Last Updated: April 2024

Buying a commercial property is a multifaceted venture that requires a strategic approach to location, market analysis, and long-term investment potential. This aspect of commercial real estate sales involves assessing the property’s compatibility with business objectives, understanding zoning laws, and evaluating the implications on cash flow and financing options.

17 Steps – How to Buy a Commercial Property?

Buying a commercial property is similar to residential properties in some ways, and drastically different in others. Before you make an offer on your dream shopping center, you should be aware of common steps found in the commercial real estate buying process. Below are 17 steps to help potential buyers navigate the process of how to buy a residential rental property:

1. Define Investment Goals

Whether it is buying an industrial warehouse for your growing manufacturing business or exchanging a 20 unit multifamily apartment into a 50 unit multifamily apartment complex, commercial real estate transactions need to be clearly defined with a plan for both your personal objectives and also to provide clarity to your lender on your loan’s purpose. Some common types of commercial properties include:

2. Determine Your Budget

Assess your finances and determine how much you can afford to spend on a property, taking into account the down payment, upgrade or repair budget, and ongoing operating expenses.

3. Get Prequalified

Even if you have the knowledge and experience, you will need to talk to a commercial mortgage broker or direct lender to determine your eligibility for a commercial real estate loan. Commercial lenders will look at your personal collateral, reserves, and ratios such as debt service coverage ratio (DSCR) and loan to value ratio (LTV).

4. (Optional/Recommended) Hire a Real Estate Agent

Most of the time, it is easier to hire a commercial real estate agent to help guide you through the buying process, since they are usually paid for by the seller. Due to the complexities of commercial real estate transactions, we recommend to utilize commercial real estate agents.

5. (Optional) Hire a Real Estate Attorney

Depending on your locality, state laws and the nature of the transaction, you may need to enlist the services of a real estate attorney. For large and complex commercial real estate transactions, real estate attorneys are very strongly recommended and usually involved.

6. (Optional) Don’t Hire a Real Estate Agent

Alternatively, an advanced technique can be to try and negotiate directly with a seller (assuming they don’t have a real estate agent either) to mutually save on commissions and in-turn pass those savings onto you. Be prepared to handle all aspects of the transaction if you decide to take this advanced approach.

7. Choose a Location

Location is one of the most important components for commercial real estate. Be sure that the location matches the demand for the type of commercial property. For example, try to avoid mismatches such as an industrial property in a residential neighborhood, or a retail shopping center away from a main street with no visibility.

8. Find a Property

Search online real estate platforms, work with a commercial real estate agent, and even cold-call or write letters to property owners in your target area for properties that meet your criteria.

9. Assess the Property’s Value

Look at similar properties that have sold, are currently for sale, or consult your real estate agent to determine the target property’s estimated value and identify any issues that may affect its rental potential.

10. Determine Rental Income Potential

If the property is already occupied, find out at what rate on the commercial lease agreements and determine if they are above market, at market, or below market. This is also an important component in securing financing since the lender will perform their own rent analysis and base the loan off of this.

11. Make an Offer

Submit an offer to purchase the property, negotiating terms and price with the seller until you reach an agreement. There may be multiple back-and-forths of counter offers until a final agreement is reached.

12. Secure Financing

Following up on your pre-approval, let your lender know that you have an accepted offer and provide them all relevant details of the property to start the loan process. Note that this process can take some time to finalize, depending on the borrower profile and property type.

13. Escrow & Contingencies

Once there is an agreed upon contract, both buyer and seller go into escrow which can usually be 30 days or longer which allows for sufficient time to work through a series of administrative requirements including satisfying loan approval conditions and completing a title search. During this period, the buyer will usually have to submit deposit monies and there may be contingencies that need to be met in order for the purchase process to continue, such as securing financing or a clean environmental assessment.

14. Environmental Assessment

The buyer usually orders an environmental site assessment that involves a licensed professional to come out to the property to perform a physical inspection of the likelihood for contamination. These can be called a Phase 1, Phase 2 or Phase 3. Note that these are often a requirement to secure a commercial loan.

15. Perform Property Due Diligence

While in escrow, you shall perform additional due diligence such as obtaining and reviewing estoppel certificates to validate rental amounts, and hiring professional inspectors and tradespeople to conduct thorough inspections of the property to assess its condition and identify any necessary repairs or upgrades.

16. Close the Deal

Finalize the purchase by completing any necessary paperwork, transferring ownership, and securing the property with commercial insurance.

