Last Updated: February 2024

Investing in rental real estate stretches far beyond the common thought of simply purchasing an investment apartment building or renting out your old single family house. While that method still works great, not everyone wants to nor can afford to invest the large amounts of time and capital needed to successfully undertake a rental property project. Nowadays, there are many types of rental real estate investments that provide exposure to the lucrative profit potential of real estate as an asset class, without the physical labor and large sums of capital often associated with it.

10 Asset Types for Rental Real Estate Investing

Investing in rental real estate by asset type offers investors the choice to generate income and build long-term wealth with a type of income producing property that they prefer the most. From single-family homes to multi-unit apartments, commercial properties, or specialized niches like vacation rentals, each asset type presents unique opportunities that can align with each investor’s unique investment goals.

15 Best Rental Real Estate Investments List

The world of rental real estate investing offers many opportunities for investors to diversify their portfolios, generate income and capitalize on market trends. These investments range from direct property ownership such as buy and hold, to indirect participation through stocks and investment funds. Understanding rental real estate finance and each of these different types of real estate investments can help investors make better informed decisions that align with their financial goals and risk tolerance.

Development

Ground up real estate development is a form of high-risk and high-reward real estate investing that involves taking raw land and building a completely new structure on it. While it may sound simple, it is one of the most challenging, yet rewarding, forms of real estate investing.

Buy and Hold

One of the most tried-and-true forms of real estate investing is simply called “buy-and-hold.” Buy and hold refers to a long-term real estate investment strategy where an investor purchases a property, rents it out, and continues to hold it for an extended period of time.

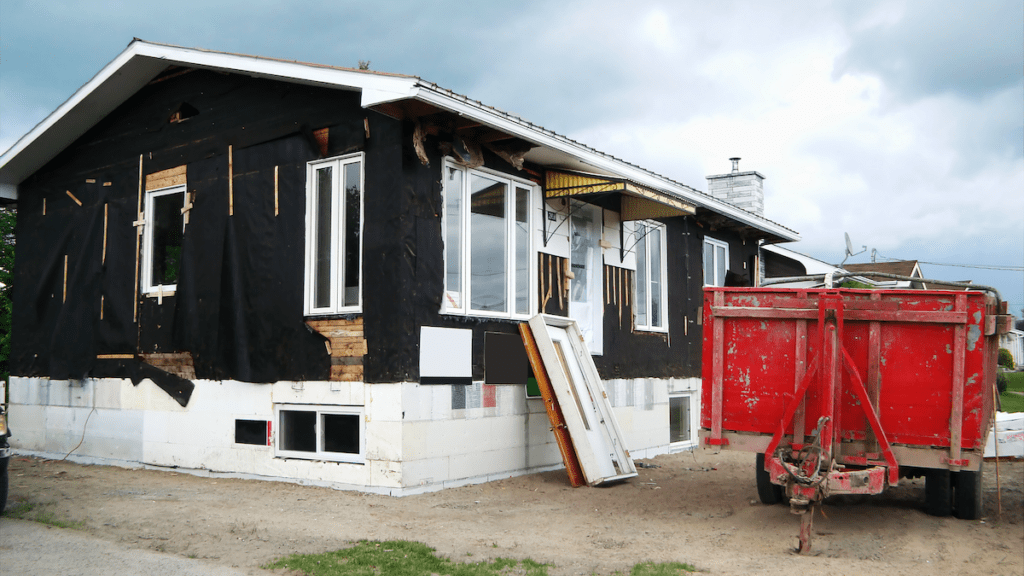

BRRRR

BRRRR (Buy, Rehab, Rent, Refinance, Repeat) is an acronym for a popular real estate investing strategy which involves purchasing a distressed property, adding value by rehabbing, placing new tenants, cash-out refinancing, and repeating the whole process over again with more properties.

House Hacking

House hacking has been around for decades, however it only recently received its trendy name. House hacking is simply the act of renting out part of your home to generate income. There are many creative ways to house hack such as renting individual rooms, parking spaces, and even ADUs.

