Last Updated: February 2024

The “buy and hold” strategy is the most common, simple, and time-tested rental real estate investing strategy. As the name suggests, buy and hold real estate investing involves purchasing a rental property and holding onto it for an extended period of time, while generating income through rent payments and appreciation in value. This long term strategy contrasts other shorter term strategies such as house hacking or wholesaling, which focus on quick profits.

What is Buy and Hold Real Estate Investing?

Buy and Hold Real Estate Investing Definition

“Buy and hold” is a term that describes the long-term real estate investment strategy where an investor purchases an investment property, rents it out, and continues to hold it for an extended period of time – usually a minimum of 3-5 years and upwards of 30 years or even multi-generational. The outcome leads to property values increasing over time of ownership, while simultaneously generating.

What is the Strategy Behind Buy and Hold?

The strategy behind buy and hold is to purchase a property that is expected to increase in value over time, and then rent it out to tenants to generate rental income. The rental income can be used to cover the mortgage, property taxes, and other expenses, while the property appreciates in value. The longer the investor holds onto the property, the more potential there is for both rental income and value appreciation. This strategy can be particularly effective in markets with strong demand for rental properties and a history of steady, reliable price appreciation.

How to Invest in Buy and Hold Real Estate?

Investing in buy and hold properties is a great investment strategy for real estate investors looking for regular cash flow and tangible hands-on control of their investment for the long term. Below is a general timeline of the common steps to execute a buy and hold rental property strategy.

1. Choose an Asset Type

The world of rental real estate stretches far beyond just residential properties. There are many different types of rental properties available for investors to choose whichever best fits their preferences and investing goals. Some of the most common include single family homes, multifamily apartments, commercial properties, hospitality properties, vacant land, parking lots, self storage, student housing, vacation rentals and more.

2. Select Location

Choosing the right location is an important step in the buy and hold investment process. If you have lived or plan to live in the same area for a while, it is best to buy locally when starting out. This is because people often understand the nuances of their local neighborhoods, better than an unknown area that is new to them. Long distance investing can be a viable option as well, however, it is very important to either understand the market or atleast have someone on your side that does.

3. Plan Financials

Before actually purchasing the property, several financial prerequisites need to be met in order to qualify for a loan. A few of these basic rental property financial planning prerequisites include setting a realistic budget for the type of property you are targeting, having sufficient liquid down payment capital along with any post-acquisition capital for repairs etc., good credit history, and a plan on how to manage the rental property with tenants.

4. Analyze Deals

Can you tell the difference between a low price vs high price for the specific market? What are market rents for similar properties? Are you familiar with how much rental property repairs and upgrades will cost? These are a few of the familiarities investors should be aware of to properly analyze potential candidate investment properties. Performing adequate deal analysis ensures that the property ultimately purchased meets all of your investment qualifications and can ideally achieve your financial goals.

5.Obtain Financing

Getting a mortgage loan for a rental property (or any property for that matter) can be an arduous process. Banks and lenders perform extensive due diligence beforehand to verify that the property has a reasonable risk profile and that you are a qualified borrower. Since buy and hold investment properties are usually intended for long-term ownership, rates are usually better than short term loans for fix and flips.

6. Complete Purchase

Once financing has been secured, the actual purchasing process consists mostly of satisfying requirements outlined in the purchase agreement. These can include title reports, plot surveys, inspections, contingencies, and any other specific escrow procedures. If it is a commercial rental property, the process can also include obtaining estoppel (i.e. verification of rents). Check out our guides on buying and selling residential properties and also buying and selling commercial properties.

