Last Updated: February 2024

An accounts payable statement can provide the best view to get an understanding of a rental property’s outgoing financial obligations. This rental property financial statement carries the responsibility of tracking the property’s outstanding obligations, keeping everyone informed about the money that needs to flow out to operate. With its precise and methodical record-keeping, it helps maintain a clear picture of the property’s immediate financial responsibilities. As we delve deeper into this subject, you’ll see the pivotal role that an accounts payable statement plays in managing the financial health of a rental property.

On This Page

Accounts Payable Statement Definition

An accounts payable statement is a financial document that lists all the outstanding bills, or liabilities, that a property (owner or manager) owes to vendors and contractors or service providers at a specific point in time. These may include expenses for property maintenance, utilities, property management services, or mortgage payments, providing a clear overview of the property’s short-term financial obligations.

Accounts Payable Statement Explained

An accounts payable statement for a rental property is like a to-do list of all the outstanding bills that the property owner needs to pay for things like utilities, repairs, or property management services. It helps keep track of what’s owed, to whom, and when it’s due, so the owner can manage their money and make sure all the bills get paid on time. It is frequently used by property management companies or with larger properties where there are many bills to track.

Top 2 Free Rental Property Accounts Payable Statement Templates

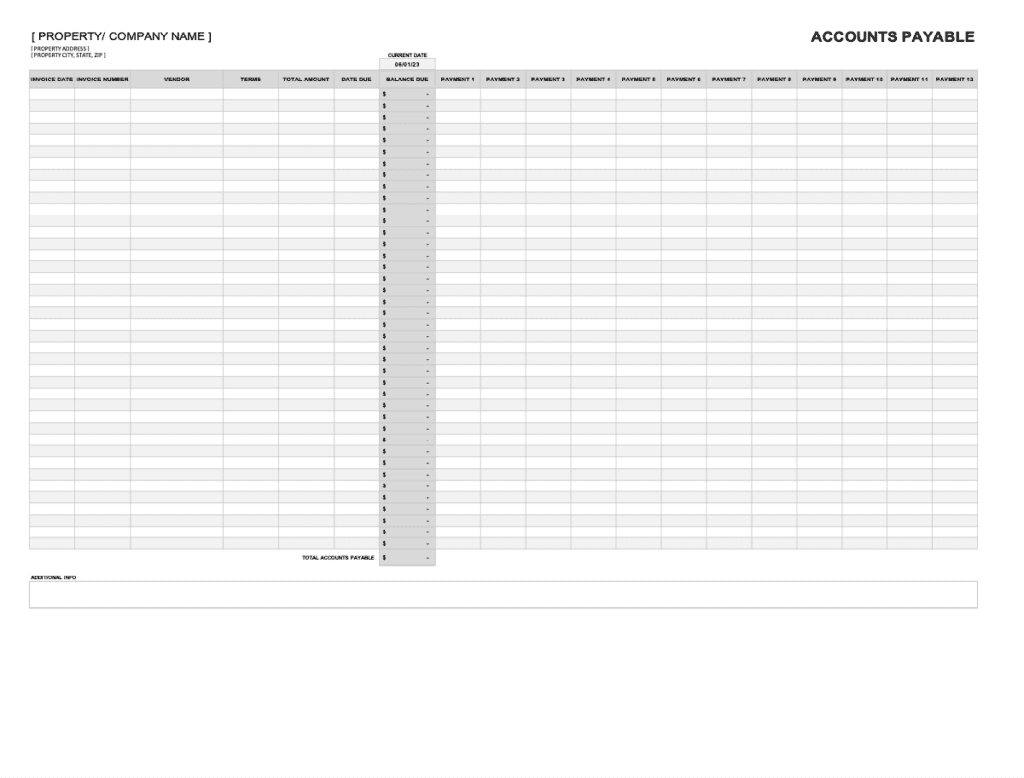

RentalRealEstate Free Rental Property A/P Template

Get started creating an accounts payable statement for your rental property with our free downloadable and customizable template below. The rental property accounts payable statement template opens up as an Microsoft Excel and can be edited in Microsoft Excel or compatible programs.

