Last Updated: January 2024

The complexity of selling a residential property typically depends on the type of property – is it a single family rental or a large multifamily building? Regardless of the specific property, there are many universal practices that go into residential rental property sales.

16 Steps – How to Buy a Residential Rental Property?

Buying a residential rental property to rent out is one of the best ways to start your journey as a successful rental real estate investor. Below are 15 steps to help potential buyers navigate the process of how to buy a residential rental property:

1. Research Residential Property Types

Research and determine what type of residential property fits your investment approach. There are several different types of residential rental property opportunities available, with the most common being single family rentals and multifamily properties. We take a look at some of the different types below:

2. Determine Your Budget

Assess your finances and determine how much you can afford to spend on a rental property, taking into account the down payment, closing costs, and ongoing expenses.

3. Get Prequalified

Even if you have the knowledge and experience, you need to talk to a mortgage broker, direct lender, or bank to determine your eligibility for a loan. Thankfully residential rental property loans are fairly common with plentiful lenders and standardized borrower requirements.

4. (Optional/Recommended) Hire a Real Estate Agent

Most of the time, it is easier to hire a real estate agent to help guide you through the buying process, since they are usually paid for by the seller.

5. (Optional) Hire a Real Estate Attorney

Depending on your locality, state laws and the nature of the transaction, you may need to enlist the services of a real estate attorney.

6. (Optional) Don’t Hire a Real Estate Agent

Alternatively, an advanced technique can be to try and negotiate directly with a seller (assuming they don’t have a real estate agent either) to mutually save on commissions and in-turn pass those savings onto you. Be prepared to handle all aspects of the transaction if you decide to take this advanced approach.

7. Choose Location

Choose a location with strong demand for residential units and potential for long-term growth to ensure consistent occupancy and profitability. Some densely populated areas are better for multifamily rentals, while suburban areas near strong job hubs are better for single family rental homes.

8. Find a Property

Search online real estate listing websites, work with a real estate agent, and attend open houses in your desired area to find a property that meets your criteria.

9. Assess the Property’s Value

Look at similar properties that have sold, are currently for sale or consult your real estate agent to determine the target property’s value and identify any issues that may affect its rental potential.

10. Determine Rental Income Potential

Review existing tenant lease agreements and research comparable residential rental rates in the area to ensure the property will generate a profitable return on investment. This is also an important component in securing financing since the lender will base the loan on this factor.

11. Make an Offer

Submit an offer to purchase the property, negotiating terms and price with the seller until you reach an agreement.

12. Secure Financing

Following up on your pre-approval, let your lender know that you have an accepted offer and provide them all relevant details of the property to start the loan process. Note that this process takes some time to finalize.

13. Escrow, Contingencies, and Inspections

Once there is an agreed upon contract, both buyer and seller go into escrow which can usually be 30 days or longer. During this period, there can be contingencies that may need to be cleared for the sales process to continue. Furthermore, the buyer usually orders an appraisal and performs physical inspections while working through a series of administrative requirements including satisfying loan approval conditions and completing a title search.

15. Evaluate the Property’s Condition

Finalize the purchase by completing any necessary paperwork, transferring ownership, and securing the rental property with insurance.

16. Property Management

Determine whether to manage the property yourself or hire a property management company to oversee day-to-day operations and tenant relations. If you do decide to hire a third party manager, be sure they have experience in single family property management or multifamily property management.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

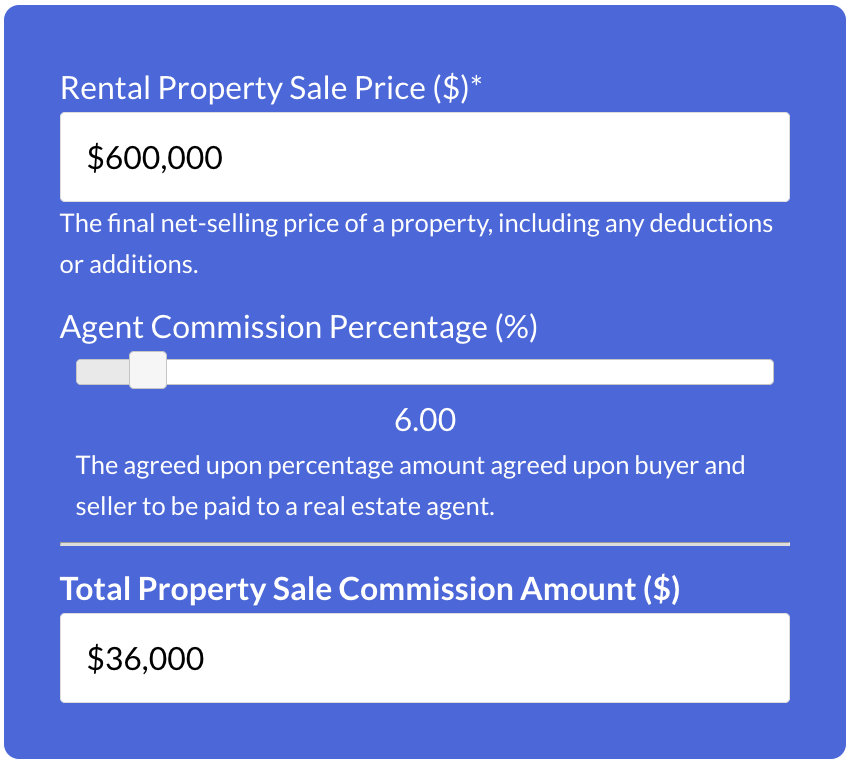

Try Our Rental Property Sale Commission

Calculator →

100% Free – No Sign Up Required

Where to Sell a Residential Property Online?

The search to buy and sell rental properties is now almost exclusively online. Online real estate listing websites have millions of listings with properties available to buy, sell, or lease. When selling a residential rental property, you will want to make sure that your property is on a listing website for residential properties for sale. These websites are typically free for buyers and renters to browse, but most charge the property owner a fee to list their property on the site. If you hire a real estate agent, they will usually syndicate it across many platforms, in addition to their local MLS, at no additional charge.

Using a Real Estate Agent to Sell Residential Rental Property

When selling an investment property such as an apartment building or single-family house, it’s important to find an rental real estate agent with experience in residential investment property sales and a strong understanding of the local real estate market. A good agent should be able to provide guidance on pricing, marketing strategies, and favorably negotiating the terms of the sale. Additionally, they should be able to work with existing tenants and address any concerns they may have throughout the sales process.

Residential Sales Companies

When buying or selling a residential rental property, the real estate agents that facilitate the process are usually associated with a particular larger company called a brokerage. Real estate brokerages hold individual real estate agent’s licenses and provide their agents with access to helpful resources through shared networks. Residential real estate brokerages can range from local small multi-person companies, to multinational brands with thousands of agents. There are also specialized brokerages who focus on residential properties such as single family homes and apartments. Much like choosing a brand of car or associating with a favorite sports team, real estate agents carefully select their brokerage to help maximize their growth and sales potential.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.