate. The loans are backed by the SBA, or Small Business Administration, and are available through participating lenders. Borrowers use these loans for a variety of purposes, including the purchase or renovation of an owner-occupied commercial property, the purchase or construction of a new facility, or the purchase of equipment. Additionally, the loan can also be used to refinance existing debt.

Commercial Real Estate SBA 7(a) Loans

The SBA 7(a) loan program is the SBA’s most popular loan program. More than half of all SBA-guaranteed loans are made through the 7(a) program.

SBA 7(a) Loan Terms

The max amount you can borrow with a 7(a) loan is $5 million. The interest rate is based on the Prime Rate plus a margin. The margin is determined by the borrower’s credit score and the length of the loan. The term of a 7(a) loan can be up to 25 years for real estate and 10 years for equipment. The repayment schedule is typically monthly but can be weekly or bi-weekly. There is no collateral required for a 7(a) loan, but the SBA does require a personal guarantee from the business owner. This means that the owner of the business is personally responsible for repaying the loan if the business cannot. The SBA does not charge any fees for guaranteed 7(a) loans. However, there may be some fees charged by the lender, such as an origination fee, appraisal fee, or closing costs.

How Borrowers Use SBA 7(a) Loans

This loan program is available to small businesses that are for-profit, have been in operation for at least two years, and meet the SBA’s size standards. To apply for an SBA 7(a) loan, you will need to submit a business plan, personal financial statements, and other documentation. The SBA does not make loans directly to small businesses but rather provides guarantees to lenders, who then make the loans. 7(a) loans are mostly used for working capital, equipment, or real estate. They can also be used for almost any business purpose. Some common uses for 7(a) loans include:

- Purchase Inventory

- Payroll

- Rent or Mortgage Payments

- Expansion

- Equipment Purchases

- Business Acquisition

Commercial Real Estate Loan & Borrower Requirements

Commercial real estate loan and borrower requirements can vary greatly depending on the type of rental property being purchased and the type of lender providing the financing. For example, a small business owner may be able to qualify for a SBA-backed loan to purchase a mixed-use property, while a large corporation may need to seek out a commercial mortgage lender to finance an office building. The following is a rundown of some of the key requirements that borrowers should be aware of when seeking a commercial real estate loan.

Loan Size

Commercial real estate loans can range in size from a few thousand dollars to millions of dollars. The size of the loan that a borrower can qualify for will depend on the value of the property being purchased, the borrower’s credit history and income, and the lender’s lending criteria.

Down Payment

Most commercial real estate loans will require a down payment of at least 10%, but some lenders may require 20% or more. The down payment requirements will vary depending on the type of loan being sought and the lender’s criteria.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is a key factor that lenders use to determine how much money to lend to a borrower. The LTV ratio is calculated by dividing the total loan amount by the value of the property. For instance, if a borrower is seeking a $1 million loan to purchase a property valued at $2 million, the LTV ratio would be 50%. Lenders typically prefer to see an LTV ratio of 80% or less, but some may be willing to lend up to 90% or even 100% for certain types of properties.

Interest Rate

The interest rate on a commercial real estate loan is typically higher than the rate on a residential mortgage. The exact interest rate will depend on the type of loan being sought, the borrower’s credit history and income, and the lender’s criteria.

Loan Term

The term of a commercial real estate loan is typically shorter than the term of a residential mortgage. Generally, the most common terms are 3, 5, 7, and 10 years. However, some lenders may offer longer terms for certain types of properties.

Amortization

Most commercial real estate loans are amortizing loans, which means that the loan balance is gradually paid down over the life of the loan. However, some loans, such as balloon loans, may have a balloon payment at the end of the loan term.

Prepayment Penalty

Some commercial real estate loans may have a prepayment penalty, which means that the borrower will be charged a fee if they pay off the loan early. This fee is typically a percentage of the loan balance.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Commercial Real Estate Financing FAQ

What to Look For in a Commercial Real Estate Lender?

When you’re looking for a commercial real estate lender, there are a few things you’ll want to keep in mind. Below we take a look at the top 4 things to look for in a CRE Lender.

Property-Specific Expertise

You want to find a lender who is experienced in the type of property you’re looking to purchase. If you’re looking to purchase an office building, for example, you’ll want to find a lender who has experience financing office buildings.

Competitive Interest Rates

Interest payments add up. Search for lenders that offer competitive interest rates. If you can avoid it, you don’t want to overpay for your loan, so it’s important to look for a lender that can offer you a competitive rate.

Flexible Loan Terms

Find a lender who offers flexible loan terms. When it comes to a commercial real estate asset, you may need a longer loan term than you would for a residential property. You’ll want to find a lender who is willing to work with you on the loan term that you need.

Down Payment

Finally, you’ll want to find a lender who is willing to work with you on the down payment. When you’re buying commercial real estate, the down payment can be a challenge. You’ll want to find a lender who is willing to work with you to get the down payment you need.

Who Uses Commercial Real Estate Loans?

Commercial real estate loans are part of day to day business for many real estate professionals, including:

- Investors that use loans to acquire or take an interest in an existing property

- Developers that need loans to finance or refinance a construction/development project

- Mortgage brokers that need to find loans for clients

- Commercial lenders that give out and manage CRE loans

In most cases, commercial real estate loan types sit within one of three categories – Investment Loans, Development Loans, and Business Loans.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

More Rental Property Loans

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.