Last Updated: February 2024

Rental properties are about making money and accounts receivable statements document all of the money that is owed to the property. This critical rental property financial statement provides a detailed look at all incoming cash flows from tenants and other revenue sources. It helps track owed amounts, due dates, and payment history, playing a key role in managing income, forecasting cash flow, and identifying delinquent accounts. As we delve deeper into this topic, you’ll discover how an accounts receivable statement is integral to maintaining the financial heartbeat of a rental property.

On This Page

- Accounts Receivable Statement Definition

- Accounts Receivable Statements Explained

- Top 2 Free Rental Property Accounts Receivable Statement Templates

- What Information is on an Accounts Receivable Statement?

- How to Use Rental Property Accounts Receivable Statements

- Rental Property Accounts Receivable Statement FAQ

Accounts Receivable Statement Definition

An accounts receivable statement is a statement that outlines all the money that is owed to the property (ownership or property management), typically in the form of rent or other fees, at a specific point in time. This statement includes details such as tenant names, the amount they owe, and when their payments are due, providing a clear overview of the property’s incoming cash flow.

Accounts Receivable Statements Explained

An accounts receivable statement, when used for a rental property, is like a list of all the money that tenants or other people owe the property, usually in the form of rent or other fees. It helps keep track of who needs to pay, how much they owe, and when their payments are due, making it easier to manage incoming cash and ensure everyone pays on time.

Top 2 Free Rental Property Accounts Receivable Statement Templates

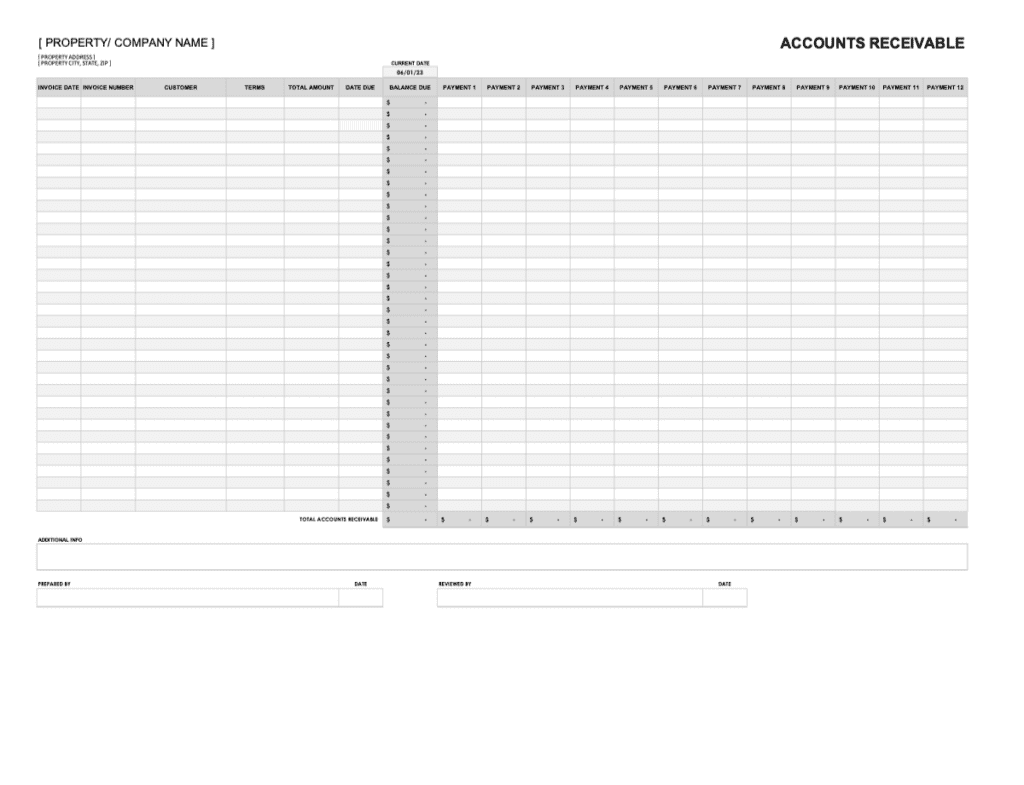

RentalRealEstate Free Rental Property A/R Template

Get started creating an accounts receivable statement for your rental property with our free downloadable and customizable template below. The rental property accounts receivable statement template opens up as an Microsoft Excel and can be edited in Microsoft Excel or compatible programs.

