Last Updated: January 2024

Rental property opportunity zones are a unique opportunity for investors to realize significant tax benefits for investing in economically distressed areas. They’re intended to be a win-win for both communities and investors, where communities benefit from stimulated economic growth in underdeveloped regions and investors get lucrative tax benefits. Like other rental real estate tax opportunities, there are a series of requirements that need to be met such as approved areas, hold periods, and improvements made to the property.

What are Opportunity Zones?

An opportunity zone is a federally designated, economically-distressed area where private investments, under certain conditions, may be eligible for significant tax benefits. The Opportunity Zones program was established by the Tax Cuts and Jobs Act of 2017 to stimulate economic development and job creation in distressed communities. Investors can receive these tax benefits by investing in a Qualified Opportunity Fund, which is a specialized investment vehicle that invests at least 90% of its assets in designated opportunity zones. The key tax benefits include deferral of tax on prior capital gains, step-up in basis for capital gains reinvested in an opportunity zone, and potential exclusion from tax on profits from the sale of an investment in a Qualified Opportunity Fund if the investment is held for at least 10 years.

How Do Opportunity Zones Work?

Investing in Opportunity Zones can be very beneficial when done correctly. Much like a 1031 exchange or cost segregation study, the process requires specialized knowledge, making it advisable to engage with a professional experienced in opportunity zone investing. Below is a simplified breakdown of how they work:

- Investment: Investors can take capital gains from any source (such as stocks, businesses, or other real estate investments) and invest them into a QOF within 180 days of the gain realization.

- Tax Deferral: By investing in a QOF, investors can defer paying taxes on the initial capital gains until December 31, 2026, or until they sell their investment property, whichever comes first.

- Tax Reduction: If the investment is held for at least 5 years, investors receive a 10% reduction in their deferred capital gains tax liability. If held for at least 7 years, the reduction increases to 15%.

- Tax Exclusion: The most significant benefit is for investors who hold the QOF investment for at least 10 years. They become eligible for an exclusion on any capital gains generated from the appreciation of their QOF investment.

Opportunity Zone Rules

Opportunity zones offer attractive financial benefits for real estate investors, but it’s crucial to understand the rules governing these investments to fully capitalize on the potential advantages. Here are key opportunity zone rules to consider:

- Investment in Qualified Opportunity Fund (QOF): To take advantage of the tax benefits, investors must invest their capital gains into a QOF within 180 days of the sale or exchange that generated the gains.

- Substantial Improvement Requirement: When investing in a property located within an opportunity zone, the investor must make improvements to the property within 30 months equal to the purchase price of the property (excluding the cost of raw land).

- Holding Period: To access the maximum tax benefits, investors must hold their investment in the QOF for at least 10 years to potentially exclude the capital gains generated from the investment’s appreciation.

- Qualified Opportunity Zone Business (QOZB): The QOF must invest at least 90% of its assets in qualified opportunity zone property, which includes tangible property or an active trade or business within the opportunity zone.

- Designated Opportunity Zones: Investors must ensure that the property they intend to invest in is located within a designated opportunity zone. These zones are selected by each state and certified by the U.S. Department of the Treasury.

Rental Property Opportunity Zone Example

Let’s consider the following example to illustrate how Opportunity Zones work. Imagine an investor named Sarah who recently sold some real estate stocks and realized a capital gain of $200,000. Instead of paying immediate taxes on the gain, Sarah decides to invest the proceeds into a Qualified Opportunity Fund (QOF) within 180 days to take advantage of the tax benefits offered by Opportunity Zones. Sarah, who is also a real estate professional as defined by the IRS, finds a property located within an Opportunity Zone and uses the $200,000 investment to purchase the property. Over the next few years, she makes substantial improvements to the property, enhancing its value and attracting tenants.

After holding the property for 10 years, the real estate market in the Opportunity Zone experiences significant growth, and Sarah decides to sell the property for $500,000 (irrespective of taxes due for selling a rental property). Since she held the investment for the required 10-year period, Sarah is eligible for a tax exclusion on any capital gains generated from the appreciation of the Opportunity Zone investment. In this case, the $300,000 gain ($500,000 – $200,000) is excluded from federal capital gains tax.

