Last Updated: February 2024

Rental property general ledgers take center stage in rental real estate accounting and finance. This vital rental property financial document records every financial transaction tied to the property, serving as a historical list of all transactions related to a rental property. For investors and stakeholders, the general ledger is an essential reference point that offers a source to track and verify a property’s financial journey. As we delve into this topic, you will see how the general ledger’s meticulous record-keeping contributes to a transparent and well-informed rental property investment environment.

General Ledger Definition

A general ledger is a comprehensive record that catalogs all the financial transactions associated with the property over its entire lifecycle. This includes revenues such as rental income, expenses like property taxes or repairs, and any changes in liabilities and equity, thus providing a detailed historical context for understanding the financial performance of the property.

General Ledger Explained

A general ledger is like a diary that keeps track of all the money that comes in (like rent from tenants) and goes out (like paying for repairs or property taxes) for the property. It helps owners and property managers keep track of their finances, see patterns over time, and make sure everything adds up correctly.

Top 2 Free Rental Property General Ledger Templates

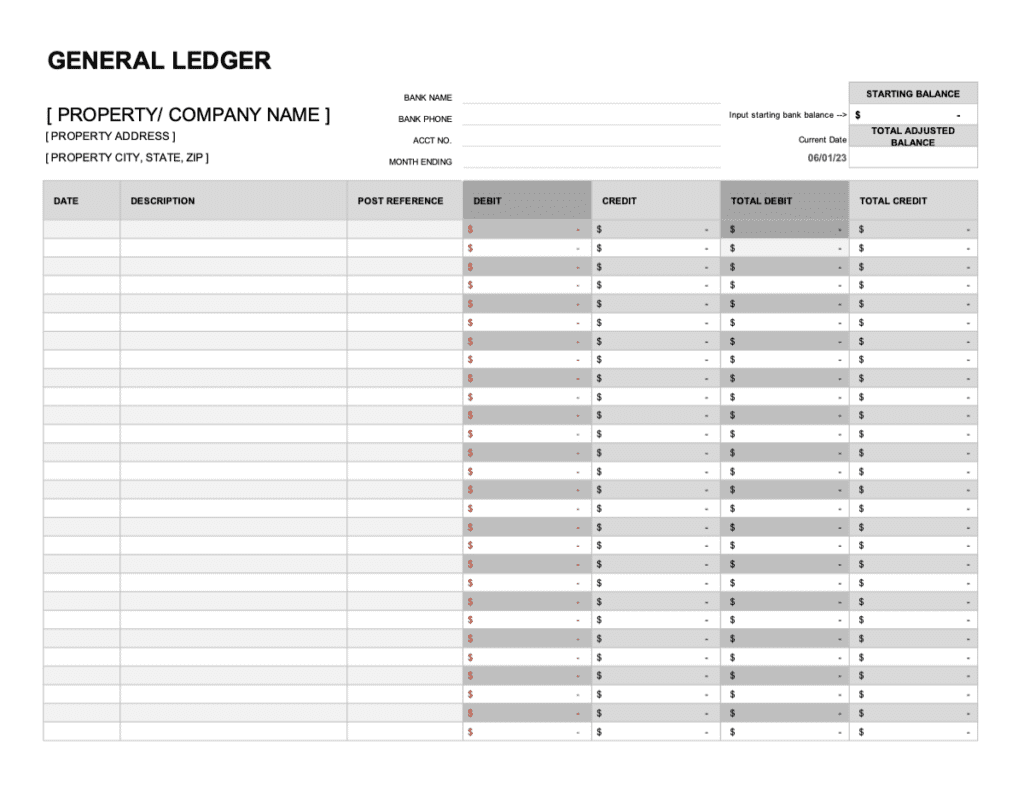

RentalRealEstate Free General Ledger Template

Get started creating a general ledger for your rental property with our free downloadable and customizable template below. The rental property general ledger template opens up as an Microsoft Excel and can be edited in Microsoft Excel or compatible programs.

