Last Updated: February 2024

Commercial property leasing requires a different set of skills and considerations compared to leasing out residential properties. As an owner or property manager, it is important to understand the commercial leasing market, how to identify potential tenants, negotiate lease terms, and effectively manage a commercial property to ensure tenant satisfaction and profitability.

12 Steps – How to Lease a Commercial Property?

Leasing out a commercial rental property can be a very profitable way for landlords to generate income from their real estate investments. However, leasing out commercial properties requires a specialized set of skills specific to the specific type of commercial property that you will be leasing. Below we take a look at 13 steps that landlords and property managers can follow to successfully lease out a commercial property.

- Understand the Local Market: Before advertising the property for rent, landlords should research the local commercial real estate market to understand the supply and demand for commercial properties, rental rates, and tenant demographics.

- (Optional/Recommended) Hire a Commercial Real Estate Broker: Most of the time, it is easier to hire a real estate agent who specializes in commercial real estate to handle the rental property leasing process. Their commission is usually a worthwhile investment if they can secure a long term lease and favorable terms for you.

- (Optional) Don’t Hire a Real Estate Broker: Alternatively, a commercial property owner can handle the leasing out of their own property to save on commissions. Be prepared to handle all aspects of the marketing process, lease negotiation, and contract drafting if you decide to take this advanced approach.

- Prepare the Property: Landlords should ensure that the property is in good condition and ready for tenants to move in. This includes making any necessary repairs or upgrades, ensuring that all existing systems such as HVAC are in good working condition, and conducting a thorough cleaning.

- Set the Rental Price: Landlords should set a competitive rental price for the property based on the local market and the property’s location, size, and amenities. This can be done with the help of a commercial real estate broker or using a real estate data software solution that has access to this data.

- Advertise the Property: Once the unit is ready and the rental price has been determined, landlords should advertise the property to potential tenants. This can be done through online real estate listing sites that specialize in commercial listings and social media.

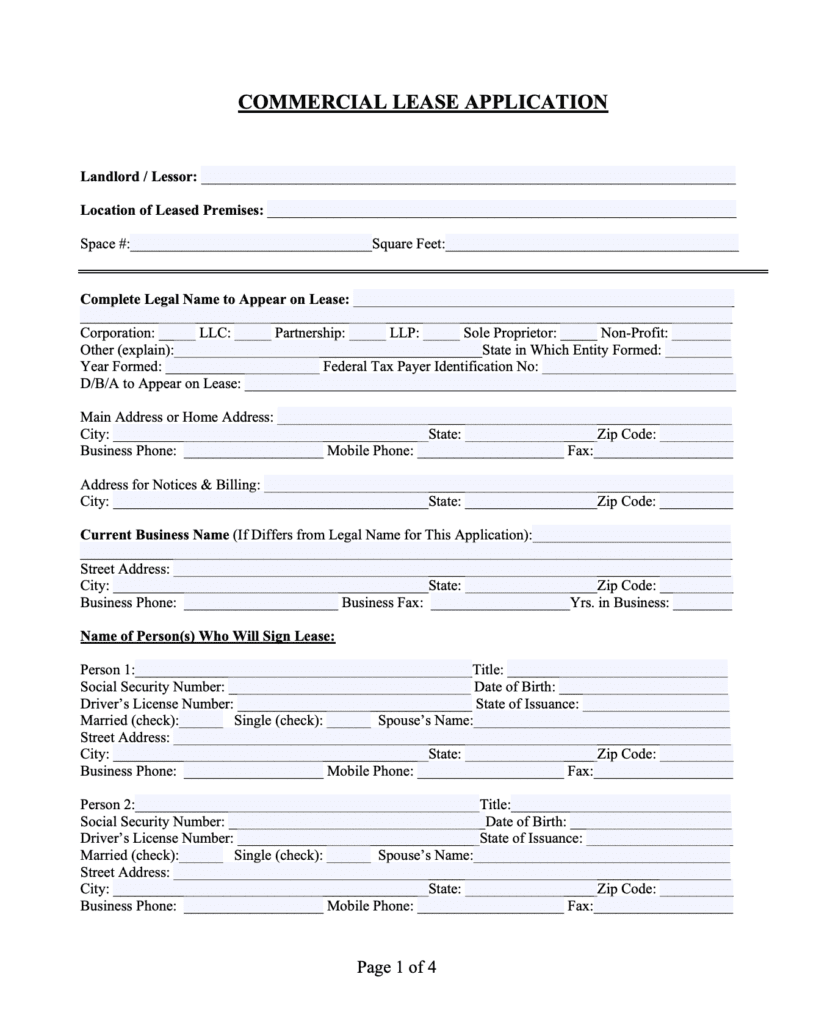

- Screen Potential Tenants: It is important for landlords to carefully screen potential commercial tenants to ensure that they are reliable and responsible. This includes conducting a background check, verifying the tenant’s financial information and references, and checking their credit history. Using a tenant screening software can help make this process easier for all parties.

