Last Updated: February 2024

In the complex landscape of real estate investing, the balance sheet is a vital navigational tool used in understanding the financial health of a rental property. By offering a snapshot of a property’s financial position at any given moment, its breakdown of a property’s assets, liabilities, and equity at a specific moment in time paves the way for prudent investment choices and effective property management. As we delve deeper into this topic, you’ll discover how balance sheets illuminate the path towards profitable real estate investment.

Balance Sheet Definition

A balance sheet, when used in real estate, is a financial statement that shows the property’s assets, such as its current market value and any income it generates, against its liabilities, which could include a mortgage or other debts. The difference between the assets and liabilities represents the property’s equity, or its net value.

Balance Sheet Explained

When used for a piece of real estate, a balance sheet is like a snapshot of the property’s financial health, showing what it’s worth (assets), what it owes (liabilities), and the owner’s stake in it (equity) at a given moment. For example, if a property is worth $500,000, has a mortgage of $300,000, the balance sheet would show $200,000 of equity, representing the owner’s actual stake in the property.

Top 2 Free Rental Property Balance Sheet Templates

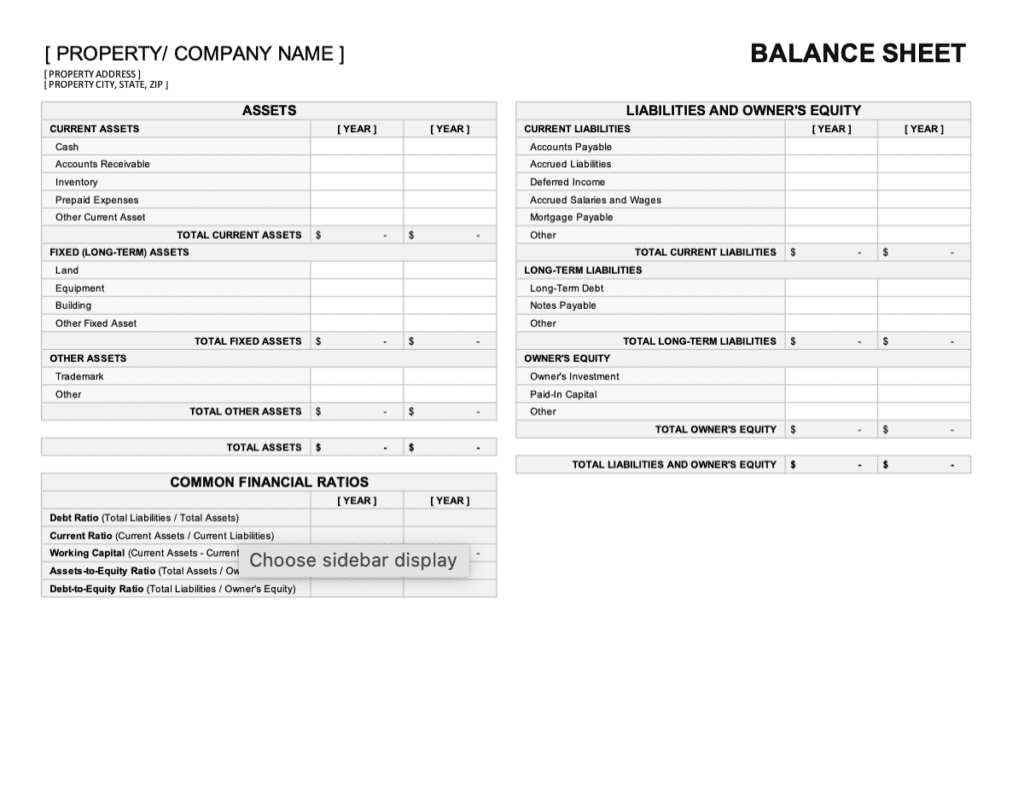

RentalRealEstate Free Balance Sheet Template

Get started creating a balance sheet for your rental property with our free downloadable and customizable template below. The rental property rent balance sheet template opens up as an Microsoft Excel and can be edited in Microsoft Excel or compatible programs.