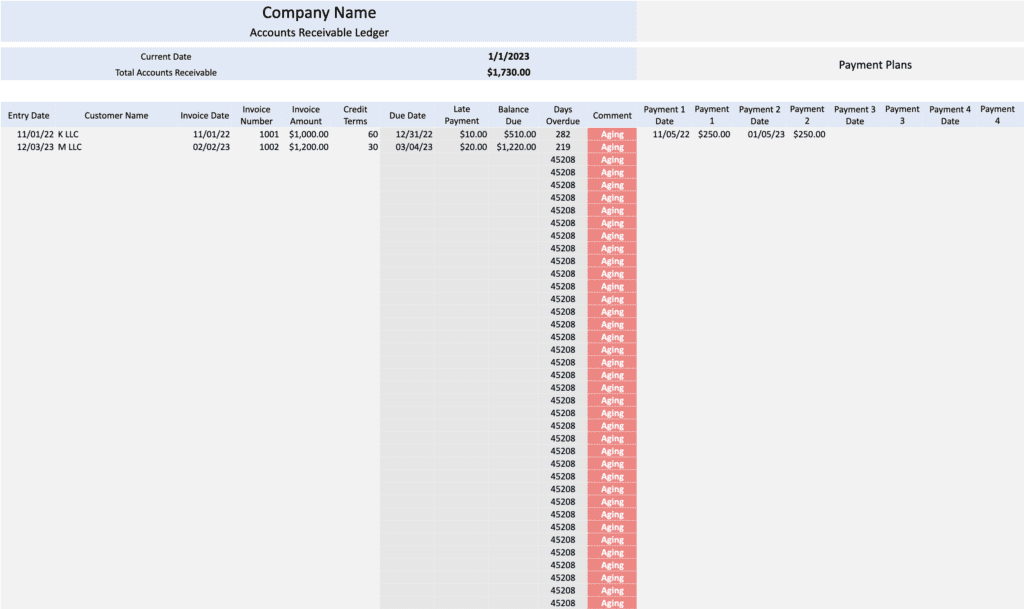

Jetpack Workflow Free Accounts Receivable Template

Jetpack Workflow has a free downloadable rental property accounts receivable templates available in both Microsoft Excel and Google Sheets formats.

What Information is on an Accounts Receivable Statement?

Accounts receivable statements generally all have similar information about a property on them. Below is a list of the most common information you can typically expect to find on an accounts payable statement for a rental property:

- Tenant Name: The name of the tenant who owes the payment.

- Lease Unit: The specific unit or property the tenant is renting.

- Description of Receivable: Details about the nature of the receivable, typically this is rent, but it could also include other charges or fees.

- Invoice Date: The date when the payment request was issued.

- Due Date: The date by which the payment should be made.

- Amount Due: The amount of money that the tenant owes.

- Outstanding Balances: Any amounts from previous billing cycles that remain unpaid.

Try Our Rental Property Late Fee Calculator →

100% Free – No Sign Up Required

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

How to Use Rental Property Accounts Receivable Statements

Rental property accounts receivable statements offer a detailed view of outstanding payments owed by tenants. These statements play a pivotal role in financial management, ensuring consistent cash flow and timely rent collection. Various stakeholders, from property owners to investors, derive significant value from these statements, as highlighted below:

| Stakeholder | Usage of Accounts Receivable Statements |

|---|---|

| Property Owners | Owners utilize accounts receivable statements to monitor outstanding rents, assess cash flow health, and determine necessary actions for long-outstanding balances. |

| Property Managers | Managers reference these statements to track unpaid rents, issue reminders or notices, and strategize collection efforts, ensuring smooth operational cash flow. |

| Real Estate Investors | Investors analyze accounts receivable statements to evaluate the efficiency of rent collection and the financial health of potential or existing investments. |

| Lenders/Banks | Lenders may review these statements to gauge the regularity and efficiency of rent collections, influencing decisions on loan approvals or terms. |

| Accountants | Accountants rely on accounts receivable statements to accurately report rental income, reconcile financial discrepancies, and prepare year-end financial reports. |

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Property Accounts Receivable Statement FAQ

How is Accounts Receivable Different from Accounts Payable?

In rental real estate finance, “Accounts Receivable” and “Accounts Payable” reflect opposite ends of financial transactions. “Accounts Receivable” symbolizes the money that tenants owe to the property primarily in the form of unpaid rent, making it an asset to the owner. Conversely, “Accounts Payable” signifies the money the property owes to others such as contractors, suppliers, or lenders, making it a liability. Therefore, Accounts Receivable contributes to incoming cash flow, while Accounts Payable represents outgoing cash flow. Together, they are summarized in reports such as a Rental Property Accounts Payable Statement, and provide a comprehensive view of the financial status of a rental property.

Why is it Important to Track Accounts Receivable in Rental Property Management?

Monitoring accounts receivable is important for managing rental properties because it helps property owners identify unpaid rents or other outstanding charges. By being aware of these outstanding payments, they can effectively manage cash flow and anticipate potential financial challenges. Timely tracking also allows for proactive communication with tenants regarding late payments. Without regular monitoring, property owners might face unexpected revenue shortfalls and collection difficulties.

What to do if Accounts Receivable Balances Remain High or Unpaid for Extended Periods on Time?

Persistently high balances in accounts receivable indicate potential collection challenges. Initially, property managers can address this by sending reminders or notices to tenants. If balances remain unpaid, further actions such as imposing late fees, offering payment plans, or engaging third-party collection services might be necessary. In extreme cases, legal measures, including eviction, may be considered to address consistent non-payment.

More Real Estate Financial Statements

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.