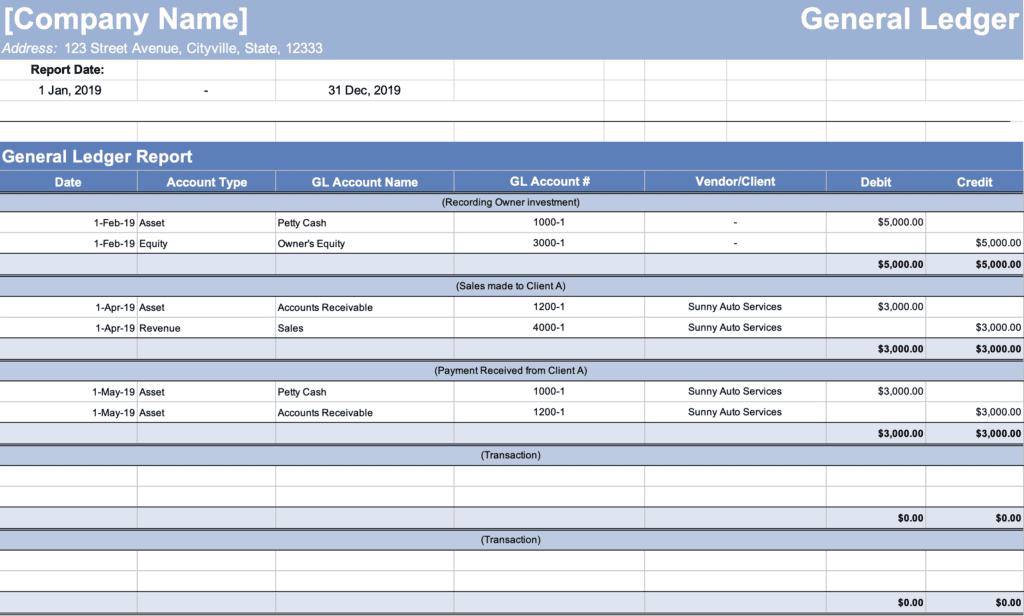

FreshBooks Free General Ledger Template

FreshBooks has a free downloadable general ledger template that you can tailor to your rental property needs. It is only available in Microsoft Excel format.

What Information is on a General Ledger?

Rental property general ledgers may differ depending on their preparers, but they all generally contain similar information. Below is a list of the most common information you can expect to find on a general ledger for a rental property:

- Account Codes/Names: These are unique identifiers for each type of financial transaction, making it easy to categorize and track different types of income and expenses.

- Date of Transaction: The date when each financial transaction occurred.

- Description of Transaction: A brief explanation of each transaction, providing necessary context.

- Debit and Credit Entries: These columns record the amount of each transaction, with debits typically representing increases in assets or expenses, and credits often indicating increases in income, equity, or liabilities.

- Balances: The current balance for each account, updated after each transaction.

In a rental real estate general ledger, you would find records of transactions like:

- Rental income received.

- Payments made for property management services.

- Money spent on repairs and maintenance

- Payments made for utilities, if applicable.

- Mortgage payments or other debt service.

- Payments received or made for any other income or expense related to the property.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

How to Use a Rental Property General Ledger

The general ledger serves as the main accounting record for any business, including rental properties, capturing all transactions using a double-entry system. For rental properties, it is a foundational tool that consolidates detailed financial data, providing a basis for the preparation of all other financial reports. Various stakeholders find value in the insights derived from the general ledger, as outlined below:

| Stakeholder | Usage of General Ledgers |

|---|---|

| Property Owners | Property owners use general ledgers to monitor all financial transactions related to their property, ensuring transparency and aiding in strategic financial planning. |

| Property Managers | Managers reference the general ledger to track income, expenses, and deposits, facilitating accurate financial reporting and aiding in day-to-day property management decisions. |

| Real Estate Investors | Investors consult the general ledger to scrutinize detailed financial data, informing their evaluations of a property’s fiscal health and guiding investment decisions. |

| Accountants | Accountants rely heavily on the general ledger to prepare financial statements, perform audits, and ensure compliance with taxation and other financial regulations. |

| Lenders/Banks | Before extending credit or refinancing loans, lenders may review the general ledger to gain a deeper understanding of a property’s financial history and evaluate its creditworthiness. |

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Rental Property General Ledger FAQ

What are “Account Codes” in a Rental Property General Ledger?

In accounting, account codes (also known as “chart of accounts”) are numerical or alphanumeric identifiers that are assigned to specific types of income, expense, asset, liability, and equity accounts. For example, in rental real estate accounting you might have an account code for “Rental Income,” another for “Maintenance Expenses,” another for “Property Taxes,” and so on. When a transaction occurs, the appropriate account code is used to record the transaction in the general ledger, which makes it easier to categorize and track financial activity related to the property.

Real Estate General Ledger Account Code Examples

- 4100 – Rental Income: Income received from tenants for renting out the property.

- 4200 – Late Fees Income: Fees charged to tenants for late payment of rent.

- 5100 – Mortgage Interest Expense: Interest paid on a mortgage loan for the rental property.

- 5200 – Property Taxes: Taxes paid on the property.

- 5300 – Maintenance and Repairs: Costs associated with maintaining and repairing the property.

- 5400 – Property Management Fees: Fees paid to a property management company for managing the property.

- 5500 – Utilities: Costs of utilities like water, electricity, and gas, if they are paid by the property owner.

- 5600 – Insurance: Premiums for insurance coverage on the property.

- 6100 – Depreciation: Non-cash expense representing the gradual loss of value of the property over time.

- 6200 – Capital Improvements: Costs for major improvements or upgrades to the property that increase its value and are capitalized (added to the property’s cost basis and depreciated over time).

Is a General Ledger the Same Thing as a Rent Ledger?

No, rental property general ledgers and rent ledgers are not the same, although they are related in the context of rental property financial management. A rental property general ledger is a comprehensive accounting record that captures all financial transactions related to a property, using a double-entry system. It includes details on income, expenses, assets, liabilities, and equity. On the other hand, a rent ledger specifically tracks the rental payments of tenants, detailing dates, amounts paid, any outstanding balances, and other rent-related transactions. While the general ledger provides a broad overview of the property’s financial activities, the rent ledger focuses solely on the rental income aspect.

More Real Estate Financial Statements

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.