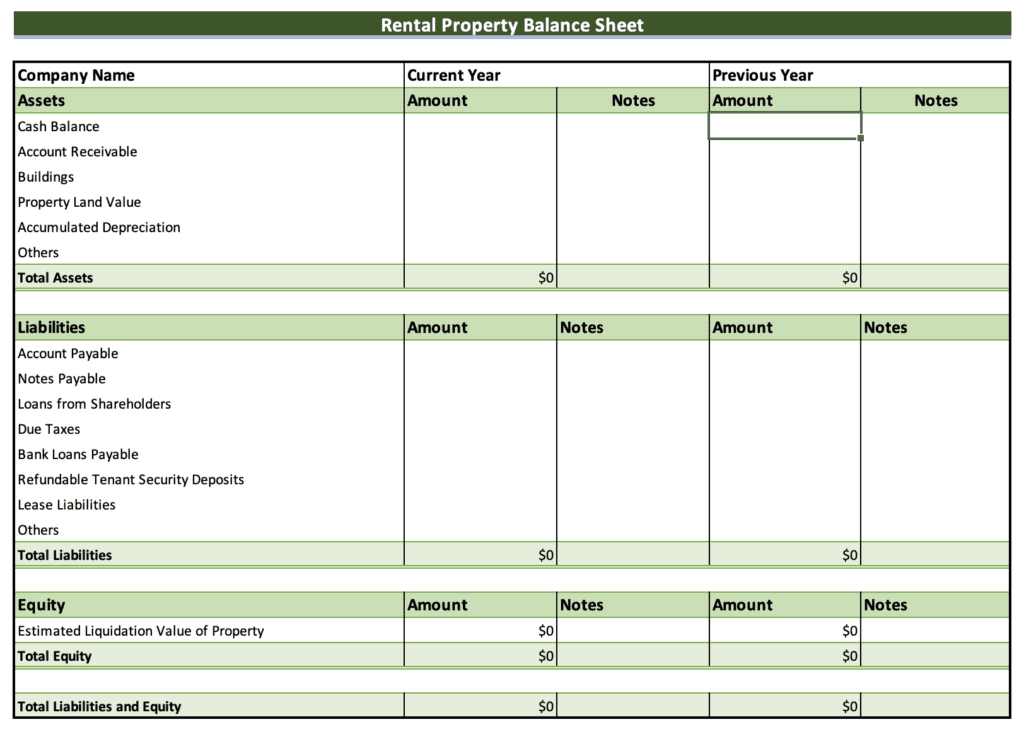

ExcelDemy Free Balance Sheet Template

ExcelDemy has a free downloadable rental property balance sheet templates available in Microsoft Excel format.

What Information is on a Balance Sheet?

Although a balance sheet may differ depending on who prepared it, they will all generally provide similar financial information about a property. Below is a list of the most common property information you can typically expect to find on a balance sheet for a rental property:

- Assets: These are what the property is worth. This can include:

- The current market value of the property.

- Any income that the property generates, such as rent.

- Liabilities: These are what the property owes. This can include:

- The remaining mortgage balance.

- Other loans or debts associated with the property.

- Any accrued expenses, such as property taxes or maintenance costs not yet paid.

- Equity: This is the owner’s stake in the property.

- It’s calculated by subtracting the total liabilities from the total assets.

Try Our Commercial Property Valuation Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

How to Use a Rental Property Balance Sheet

Rental property balance sheets are integral tools that provide a snapshot of a property’s financial standing at a given point in time. Detailing assets, liabilities, and equity, these statements offer crucial insights to a variety of stakeholders. The table below delineates the primary users of rental property balance sheets and outlines their specific uses:

| Stakeholder | Usage of Balance Sheets |

|---|---|

| Property Owners | Property owners utilize balance sheets to monitor the financial health, equity position, and overall value of their property, aiding in strategic planning. |

| Property Managers | Managers reference balance sheets to ensure financial obligations are met, track security deposits, and oversee the property’s financial operations. |

| Real Estate Investors | Investors analyze balance sheets to evaluate a property’s financial stability, equity growth, and to make informed acquisition or divestment decisions. |

| Lenders/Banks | Before sanctioning loans, lenders review balance sheets to gauge a property’s financial health, ensuring the loan can be serviced and assessing risk. |

| Potential Buyers | Those considering property acquisition consult balance sheets for insights into a property’s liabilities, assets, and to gauge the owner’s equity position. |

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Property Balance Sheet FAQ

Does My Rental Property Need a Balance Sheet?

Realistically speaking, many small mom-and-pop landlords get by perfectly fine without ever creating a balance sheet. The need usually arises when the complexity of the rental property increases. Commercial properties, rental property investment partnerships, and large portfolios of rental properties that require complex financing, commonly require balance sheets. Even if you don’t have an immediate need for one, try downloading our template above to start understanding how they work. The practice of maintaining a balance sheet promotes good financial management, which can help you sustain and grow your rental property business over the long term.

Where to Put Rent for a Rental Property on a Balance Sheet?

On a rental property balance sheet, rental income does not typically appear directly because a balance sheet specifically captures the financial status of assets, liabilities, and equity at a given point in time. Rent, as a form of income, is part of the property’s cash flow and would usually be reflected in the income statement. However, any rent that has been collected but not yet spent could be part of the “Cash and Cash Equivalents” line item under the “Assets” column. If there is rent due but not yet paid by the tenants, it could be included under “Accounts Receivable” in the “Assets” section (See our Ultimate Guide to Rental Property Accounts Receivable Statements). Conversely, if you received a prepayment of rent, it would be recorded as a liability (under “Unearned Revenue” or “Prepaid Rent”) until the period in which the rent applies.

How Can a Balance Sheet Help Evaluate the Financial Health of a Rental Property?

The balance sheet provides insights into liquidity, solvency, and overall financial stability. A property with a strong balance of assets to liabilities indicates good financial health. Regularly monitoring the balance sheet can alert property owners to increasing liabilities, decreasing equity, or other potential financial challenges, enabling proactive management.

More Real Estate Financial Statements

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.