Last Updated: February 2024

Wholesaling is a real estate investing method that sounds much more complicated than it really is. The process simply involves finding a property owner who is willing to sell a property at a discount, and connecting it quickly to an investor for a profit or fee. The process is generally a low-risk and low-capital way for investors to get started in real estate investing, as it does not require buying or rehabbing properties.

What is Real Estate Wholesaling?

Real Estate Wholesaling Definition

Real estate wholesaling is an investment strategy in which an investor, known as a wholesaler, gets a property under contract at a discounted price and then quickly resells it to another buyer for a profit. The wholesaler does not actually purchase the property, but rather assigns the contract to another investor for a fee, which is typically a percentage of the sale price. The buyer then takes over the contract and closes on the property. It is important to distinguish that a wholesale contract is not a promise to buy the property, rather it is a contract giving the wholesaler a set period of time to find a buyer for the property.

Can You Wholesale a Rental Property?

Yes, rental properties can be wholesaled just like any other type of property. The wholesaler would enter into a contract with the owner of the rental property and then assign that contract to an interested buyer, typically an investor looking for income-producing properties. It’s important to note that the existing lease agreements and tenant rights must be honored in these transactions, which can add complexity to the deal.

Important Wholesaling Terms

Assignment of Contract – An assignment of contract is a legal and binding agreement that allows the wholesaler to transfer their rights to buy the property to another buyer before the contract with the original seller closes.

Cash Buyers List – A cash buyers list is a list of potential real estate investors who can purchase properties in cash quickly. Wholesalers often build and maintain a cash buyers list as it can make the process of selling contracts more efficient.

What is a “Contract” in Real Estate Wholesaling?

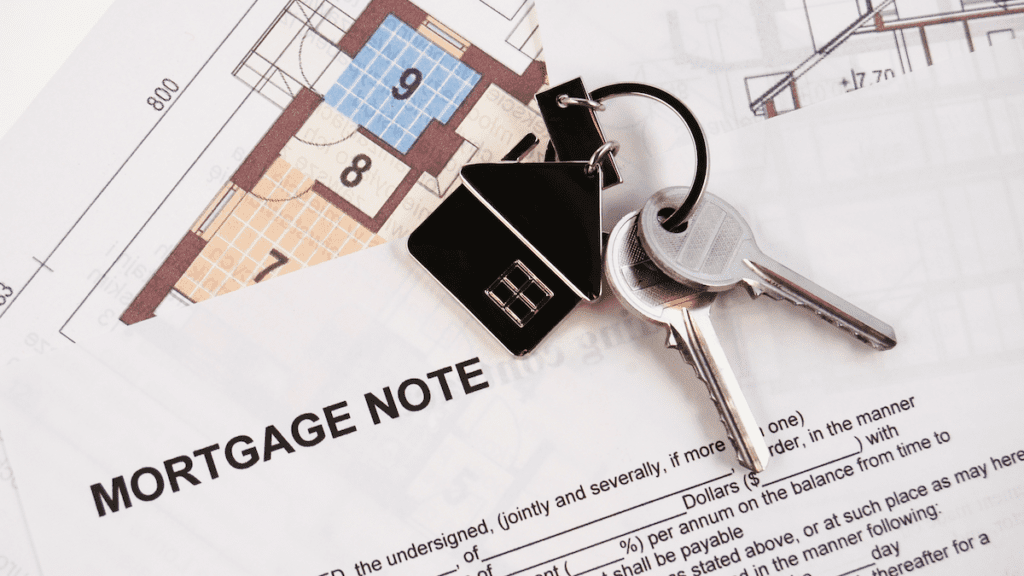

A wholesale real estate contract is the centerpiece of the entire wholesaling process. It is a legally binding agreement between a property owner and a wholesaler, wherein the wholesaler obtains the rights to purchase the property. The wholesaler’s intention is not to buy the property themselves, but to find an end buyer to whom they can assign that contract to for a fee. This real estate document outlines the price and terms agreed upon by the initial seller and the wholesaler, serving as the foundation for the wholesaling transaction.

How to Wholesale Real Estate?

The actual process of wholesaling real estate is not very complicated, and can be done with just a computer and phone. When compared to other investment methods such as turnkey investing, a wholesaler’s success will ultimately depend on their ability to find and negotiate good deals, market properties effectively, and quickly assign to buyers. Here are the 5 steps to successfully wholesale real estate.

1. Learn Local Laws

Before you venture into real estate wholesaling, it’s important to understand the laws and regulations in your area, on top of a fundamental understanding of real estate finance. These laws include zoning laws, contract laws, and any licensing requirements. Familiarize yourself with the rules and regulations in your area to avoid legal trouble.

2. Research and Find Properties

Once you understand the legalities and economics of wholesaling real estate, you can start researching potential properties that are undervalued or have motivated sellers. This requires finding discounted properties that you can put under contract and resell for a profit. Start by networking with real estate agents, attending auctions, and searching online for properties that fit your criteria. Look for distressed properties, motivated sellers, or homes that have been on the market for a long time.

3. Negotiate and Put Under Contract

Once you’ve found a property, it’s time to negotiate with the seller and put the property under contract. This means you’ll sign a purchase agreement with the seller that gives you the right to buy the property at a certain price. Utilizing online contract software can help make this step easier for managing important documents. Among other things, make sure the contract includes an inspection period and a contingency that allows you to back out if you can’t find a buyer.