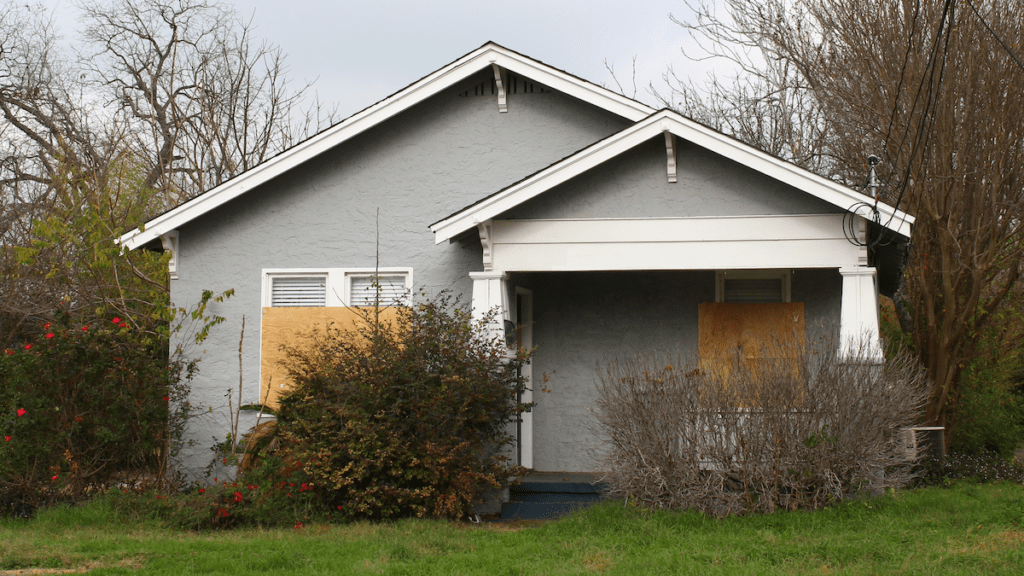

Fix and Flips

Contrary to popularized television shows, fix and flips are actually a very intense process that requires great coordination to pull off timely and profitable flips. The fix-and-flip process involves purchasing a distressed property at a discount, renovating it, then selling it at market value for a profit.

Wholesaling

Real estate wholesaling involves finding and getting a property under contract to buy for a discounted price, then reselling that contract to an investor. Unlike traditional buy-and-hold investing, wholesalers never technically buy the property. Instead, they resell the “contract to buy” to an investor for a profit.

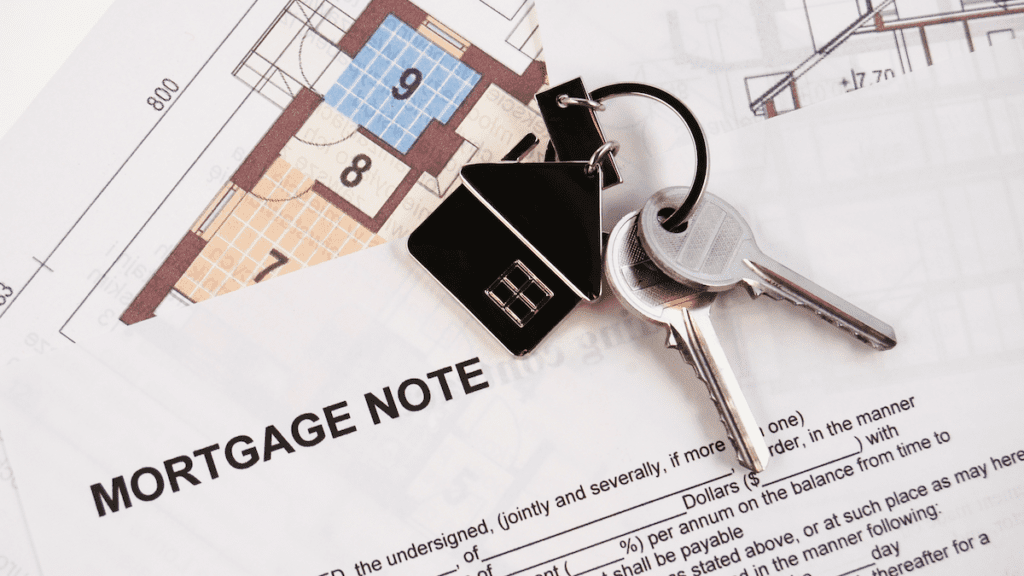

Notes

Real estate note investing is a strategy where investors act as the bank to lend money. The lent money is secured by a mortgage or deed of trust to a piece of real estate. Investors earn a return on their investment through interest payments and principal repayment.