17. Property Management

Determine whether to manage the property yourself or hire a property management company to oversee day-to-day operations and tenant relations. If you do decide to hire a third party manager, be sure they have experience in commercial property management.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

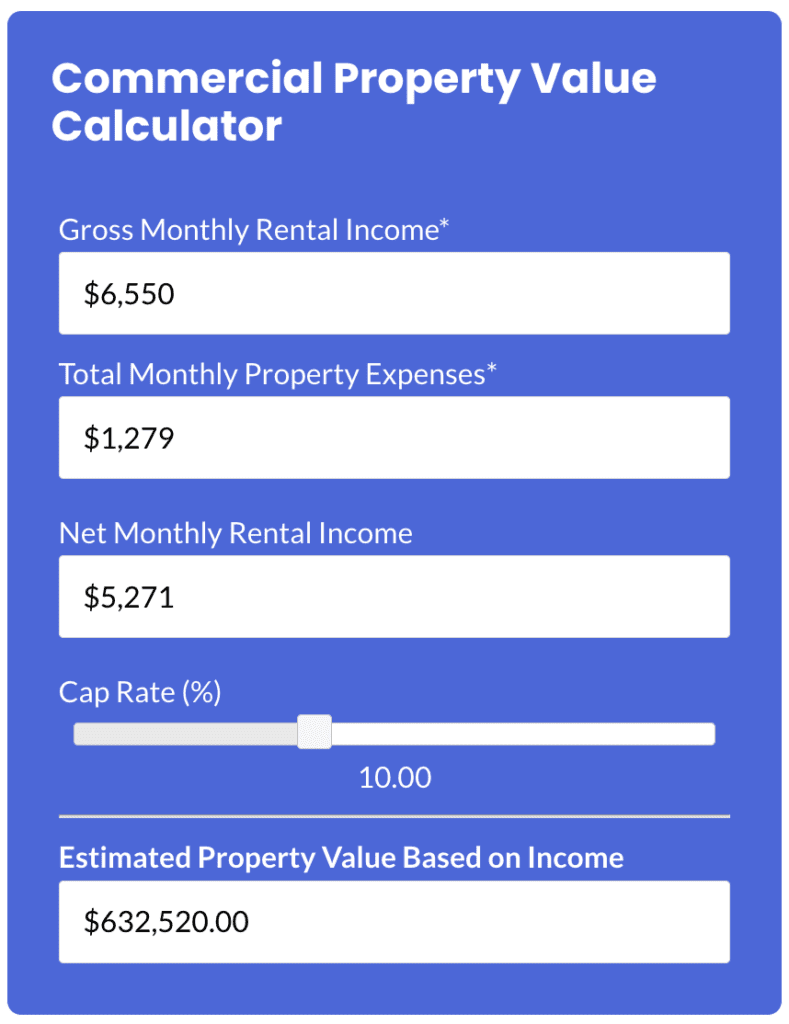

Try Our Commercial Property Valuation Calculator →

100% Free – No Sign Up Required

Where to Find a Commercial Property Online?

The search to buy a commercial property is now almost exclusively online. Online real estate listing websites have millions of listings with properties available to buy, sell, or lease. When selling commercial real estate, you will want to make sure that your property is on a listing website for commercial properties for sale. These websites are typically free for buyers and renters to browse, but most charge the property owner a fee to list their property on the site. If you hire a commercial real estate agent, they can also find properties that might not be listing on these websites.

Commercial Real Estate Agents

When selling a piece of commercial real estate such as an office building or industrial property, it’s important to find an agent with experience in commercial investment property sales. A good commercial real estate agent (also called a Broker) should be able to provide guidance on pricing the property, market it effectively, and favorably negotiate the terms of the sale with potential buyers to your benefit.

Commercial Sales Companies

The commercial real estate agents used to sell a commercial property are usually associated with a particular larger company called a brokerage. Real estate brokerages hold individual real estate agent’s licenses and provide their agents with access to helpful resources through shared networks. Commercial real estate brokerages can range from local small multi-person companies, to multinational brands with thousands of agents. There are also specialized brokerages who focus solely on specific types of commercial properties such as industrial warehouses or retail shopping centers. Much like choosing a brand of car or associating with a favorite sports team, real estate agents carefully select their brokerage to help maximize their growth and sales potential.

More Rental Property Sales Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice. As such, all information, content, and materials available on this site are for general informational purposes only. See Our Disclaimer Page for more information.