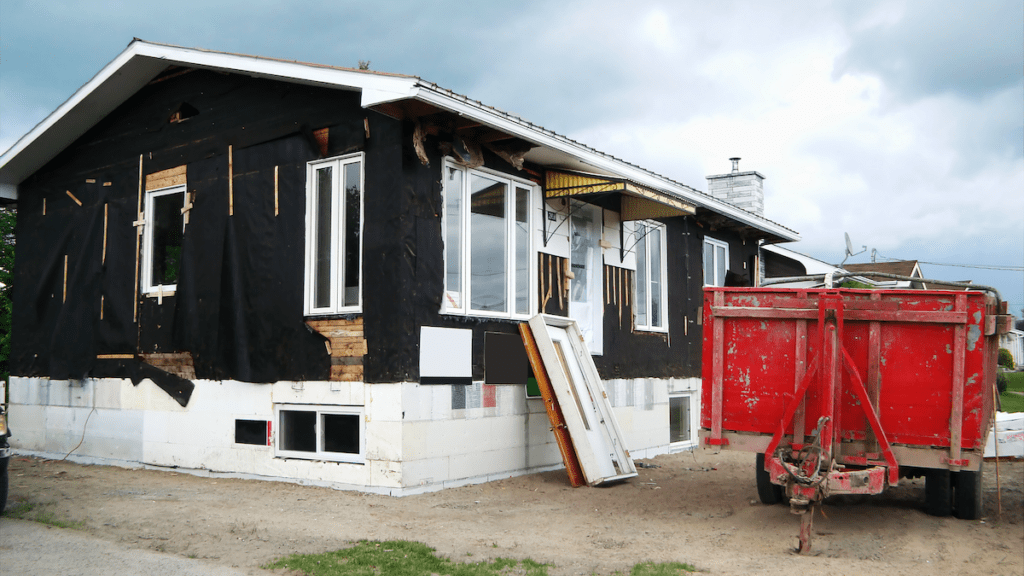

7. Rehab or Upgrade (If Necessary)

Unless the property is a new construction investment or the previous owner recently renovated the property, it is always best to do any rehabilitation or upgrades upon purchasing. Not only can this help you familiarize yourself with your new investment, but it also sets up the property for the next batch of renters. Be sure to plan ahead for this step. Contractors and service professionals can schedule out weeks in advance, and utilizing a budget for purchasing building products can keep your investment on track.

8. Rent and Manage

The last and final step of buy and hold investing is to rent out the unit and manage it. Finding the right tenant will depend if you plan to self manage or hire a property management company. If you plan to self manage, then becoming familiar with property management practices can be an invaluable skillset to have when screening for the most qualified tenants. If hiring a property management company, then they will handle the tenant selection process for you (for a fee), as well as ongoing management of the property.

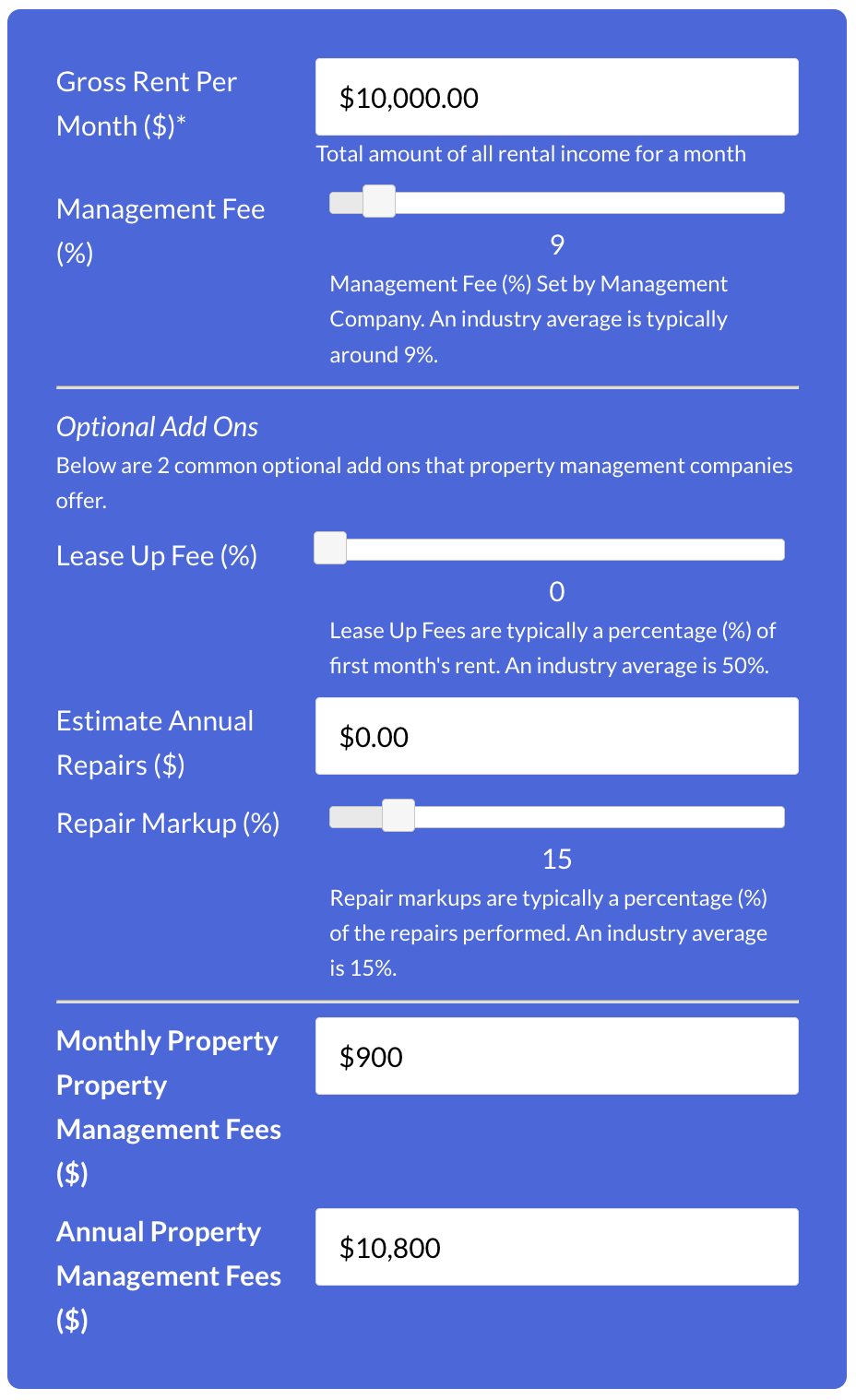

Try Our

Property Management

Cost Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Buy and Hold Real Estate Investing Tools and Resources

In buy and hold real estate investing, online real estate listing platforms (websites and apps) are strategic marketing tools used to search and list available properties to buy, sell, and lease.