- Negotiate Lease Terms: Once a tenant has been identified, landlords should negotiate lease terms that are favorable to both parties. This includes setting the lease term, rental rate, security deposit, and any other terms and conditions of the lease. Be aware that commercial lease negotiation can is easier-said-than-done as commercial tenants are usually represented by savvy brokers who fight to get their clients the best favorable terms.

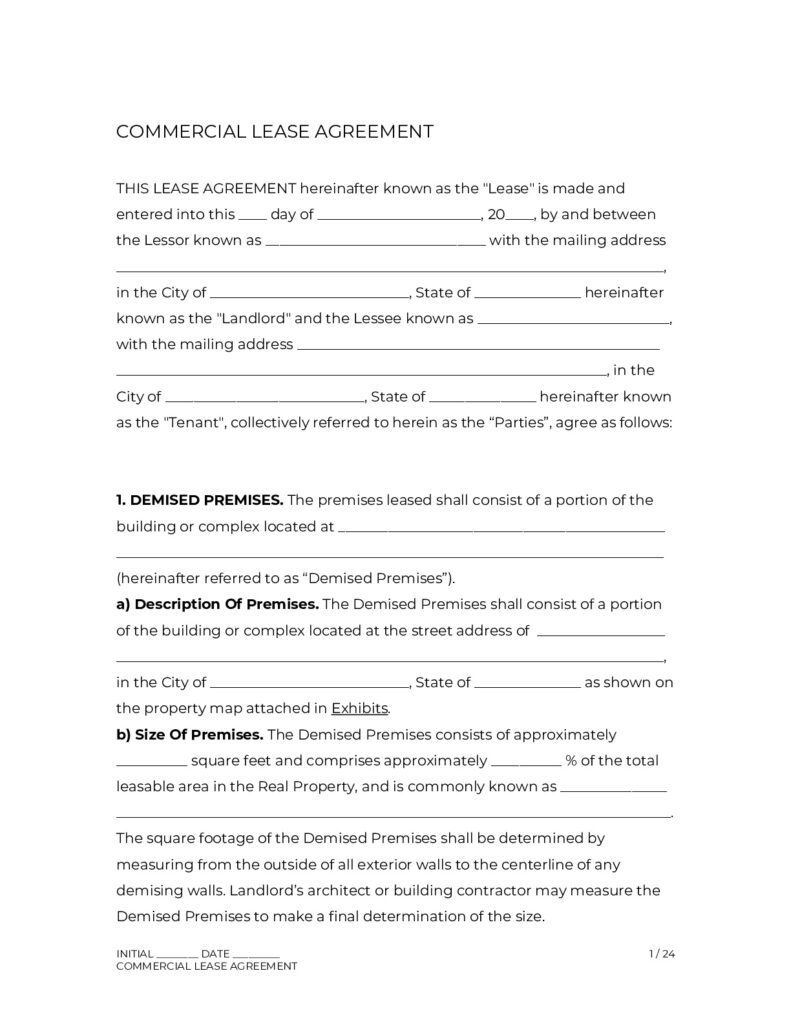

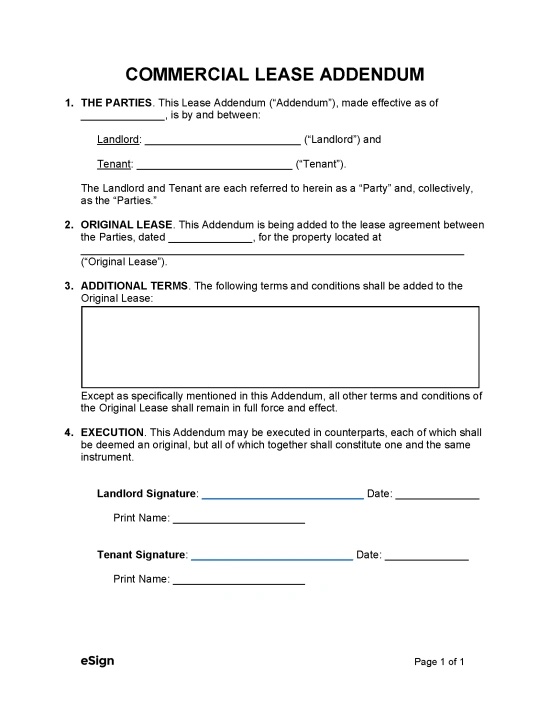

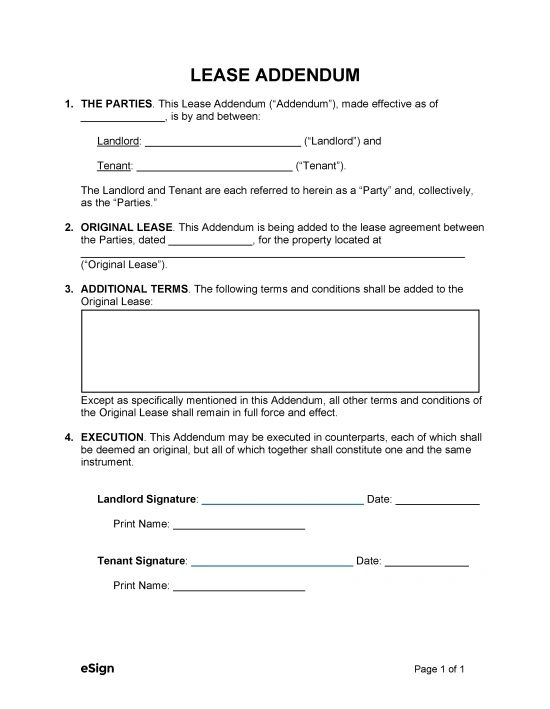

- Draft a Lease Agreement: Once the lease terms have been negotiated, landlords should draft a lease agreement that outlines the terms and conditions of the rental agreement. This can be done with a premade template or a custom one drafted by a legal professional. This should include details such as the rental price, length of the lease, and any restrictions or requirements.

- Collect Security Deposit and Rent: Before the tenant moves in, landlords should collect a security deposit and the first month’s rent. The security deposit should be held in a separate account and returned to the tenant at the end of the lease term, provided there is no damage to the property.

- Conduct a Move-In Inspection: Before the tenant moves in, landlords should conduct a move-in inspection to document the condition of the property. This can help to avoid disputes over damages or repairs when the tenant moves out.

- Communicate with the Tenant: Landlords should maintain open communication with their tenants throughout the lease term. This can help to address any concerns or issues that arise and ensure that the tenant is satisfied with the rental experience. Landlords can use a commercial rental property management software to facilitate the relationship to track rent payments, maintenance requests, and more.

- Renew or End the Lease: Commercial leases are usually for extended periods of time (e.g. 2-5 years). At the end of the lease term, landlords can choose to renew the lease with the tenant or end the rental agreement. If the tenant is interested in renewing, landlords should draft a new lease agreement that outlines any changes to the rental terms. If the landlord decides not to renew the lease, they should provide the tenant with appropriate advanced notice and follow local laws and regulations for ending a rental agreement.

5 Types of Commercial Real Estate Leases

Commercial real estate leasing can take many forms, with different types of leases available to meet the needs of landlords and tenants. As a landlord, it is important to understand the different types of commercial real estate leases and their respective advantages and disadvantages. Below is an overview of the most common types of commercial real estate leases, including Triple Net, Modified Net, Gross Lease, Percentage Lease, and Ground Lease.

Triple Net (NNN)

A Triple Net Lease (NNN) is a lease in which the tenant is responsible for paying all or most of the property’s operating expenses, including property taxes, insurance, and common area maintenance (CAM) fees, in addition to the base rent. The fees collectively referred to as “net-fees”. This type of lease is common in commercial real estate, particularly for properties such as retail centers and industrial properties. This type of contract creates peace-of-mind for landlords who can rest assured expenses will be taken care of without needing additional input from them.

