Last Updated: February 2024

Rental property income statements are a key real estate financial report that paints a vivid picture of the property’s incoming revenues and outgoing expenses over a specific period, offering vital insights to owners, managers and investors. Understanding an income statement is an invaluable skill for owners, managers and investors to possess, as it can provide a detailed understanding of a property’s revenues and expenses. As we delve deeper into this subject, you’ll discover just how influential an income statement can be in shaping the trajectory of a rental property’s success.

Income Statement Definition

An income statement, also called a Profit and Loss Statement (P&L), when used for a piece of real estate, summarizes the revenues (like rental income), and the expenses (like property taxes, maintenance, and insurance) incurred over a specific period of time. The difference between the total revenue and total expenses represents the net income or loss, providing insight into the rental property’s profitability.

Income Statement Explained

An income statement is like a report that shows how much money the property has made (through rent or other income) and how much it has spent (on things like maintenance, taxes, or mortgage interest) over a certain period. By subtracting the expenses from the income, you can see whether the property is making or losing money, which can help in decision-making about the property’s management or future.

Top 2 Free Rental Property Income Statement Templates

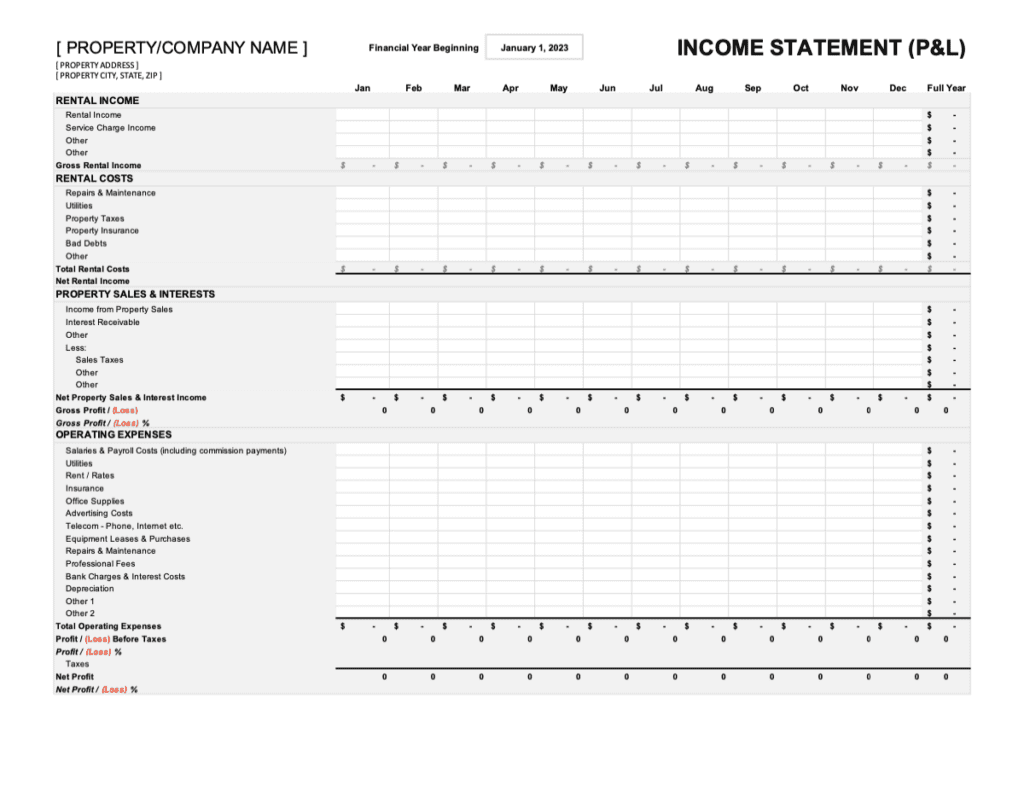

RentalRealEstate Income Statement Free Template

Get started creating an income statement (profit & loss) for your rental property with our free downloadable and customizable template below. The rental property income statement (profit & loss) template opens up as an Microsoft Excel and can be edited in Microsoft Excel or compatible programs.

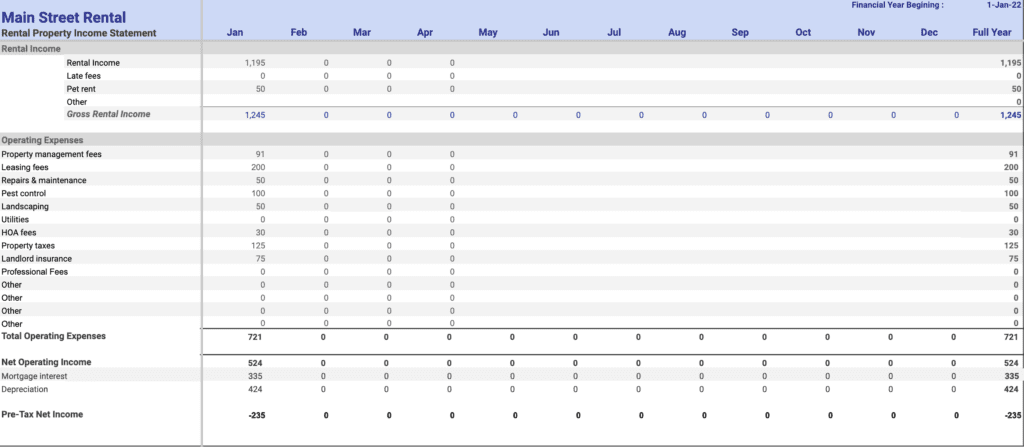

Stessa Income Statement Free Template

The Stessa website has 2 free rent roll templates available for download in both Microsoft Excel and Google Sheets formats.