4. Market and Assign Contract to Investor

With the property under contract, it’s time to market it to potential investors who may be interested in purchasing it from you at a higher price than what you paid for it. You can do this by posting ads online and sending emails to your investor network. Once you find a buyer, you’ll assign the contract to them, which involves legally transferring your rights to buy the property, over to the investor for a fee.

5. Close Deal and Collect Assignment Fee

Finally, it’s time to close the deal and collect your assignment fee. This fee can be in 1 of 3 forms. It is typically a set amount that is agreed upon by you and the investor, the difference between what you purchased the property for and sold it to the investor, or a percentage of the sale price. Assignment fees are typically paid by the buyer. Depending where you live, an escrow company or lawyer, will handle the transaction paperwork and disburse the funds to you and the seller.

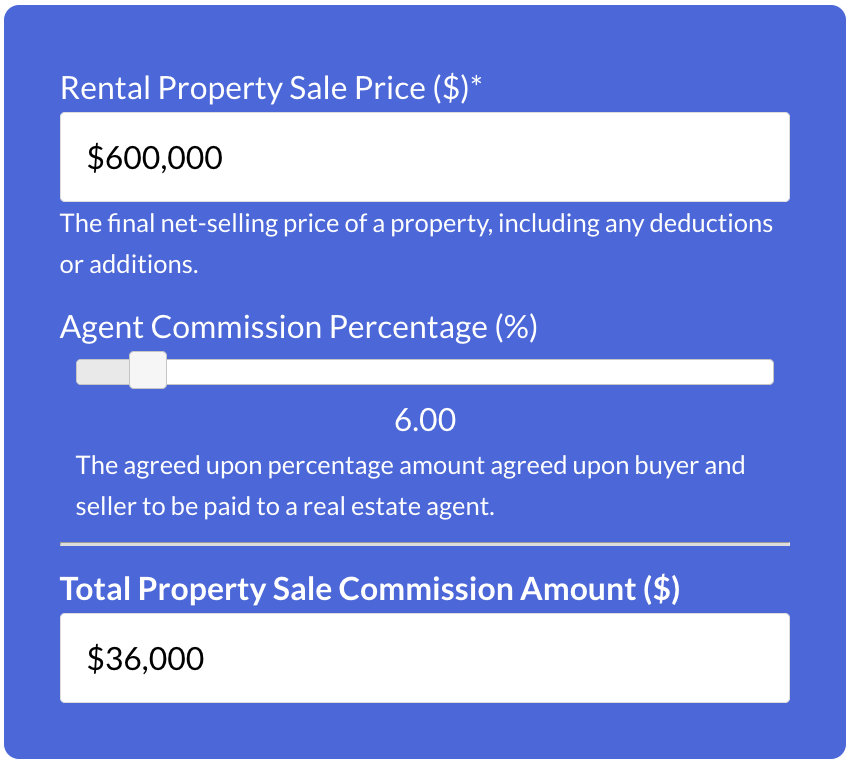

Try Our Property Sale Commission Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Real Estate Wholesaling Software & Tools

Pros & Cons of Real Estate Wholesaling

While there are several benefits to investing in real estate through wholesaling, there are also some potential drawbacks that investors should be aware of. We take a look at the pros and cons of each below.

Pros of Wholesaling

- Low Capital Requirements – Real estate wholesaling requires less capital compared to other real estate investment strategies such as buying and holding, or fix-and-flip. Wholesalers only need to put down earnest money, which is a small fraction of the purchase price, to secure a property.

- Minimal Risk – Since wholesalers are not purchasing the property themselves, they assume very little risk. If they are unable to find a buyer for the property, they can simply walk away from the deal by using a contingency clause in the contract. This limits the financial risk of the transaction.

- Quick Turnaround Time – Real estate wholesaling offers a quick turnaround time, as the wholesaler typically contracts and sells the property in a short period. This means you can generate revenue quickly without holding onto a property for a long time, and then use those profits to reinvest into other deals such as real estate private notes.

Cons of Wholesaling

- Lack of Consistent Deals – As a wholesaler, you are always hunting for the next deal. Competition among other real estate investors and changing market trends can lead to unstable and unpredictable income.

- Legal Complications – Some jurisdictions have specific laws and regulations concerning real estate wholesaling, and non-compliance could result in legal issues. Additionally, without a proper understanding of real estate contracts, you could find yourself in legal trouble.

- Good Negotiation and Marketing Skills – In order to succeed as a wholesaler, you need to be good at negotiating to buy properties below market and marketing properties to qualified buyers. Without these 2 skills, it can be difficult to find deals and close them quickly.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Real Estate Wholesaling FAQ

How Do I Calculate the Right Offer to Make on a Property?

A quick and simple way for wholesalers to determine their maximum offer price is the following equation:

Maximum allowable offer (MAO) = 70% x After Repair Value (ARV) – Estimated Rehab Costs – Wholesale Fee (If applicable).

What are the Laws for Wholesaling Real Estate?

The laws for wholesaling real estate vary significantly by state and locality, generally focusing on the legality of selling a purchase contract without actually owning the property. Many jurisdictions require wholesalers to either obtain a real estate license or ensure they are legally considered principals in the transaction by having a vested interest in the property, thus avoiding the unlicensed practice of real estate brokerage.

Can I Wholesale Real Estate with No Money?

Yes, you can wholesale real estate with no money by focusing on contract assignment, where you secure a contract to purchase a property and then assign that contract to an end buyer for a fee, without ever taking ownership of the property yourself. This strategy requires minimal upfront investment, primarily in the effort to find and negotiate deals, but does not necessitate significant capital for property purchase.

More Rental Real Estate Investments

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.