Modified Net Lease (Double Net)

A Modified Net Lease (or sometimes called Double Net) is a type of commercial lease agreement in which the tenant and landlord share responsibility for paying operating expenses. In a Modified Net Lease, the tenant may be responsible for some operating expenses, such as property taxes and insurance, while the landlord is responsible for other expenses, such as maintenance and repairs. This type of lease is often used for office and retail properties. Modified Net Leases can be thought of as a compromise between a Gross Lease and a Triple Net Lease (NNN). In this case, the property manager and tenant will agree to split the maintenance expenses, while the tenant remains responsible for the real estate taxes and insurance.

Gross Lease

A Gross Lease is a lease in which the tenant pays a single, fixed rent amount that includes all operating expenses, such as property taxes, property insurance, and maintenance costs. This type of lease is most commonly found in office space rental properties and is preferred by tenants who want predictable expenses. Typically, gross lease agreements have a clause that allows ownership to increase the monthly rental rate to cover any increased taxes or insurance for the landlord (called Operating Expense Increase).

Percentage Lease

A Percentage Lease is a lease in which the tenant pays a base rent amount, plus a percentage of their sales revenue above a certain threshold. This type of lease is commonly used in retail properties such as shopping centers and shopping malls, and can be beneficial for both the landlord and the tenant, as it incentivizes the tenant to increase their sales while providing the landlord with a predictable income stream.

Ground Lease

A ground lease is a type of long-term commercial real estate lease in which the tenant leases land from the landlord and constructs a building on the property. The landlord retains ownership of the land while the tenant owns the building and is responsible for maintaining it. Ground leases are common in high-value commercial real estate locations such as downtown areas and are often used for properties such as office buildings, hotel properties, and shopping centers.

Commercial Property Leasing Documents

Commercial real estate leasing documents are essential legal contracts that outline the terms and conditions of the lease agreement between a landlord and a tenant for a commercial property. These leasing documents serve as the foundation for a legally binding relationship, ensuring clarity and protection for both parties involved in the commercial leasing process.

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Best Websites for Commercial Property Lease Listings

Commercial real estate leasing websites across the internet attract millions of visitors every year and streamline the renting process for both property owners and searching tenants. Commercial property investors and tenants use these platforms to easily find available properties in almost any market. Access to these leasing platforms is typically free to browse, but commonly charge the property owner a fee to list their unit on the site. If you hire a commercial real estate agent to lease your unit, they typically cover this cost.

Using a Commercial Broker to Lease Commercial Real Estate

Using a commercial real estate agent (often called Brokers) to lease commercial real estate is often a wise choice for landlords who want to lease out their properties quickly and efficiently. Commercial real estate agents have a wealth of knowledge and expertise in the commercial leasing market, which can help landlords to find potential tenants and negotiate lease terms.

Commercial Leasing Companies

The agents that facilitate commercial real estate leases are usually associated with a particular larger company called a brokerage. Real estate brokerages hold individual agent’s licenses and provide them with access to resources and training through their shared networks. Commercial real estate brokerages can range from local small multi-person companies, to multinational brands with thousands of agents. There are also specialized brokerages who focus solely on specific types of commercial properties such as industrial warehouses or retail shopping centers.

Search Rental Real Estate

Try searching out site for hundreds of rental property topics ranging from property management, investor tool reviews, investment research, and more.

Commercial Leasing FAQ

How is Commercial Leasing Different from Residential Leasing?

Leasing commercial properties is significantly different from leasing residential properties, both in terms of the leasing process and the responsibilities of the landlord and tenant. Commercial properties are typically leased to businesses and organizations for commercial purposes, while residential properties are leased to individuals or families for living purposes. Commercial leases tend to be longer and more complex, with a higher level of negotiation and customization, compared to residential leases. Commercial tenants often require more specific buildout requirements and customization to meet their unique business needs. In addition, commercial property maintenance is often the responsibility of the tenant, rather than the landlord, and lease agreements may include provisions for additional operating expenses and maintenance costs.

Try Our Commercial Leasing Calculators

100% Free – No Sign Up Required

What is Key Money in Commercial Leasing?

Key money in commercial leasing refers to a non-refundable payment made by a tenant to a landlord or property owner for the privilege of leasing a commercial property, often in a prime location or high-demand area. This payment is separate from rent, security deposits, or other fees associated with the lease. Key money is more common in certain markets and industries and can be seen as a way for tenants to secure a desirable location that might otherwise attract a lot of competition.

More Rental Property Marketing Guides

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.