What Information is on an Income Statement?

Although an income statement may differ depending on who prepared it, rental property income statements generally all contain similar information. Below is a list of the most common property information you can expect to find on an income statement for a rental property:

- Gross Revenue: This includes all income generated by the property. Most commonly, this is rental income, but it could also include other sources, such as fees for late payments or income from vending machines or laundry facilities in the building.

- Operating Expenses: These are the regular, necessary costs of running the property. They can include:

- Maintenance and repair costs

- Property management fees

- Property taxes

- Insurance

- Utilities (unless paid by tenants)

- Marketing or advertising expenses

- Net Operating Income: This is calculated by subtracting the total operating expenses from the gross revenue. It represents the income generated from the property before factoring in debt service or capital expenditures.

- Debt Service: This refers to mortgage payments or other debts associated with the property.

- Capital Expenditures: These are larger, often one-time expenses for significant improvements or repairs. They could include a new roof, upgraded HVAC system, or major landscaping.

- Net Income/Loss: This is the final line of the income statement. It’s calculated by subtracting the total expenses (operating expenses, debt service, and capital expenditures) from the total revenue. A positive number indicates a profit, while a negative number indicates a loss.

Try Our Rental Property Net Operating Income (NOI) Calculator →

100% Free – No Sign Up Required

Rental Property Income Statement Example

To better understand how rental property income statements work, lets take a look at an example for an investment property. For this example, let’s assume you own a rental property that generates $1,000 of monthly income and incurs various expenses. Below is a breakdown of income and expenses as they would be categorized on an income statement (profit and loss statement):

Income

- Monthly Rental Income: $500

- Other Income: $500

- Total Annual Income: $1,000 x 12 = $12,000

Expenses

- Property Management Fees (8% of rental income): 0.08 x $12,000 = $960

- Maintenance and Repairs: $2,000

- Property Taxes: $1,500

- Insurance: $1,000

- Mortgage Interest (if applicable): $2,500

- Utilities (if not paid by tenant): $1,200

- Other Expenses (advertising, legal fees, etc.): $2,000

- Total Annual Expenses: $11,160

Net Operating Income (NOI)

- NOI = Total Annual Rental Income – Total Annual Expenses

- NOI = $12,000 – $11,160 = $840

This example assumes the property is rented throughout the year without any vacancy. If there are vacancies, the rental income should be adjusted accordingly. Additionally, cash flow can be negative, as in this example, if the expenses are higher than the rental income. This is often the case in the early years of property ownership or in high-leverage situations.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

How to Use a Rental Property Income Statement

Rental property income statements, often termed Profit and Loss statements, are pivotal financial documents detailing a property’s revenues and expenses over a defined period. Offering insights into the operational profitability and expenditure trends, these statements are indispensable to various stakeholders involved in rental property management and investment. The table below illustrates the primary users of rental property income statements and explicates their specific applications:

| Stakeholder | Usage of Income Statements |

|---|---|

| Property Owners | Owners utilize income statements to understand revenue streams, track operational costs, and measure the profitability of their property. |

| Property Managers | Managers use income statements to monitor rental income, manage operational expenses, and to provide financial reporting to property owners. |

| Real Estate Investors | Investors consult income statements to analyze a property’s earning potential, cost structure, and to inform investment strategies. |

| Lenders/Banks | Lenders review income statements to evaluate a property’s income consistency and ability to service debt, aiding their lending decisions. |

| Potential Buyers | Prospective buyers analyze income statements to understand a property’s financial performance, identifying potential areas of growth or concern. |

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Property Income Statement FAQ

Are Profit and Loss Statements the Same as Income Statements?

Yes, a “Profit and Loss Statement (P&L)” and an “Income Statement” are essentially the same. Both terms refer to a rental real estate financial report that summarizes the revenues (like rental income) and expenses (like maintenance costs, taxes, and insurance) associated with managing a rental property over a specific period of time. The goal of both reports is to show the net profit or loss of the property during that period.

Are Income Statements the Same as Cash Flow Statements?

No, income statements and cash flow statements are not the same. An income statement, also known as a profit and loss statement, focuses on summarizing the net income or net loss over a specified period of time. On the other hand, a cash flow statement tracks the inflow and outflow of cash, which reflects how account changes affect cash and cash equivalents. In simple terms, an income statement shows whether a property is profitable or not, while a cash flow statement shows where the property’s cash came from and where it went.

How is an Income Statement Different from a Balance Sheet?

Income Statements detail the revenues and expenses of a rental property over a specific time period, showcasing its operational profitability. In contrast, Balance Sheets provide a snapshot of a property’s financial position at a particular point in time, categorizing assets, liabilities, and the owner’s equity. While the Income Statement focuses on the performance and profitability of a property, the Balance Sheet emphasizes its overall financial health and net worth.

More Real Estate Financial Statements

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.