Turnkey

As the name implies, turnkey investment properties are rental properties that require zero or minimal work to start generating cash flow from tenants. Some companies take it a step further and may already have tenants in place while providing property management services.

Triple Net (NNN)

Triple net (NNN) investing is a type of commercial real estate investment, where the property’s lease agreements stipulate that the tenants are responsible for paying all property-related expenses such as property taxes, property insurance, and maintenance costs on top of their base rent payments.

Syndication

Real estate syndication is the process of using investor pooled capital to purchase and reposition real estate, and they usually follow a repeatable process: Origination, Operation, and Liquidation. This means the Sponsor, finds and manages the deal, while the Investor provides the capital and enjoys financial returns based on their investment.

Stocks

Real estate stock investing allows investors to gain direct ownership into promising real estate related companies. Since real estate is an extremely broad category, investors have countless options for companies to invest in. From the shopping mall owner and operator Simon Property Group (NYSE:SPG), to real estate software data and marketing companies such as Costar Group (NASDAQ: CSGP), there are plenty of options available for all types of investors.

Crowdfunding

Real estate crowdfunding has revolutionized traditional real estate investments by giving individuals an opportunity to invest in larger properties they would have normally been unable to afford on their own. With crowdfunded properties, investors pool their money together and invest in shares of different properties, allowing them to diversify their portfolio without the need for a large capital investment.

Tax Liens

Investing in real estate tax liens can be an alternative strategy for real estate investors looking to generate income and potentially acquire properties at a discounted price. Tax liens are legal claims placed by local public government bodies, on properties that are delinquent on their property taxes. Investors can purchase these liens at auctions, to potentially earn attractive returns and, in some cases, even obtain ownership of the property.

Fractional

Fractional ownership real estate investing offers property investors the opportunity to purchase small shares of ownership in a larger piece of investment real estate. This model allows investors to contribute small amounts of capital and spread out their investment risk across multiple sectors and areas. The benefit of fractional ownership is the ability to realize shared financial returns on larger properties that would have otherwise been too costly to invest on their own.

Metaverse

The concept of “Virtual Real Estate” is gaining notoriety especially with Metaverse real estate sales recently bringing in over $500 Million. Metaverse real estate can be described as unique parcels of virtual land, within a virtual world. The promise of these virtual parcels is that they are programmable and can be used for socializing, hosting virtual events, and digital real estate investors can even develop, flip or lease them.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Rental Real Estate Investing Tools

Rental real estate investors need all the help they can get, and real estate investor tools play a crucial role in maximizing the efficiency and profitability of real estate investing. These tools encompass a wide range of resources, technologies, and strategies that empower investors in acquiring, managing, and maintaining rental properties.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Real Estate Investing FAQ

Why Invest in Rental Real Estate – Is it Worth it?

Investing in rental real estate offers several compelling advantages for investors. Firstly, rental properties can provide a steady and passive income stream through monthly rental payments, potentially creating a consistent cash flow. Secondly, real estate investments have the potential for long-term appreciation, allowing investors to build equity over time. Additionally, rental properties offer tax benefits, such as deductions for mortgage interest, property taxes, and depreciation. Lastly, real estate investments provide diversification in an investment portfolio, as they tend to have low correlation with other asset classes, reducing overall risk. Combined, these factors make rental real estate an attractive investment option for generating income, building wealth, and diversifying investment portfolios.

How Much Do I Need to Invest in Rental Real Estate?

The amount of money needed to invest in a rental property can vary widely depending on factors such as the property type, location, market conditions, and financing options. Aspiring real estate investors can start with a modest down payment, often around 20% of the property’s purchase price or 3.5% for an owner occupied FHA rental property loan, or even little to no money down in certain creative circumstances. Experienced investors may leverage their existing properties or use creative financing strategies such as partnerships or syndication to fund larger investments. It is essential to carefully analyze the investment, consider cash flow projections, and evaluate financing options to determine the appropriate amount of capital needed for a rental property investment.

More Real Estate Finance Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.