Last Updated: February 2024

Real estate note investing can be a great way to generate income from real estate without having to deal with the physical headaches of buy and hold or ground up development. In note investing, you essentially act as the bank for a rental property loan. This can be done with small and large amounts of capital, and also private money notes or institutional notes. Note investing can provide a consistent and reliable stream of passive income, however, it can also come with risks such as borrower default.

What is Real Estate Note Investing?

Real Estate Note Investing Definition

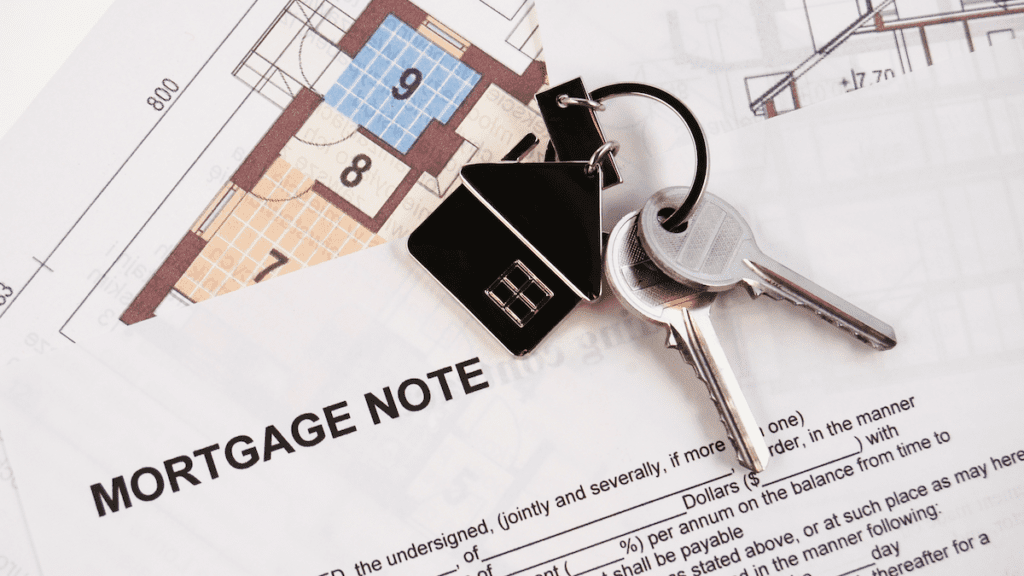

Note investing (also called Promissory Notes or Mortgage Notes) in real estate is a strategy in which an investor provides the capital for a mortgage note. The mortgage note is essentially a legal IOU that outlines the terms of the loan, including the interest rate, payment schedule, and other details. Most notes can be classified as private or institutional. Private notes are those directly with the property owner, whereas institutional notes are existing notes held with existing banks or lenders.

Performing vs Non-Performing Notes

In real estate note investing, a performing note refers to a loan where the borrower is making their payments on time and the loan is not in default. A non-performing note is associated with a loan where the borrower is behind on payments or in default. Non-performing notes can typically be acquired at a discount and have the potential for higher returns if the investor can successfully navigate the recovery process.

What is Lien Position and Why it’s Important?

Lien position refers to the order in which claims against a property will be paid in the event of a default that results in foreclosure. This is important in real estate note investing because it impacts the likelihood of recouping investment funds if the borrower defaults. The first lien position is typically held by the primary mortgage, and will be the first to be paid from any proceeds from a foreclosure sale. Junior or subordinate liens, such as a home equity line of credit, are paid afterwards, which can be risky if the foreclosure sale does not generate enough funds to cover these additional liens. Understanding lien positions can help assess the potential risk and return of a real estate note investment.

Important Note Investing Terms

Collateral – In the context of real estate lending, collateral is the property that secures the loan. If the borrower defaults on the loan, the collateral can be seized by the lender (or the owner of the note) as a form of repayment.

Deed in Lieu of Foreclosure – Deed in Lieu of Foreclosure is a document that transfers the title of a property from the borrower to the lender when the borrower is unable to make mortgage payments. It can serve as an alternative to foreclosure, as it can be less damaging to the borrower’s credit.

How to Invest in Real Estate Mortgage Notes?

Investing in real estate notes can be an effective way to generate passive income and earn higher returns than other forms of rental real estate investment. Here are the 7 steps to invest in private real estate notes.

1. Identify Investment Goals

The first step in investing in private real estate notes is to identify your investment goals. Determine how much capital you have to invest, what type of returns you are seeking, and what level of risk you are comfortable with.

2. Choose Private or Institutional Notes

The second step is to choose which type of notes you are interested in investing – private or institutional. Private notes are those directly with the property owner, whereas institutional notes are usually existing notes held with existing banks or lenders. Private notes are often originated directly by investors by providing private money loans directly to borrowers, or originating seller finance notes. Institutional notes can be purchased on secondary markets from banks, brokers and other note investors.