Securing a favorable mortgage for buy and hold rental real estate investments provides an important foundation, as it can impact cash flow, return on investment, and the overall financial success of the investment.

Effective rental property management is essential in the buy and hold strategy, as it ensures well-maintained properties, satisfied tenants, and consistent rental income, all of which contribute to the long-term success of the investment.

Real estate investor tools, such as rental real estate software, can greatly aid investors in the buy and hold investing strategy by streamlining the evaluation process and facilitating with the ongoing ownership duties.

Pros & Cons of Buy and Hold Real Estate Investing

While there are several benefits to the buy and hold investment strategy, there are also some potential drawbacks that investors should be aware of. We take a look at the pros and cons of both below.

Pros of Buy and Hold Real Estate Investing

- Property Value Appreciation – Real estate as an asset class has historically consistently grown upwards in value over long periods of time. The buy and hold method typically cycles through downturns and upward trends long enough for investors to see the property’s price rise.

- Lower Risk Investment – Other types of real estate investments such as fix and flips or real estate stocks require substantially more risk tolerance to a potential loss. Assuming that you did proper due diligence before buying the property, the buy and hold method’s simplicity greatly reduces the risk of a loss.

- Cash Flow – Rented out units generate consistent monthly recurring rental income to cover property overhead such as mortgage payments and property tax payments. In addition to covering expenses, this consistent cash flow can help contribute to paying down the loan principal which reduces the interest charged on the loan over time.

Cons of Buy and Hold Real Estate Investing

- Long Term Commitment – Buy and hold investments are executed over the course of years rather than months. When compared to shorter term investments such as BRRRR or real estate syndicates, buy and hold investments require patience and no urgency to see the return on investment (ROI).

- Property Management – Even if an investor decides to outsource property management responsibilities to a third party management company, there is always behind the scenes work required. Self-management can cut out the cost of hiring a property management company, but will require a great amount of time and effort for the investor.

- Limited Liquidity – Before purchasing a buy and hold rental property, it is very important to ensure that the estimated expenses of the rental property are accurate. The long term nature of this method requires tying up a lot of liquid capital for a long period of time, while also exposing yourself to new expenses such as mortgage payments, maintenance bills, and tenant turnover.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Buy and Hold Real Estate Investing FAQ

How Does Buy and Hold Real Estate Investing Compare to Other Real Estate Investment Strategies?

Buy and hold real estate investing is a long-term investment strategy focused on acquiring properties to rent out for ongoing income and capital appreciation. It contrasts with other strategies through its emphasis on long-term growth and passive income, as opposed to quick profits or high levels of active management.

| Investment Strategy | Comparison with Buy and Hold Investing |

|---|---|

| Ground-Up Development | Involves higher initial risks and capital for developing properties from scratch, offering potentially higher returns, unlike the more stable, long-term approach of buy and hold. |

| BRRRR (Buy, Rehab, Rent, Refinance, Repeat) | BRRRR involves actively renovating properties to increase value and rent, requiring more involvement and offering quicker returns compared to the typically passive buy and hold strategy. |

| House Hacking | House hacking offers a way to offset mortgage payments and generate income while living in the property, requiring more active management compared to traditional buy and hold investments. |

| Fix and Flip | Focuses on short-term profits through quick renovation and resale, contrasting with buy and hold’s long-term income and appreciation focus. |

| Wholesaling | Wholesaling involves quick, short-term profits from contract assignments without holding the property, unlike the long-term asset accumulation strategy of buy and hold. |

| Mortgage Notes | Investing in mortgage notes is a more passive form of investment focusing on interest income from loans, offering a different risk and return profile compared to owning physical property. |

| Turnkey Rentals | Turnkey rentals provide immediate rental income with minimal initial effort, aligning closely with buy and hold’s passive income goals but with less personal control over property selection. |

| NNN (Triple Net Lease) | NNN leases offer long-term, stable income with tenants covering most expenses, similar to buy and hold but typically involves commercial properties and more predictable expenses. |

| Syndication | Allows investors to pool funds for larger projects, offering passive income and diversification without direct management responsibilities, similar to buy and hold but on a larger scale. |

| Real Estate Stocks | Real estate stocks (REITs) offer liquidity and passive income through dividends, providing exposure to real estate without the direct ownership or management involved in buy and hold. |

Can You Invest in Buy and Hold Real Estate With Little or No Money?

Yes. Investing in buy and hold real estate with little or no money can be achieved through creative financing options such as partnering with investors who have the necessary funds, utilizing seller financing where the seller agrees to be paid over time, or exercising a lease option to control a property with an option to buy later. Purchasing with a bank loan can be done via government programs like FHA loans that allow for low down payments, particularly for first-time home buyers.

More Rental Real Estate Investments

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards Standards for more info.