Last Updated: January 2024

Residential rental properties can be some of the most stable and time-tested types of investment properties. Buying and selling them has been greatly streamlined over the years, but the process still requires proper steps to be followed. Whether a property is a single family rental home or a 300 unit multifamily apartment building, performing proper due diligence, securing financing, and overseeing many of the other tasks involved in a property sale all come into play for both the buyer and seller to ensure a successful closing for both parties.

On This Page

- How to Buy a Residential Rental Property?

- How to Sell a Residential Rental Property?

- 3 Important Factors When Buying or Selling Residential Rentals

- Where to Buy or Sell a Residential Rental Property Online?

- Using a Real Estate Agent to Buy or Sell

- Residential Sales Companies

- Buying and Selling Residential Rentals FAQ

How to Buy a Residential Rental Property?

Understanding how to buy a residential rental property requires a strategic process that involves assessing potential locations for market demand and rental yield, as well as evaluating the condition and value of properties. Financial considerations are key, including securing financing, understanding the implications of landlord insurance, and calculating expected return on investment.

How to Sell a Residential Rental Property?

Mastering how to sell a residential rental property involves several key steps, including assessing the property’s value in the current market and making any necessary improvements to enhance its appeal. It’s important to consider the timing of the sale, the property’s rental history, and the current state of the real estate market to attract potential buyers.

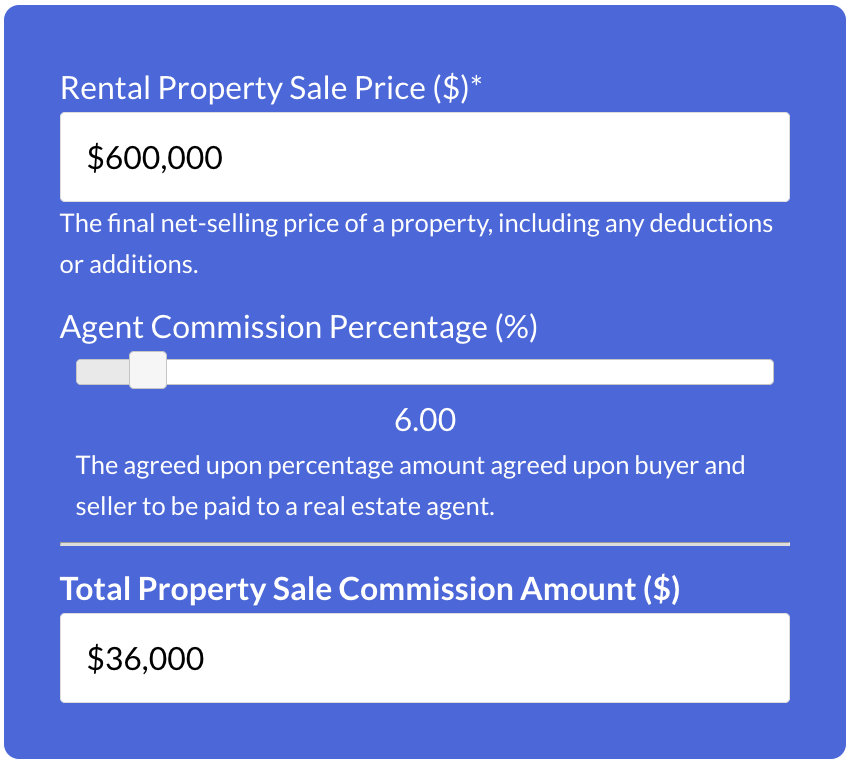

Try Our Rental Property Sale Commission Calculator →

100% Free – No Sign Up Required

3 Important Factors When Buying or Selling Residential Rentals

When buying or selling a residential rental property, there are several key factors for consideration to ensure a successful transaction. These factors apply to both buyers and sellers, and each includes a “Pro Tip” based on real world experience.

1. Tenant Occupancy

If the property is occupied by tenants, sellers must determine whether to sell the property with or without tenants and give proper notice before showings. Buyers must assess current rents and determine if they are up to market or need to be adjusted.

Pro Tip: Depending on the market, occupied units can be a positive or negative selling point.

2. Property Condition

Sellers should assess the property’s condition and address any necessary repairs or upgrades before listing to attract potential buyers. Buyers should also assess and determine a budget of planned repairs or upgrades beforehand to understand how much capital will be required.

Pro Tip: Properties that are in good condition usually attract more buyers and generate higher offers.

3. Market Conditions

Sellers should evaluate the current market conditions in the area and determine the best time to sell to maximize profits. Buyers should also keep an eye on market conditions to understand the nuances between active and slower times of sale activity.

Pro Tip: Start tracking nearby multifamily or single family homes that are for sale to get an idea what to expect when a property hits the market.

Where to Buy or Sell a Residential Rental Property Online?