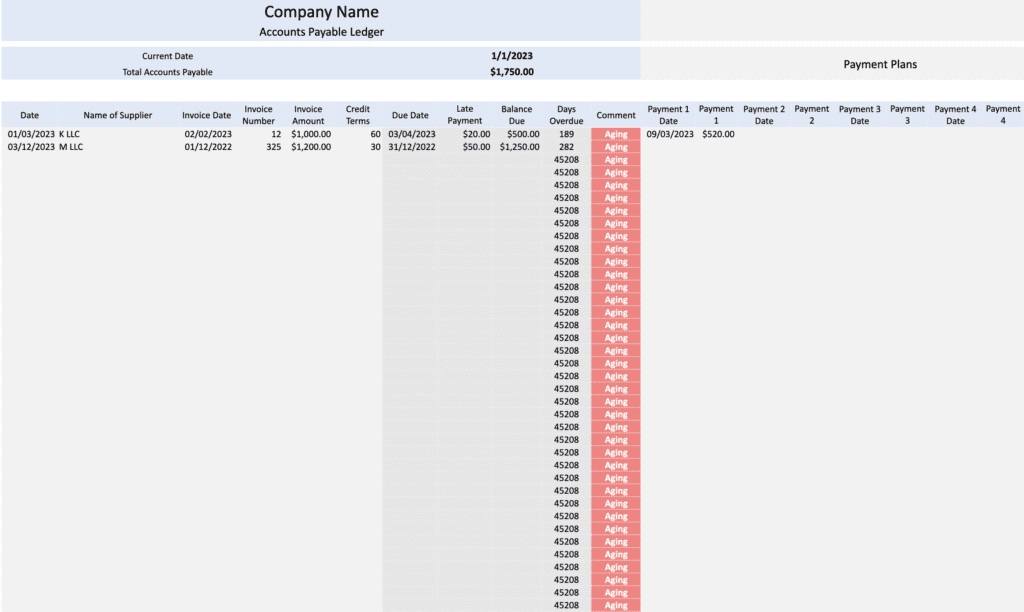

Jetpack Workflow Free Accounts Payable Template

Jetpack Workflow has a free downloadable rental property accounts payable templates available in both Microsoft Excel and Google Sheets formats.

What Information is on an Accounts Payable Statement?

Accounts payable statements may slightly differ, but usually all have similar information about a property. Below is a list of the most common information you can typically expect to find on an accounts payable statement for a rental property:

- Vendor Name: The name of the individual or company to which money is owed.

- Invoice Number: A unique identifier for each bill, if provided by the vendor.

- Description of Expense: Details about the services or goods provided.

- Invoice Date: The date when the bill was issued.

- Due Date: The date by which the bill should be paid.

- Amount Due: The amount of money that needs to be paid.

- Outstanding Balances: Any amounts from previous billing cycles that remain unpaid.

Try Our Rental Property Maintenance Expense Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

How to Use Rental Property Accounts Payable Statements

Rental property accounts payable statements provide a detailed overview of outstanding financial obligations that property owners or managers owe to vendors or service providers. These statements ensure the systematic tracking of debts, helping to manage and streamline cash outflows effectively. Here’s a table highlighting the primary users of rental property accounts payable statements and their specific applications:

| Stakeholder | Usage of Accounts Payable Statements |

|---|---|

| Property Owners | Owners use accounts payable statements to monitor and manage their outstanding liabilities, ensuring they meet financial commitments and maintain good relationships with vendors and service providers. |

| Property Managers | Managers reference these statements to schedule payments, budget for upcoming expenses, and to ensure timely settlement of bills, reducing the risk of late fees or service interruptions. |

| Real Estate Investors | Investors review accounts payable statements to understand the property’s short-term financial obligations, aiding in cash flow analysis and investment evaluation. |

| Lenders/Banks | Lenders may assess these statements to determine the property’s current liability landscape, influencing decisions about the property’s financial stability and lending terms. |

| Accountants | Accountants utilize accounts payable statements for accurate financial reporting, reconciling payment discrepancies, and preparing financial documents for audit or year-end reporting. |

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Property Accounts Payable Statement FAQ

How is Accounts Payable Different from Accounts Receivable?

In the realm of rental real estate accounting, “Accounts Payable” and “Accounts Receivable” represent two opposing flows of a property’s finances. “Accounts Payable” refers to the money that the property owes to others, such as vendors, contractors, or lenders – essentially, these are the property’s outstanding bills. Conversely, “Accounts Receivable” signifies the money that tenants or other parties owe to the property, like unpaid rent or late fees. Together, they are summarized in reports such as a Rental Property Accounts Receivable Statement, and provide a comprehensive view of the financial status of a rental property.

Why is it Important to Manage and Monitor Accounts Payable for Rental Properties?

Efficiently managing accounts payable is important for timely bill settlements and maintaining positive vendor relationships. By ensuring timely payments, property owners can avoid late fees and potential service disruptions. Accurate accounts payable tracking also supports precise financial reporting and helps maintain consistent cash flow. Proper oversight can, therefore, prevent unexpected financial challenges and maintain a property’s operational integrity.

What Best Practices Should be Followed to Effectively Manage Accounts Payable?

In order to manage accounts payable effectively, it’s essential to establish regular payment schedules and match them against vendor invoices for accuracy. Open communication with creditors ensures clarity on any discrepancies and facilitates negotiation. Leveraging digital payment methods provides traceability and efficiency in transactions. Regular reviews of the expenses can highlight potential areas for cost savings or vendor renegotiations.

More Real Estate Financial Statements

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.