3. Conduct Due Diligence

Conduct thorough research and due diligence on the borrower, the property, and the note. Evaluate the borrower’s creditworthiness, the property’s value and condition, and the terms of the loan to ensure that it’s a sound investment.

4. Make an Offer

If you decide to move forward with the investment, make an offer to purchase the mortgage note. Negotiate the terms and price of the note with the current owner.

5. Close the Deal

Once you have agreed on the terms, close the deal by executing the necessary paperwork such as a purchase agreement as well as transferring funds. It’s important to work with a reputable escrow and title company or attorney to ensure a smooth and legally binding transaction.

6. Collect Payments

As the new lender, you will start collecting payments from the borrower according to the terms of the loan. Make sure to keep accurate records of payments and stay in communication with the borrower to ensure they stay current on their payments. For institutional type notes, a servicing company can be used to facilitate payment collection.

7. Monitor and Manage the Investment

Monitor the performance of the investment and manage it accordingly. Stay up-to-date on the borrower’s financial situation and the property’s value to ensure that the investment remains sound.

Try Our

Cap Rate Calculator →

100% Free – No Sign Up Required

Try Our Commercial Valuation Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Pros & Cons of Real Estate Mortgage Note Investing

While there are several benefits to investing in private notes, there are also some potential drawbacks that investors should be aware of. We take a look at the pros and cons of both below.

Pros of Note Investing

- Passive Income – One of the key advantages of real estate private note investing is the ability to generate a consistent and reliable stream of passive income. As the lender, you receive regular payments from the borrower, which can help to supplement or replace traditional income streams.

- Higher Returns – Real estate private note investing can offer higher returns compared to other traditional investment options, such as real estate stocks or bonds. This is because private notes often offer higher interest rates and less competition, allowing investors to earn a premium for taking on the risk.

- Diversification – Investing in real estate private notes can offer diversification to a portfolio. It can provide exposure to real estate without the need to own or manage properties directly, and can also help to hedge against stock market volatility.

Cons of Note Investing

- Potential Risks – Real estate private note investing comes with inherent risks, including the potential for borrower default, property value decline, and changes in interest rates. As such, it’s important for investors to conduct thorough due diligence and risk management strategies to minimize potential losses.

- Limited Liquidity – Private notes can be illiquid investments, meaning that they cannot be easily sold or traded. This can limit the ability to access capital quickly, and investors should be prepared to hold their investments for longer periods.

- Complexity – Private note investing can be a complex investment strategy, requiring significant research, knowledge, and expertise. Investors should be prepared to commit the time and resources necessary to properly analyze and manage their investments.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Real Estate Mortgage Note Investing FAQ

Where to Buy and Sell Mortgage Notes?

Mortgage notes can be bought and sold through a variety of platforms, including online marketplaces dedicated to note trading, real estate investment groups, and directly from private parties, banks or lending institutions. Each source offers a range of note types, from performing notes with consistent payment histories to non-performing notes that carry higher risk but potentially higher returns. Below are a few popular platforms to buy and sell mortgage notes:

How Does Mortgage Note Investing Compare to Other Real Estate Investing Strategies?

Mortgage note investing offers a distinct approach to real estate investment by focusing on the financial aspect of property ownership rather than the physical property itself. This strategy can provide passive income and involves different risks and management efforts compared to traditional real estate investments.

| Investment Strategy | Comparison with Mortgage Note Investing |

|---|---|

| Ground-Up Development | Ground-up development involves high capital investment and hands-on management to create properties from scratch, unlike the passive income focus of mortgage notes. |

| Buy and Hold | Buy and hold focuses on acquiring physical properties for rental income and appreciation, requiring property management, unlike the more hands-off nature of mortgage notes. |

| BRRRR | BRRRR involves active property management and rehabilitation, contrasting with mortgage note investing’s passive income stream from loan repayments. |

| House Hacking | House hacking requires living in the investment property and managing tenants, unlike mortgage note investing, which does not involve direct property management. |

| Fix and Flip | Fix and flip is a short-term, hands-on investment strategy focusing on property renovation and resale, unlike the passive and long-term income potential of mortgage notes. |

| Wholesaling | Wholesaling involves quickly turning contracts for a profit without owning the property, contrasting with mortgage note investing’s long-term income from loan interest. |

| Turnkey Rentals | Turnkey rentals offer direct ownership of rental properties with minimal initial effort, unlike mortgage notes that offer passive income without physical property management. |

| NNN | NNN leases involve owning commercial properties with long-term, low-maintenance leases, contrasting with mortgage notes’ focus on income from borrowers’ loan payments. |

| Syndication | Syndication pools investor money for direct property investments, requiring more capital and offering potential for physical property appreciation, unlike mortgage notes. |

| Real Estate Stocks | Investing in real estate stocks or REITs offers liquidity and market-based returns, differing from the more direct, loan-based income stream of mortgage note investing. |

More Rental Real Estate Investments

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.