The search to buy and sell rental properties is now almost exclusively online. Online real estate listing websites have millions of listings with properties available to buy, sell, or lease. When selling a residential rental property, you will want to make sure that your property is on a listing website for residential properties for sale. These websites are typically free for buyers and renters to browse, but most charge the property owner a fee to list their property on the site. If you hire a real estate agent, they usually syndicate it across many platforms at no additional charge.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Using a Real Estate Agent to Buy or Sell

When selling an investment property such as an apartment building or single-family house, it’s important to find an rental real estate agent with experience in residential investment property sales and a strong understanding of the local real estate market. A good agent should be able to provide guidance on pricing, marketing strategies, and favorably negotiating the terms of the sale. Additionally, they should be able to work with existing tenants and address any concerns they may have throughout the sales process.

Residential Sales Companies

When buying or selling a residential rental property, the real estate agents that facilitate the process are usually associated with a particular larger company called a brokerage. Real estate brokerages hold individual real estate agent’s licenses and provide their agents with access to helpful resources through shared networks. Residential real estate brokerages can range from local small multi-person companies, to multinational brands with thousands of agents. There are also specialized brokerages who focus on residential properties such as single family homes and apartments. Much like choosing a brand of car or associating with a favorite sports team, real estate agents carefully select their brokerage to help maximize their growth and sales potential.

Buying and Selling Residential Rentals FAQ

What is the Difference Between Residential vs Commercial Sales?

Selling a residential rental property and selling a commercial property can be vastly different processes. Residential rental properties are typically designed for individuals or families to live in, while commercial properties are intended for business purposes. Understanding the nuances and differences between these two sectors is essential for effective real estate transactions.

| Aspect | Residential Sales | Commercial Sales |

|---|---|---|

| Primary Purpose | Residential properties are designed for living purposes, such as houses and apartments. | Commercial properties are intended for business use, like offices, retail spaces, and warehouses. |

| Market Dynamics | Driven by factors like location, school districts, and neighborhood amenities. | Influenced by economic trends, business growth, and investment potential. |

| Buyer Profile | Buyers are typically individuals or families looking for homes or small-scale investments. | Buyers often include investors, corporations, and entrepreneurs seeking profitable opportunities. |

| Transaction Complexity | Transactions are usually less complex, with standardized processes and fewer legal hurdles. | More complex, involving detailed contracts, zoning laws, and potentially longer negotiation processes. |

| Investment Strategy | Focuses on property value appreciation and rental income potential. | Emphasizes return on investment, cash flow analysis, and commercial property potential. |

How to Handle Existing Tenants When Buying or Selling a Rental Property?

Managing existing tenants during the purchase or sale of a rental property requires careful consideration of their rights and the terms of their lease agreements. It’s essential to maintain clear and respectful communication with tenants throughout the transition process. When buying, understanding the lease terms and tenant history is crucial for a smooth transition and to align with your investment goals. When selling, the presence of tenants can be a selling point or a challenge, depending on the buyer’s intentions and the nature of the existing leases.

Tenants When Buying

Inheriting tenants means respecting existing lease terms and building a positive relationship with them from the outset. It’s important to conduct due diligence on the rental history and payment records of the tenants to understand what to expect.

Tenants When Selling

Selling a property with tenants requires transparent communication about the sale process and how it impacts them. Consider the lease terms and potential buyer preferences, as some may value an occupied property while others might seek vacancy.

Should You Use a Flat Fee Service When Buying or Selling a Rental Property?

While flat fee services can often save money and time when buying and selling a property, they often have several pros and cons that should be seriously considered beforehand. Below we take a look at the most common types, as well as who they are best and least suited for.

| Service Type | Features | Best Suited For | Least Suited For |

|---|---|---|---|

| Flat Fee MLS | Listing on the Multiple Listing Service for a fixed fee, offering wide exposure without traditional commission costs. | Sellers comfortable with handling some sale aspects themselves but wanting MLS exposure. | Sellers who prefer comprehensive support from a real estate agent throughout the selling process. |

| iBuyers | Digital platforms for quick, automated buying, offering sellers a market-based price. | Sellers seeking a rapid, hassle-free sale, often at the expense of higher offers. | Sellers aiming to maximize profit through traditional market negotiations and exposure. |

| Instant Cash Offers | Services providing immediate cash offers for properties, enabling a quick sale without traditional listing. | Sellers in urgent need of liquidity, willing to accept a lower offer for convenience and speed. | Sellers who are not in a rush to sell and are looking to get the best possible market price. |

| For Sale by Owner (FSBO) | Enables sellers to directly market and manage the sale without a real estate agent, saving on commission fees. | Knowledgeable sellers with time and resources to market their property and comfortable with direct negotiations. | Sellers unfamiliar with the real estate process or those who prefer the expertise and full service of an agent. |