By utilizing Opportunity Zones, Sarah not only deferred the taxes on her initial capital gains but also enjoyed potential tax reductions and ultimately excluded a portion of the gains from taxation. This example showcases the potential benefits that Opportunity Zones can offer to real estate investors seeking to maximize their after-tax returns.

Opportunity Zone Pros and Cons

Opportunity zones offer real estate investors the potential for significant tax advantages while promoting economic development in distressed areas. However, like any investment strategy, there are both advantages and drawbacks to consider.

| Pros of Opportunity Zones | Cons of Opportunity Zones |

|---|---|

| Tax Incentives: Real estate investors can benefit from tax deferral, reduction, and potential exclusion on capital gains, potentially leading to increased investment returns. | Limited Availability of High-Quality Investments: Finding viable investment opportunities in designated opportunity zones can be challenging, and there may be a scarcity of quality projects in some areas. |

| Community Development: Opportunity zones aim to revitalize economically disadvantaged communities, bringing potential growth, job creation, and improved infrastructure. | Long-Term Commitment: To fully maximize tax benefits, investors must hold their investment in an opportunity zone for at least ten years, which requires a long-term commitment. |

| Diversification:Investing in opportunity zones can offer investors the opportunity to diversify their portfolio and explore new markets. | Potential Risks: Investing in economically distressed areas can be associated with higher risks, such as lower demand, regulatory challenges, or slower appreciation compared to more established markets. |

The #1 Rental Property Newsletter

Once a month, we send out an exclusive Rental Property Market Update with top stories, current mortgage rates, building products, and more. No spam and unsubscribe anytime.

Opportunity Zone Rental Properties FAQ

What is a Qualified Opportunity Fund (QOF)?

A Qualified Opportunity Fund (QOF) is an investment vehicle that allows investors to pool their capital gains and invest them in designated Opportunity Zones to take advantage of the associated tax benefits. QOFs are typically structured as partnerships or corporations and must hold at least 90% of their assets in qualified opportunity zone properties. These funds provide investors with a means to invest in real estate or businesses located within Opportunity Zones and potentially benefit from tax deferral, reduction, and exclusion on capital gains.

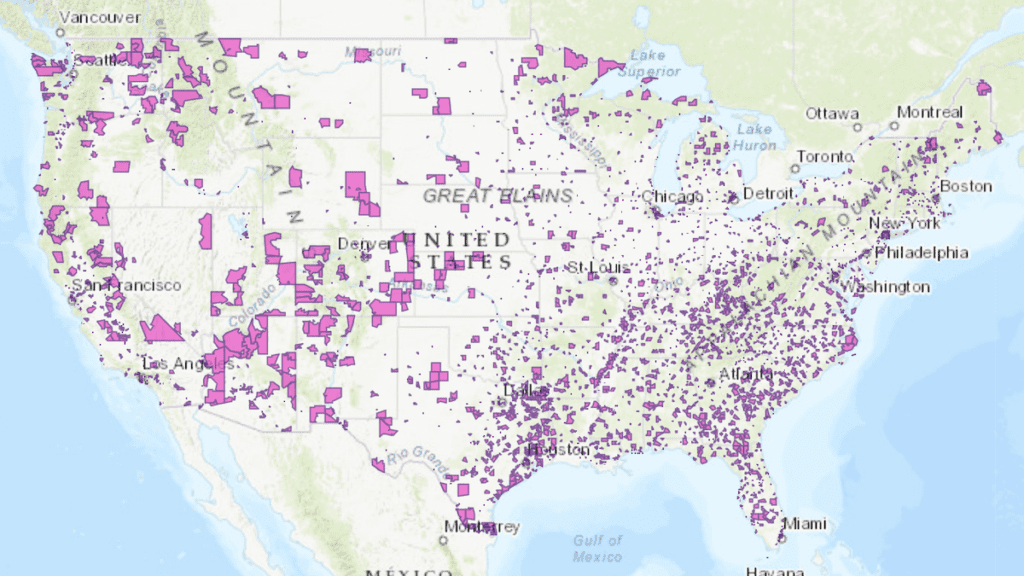

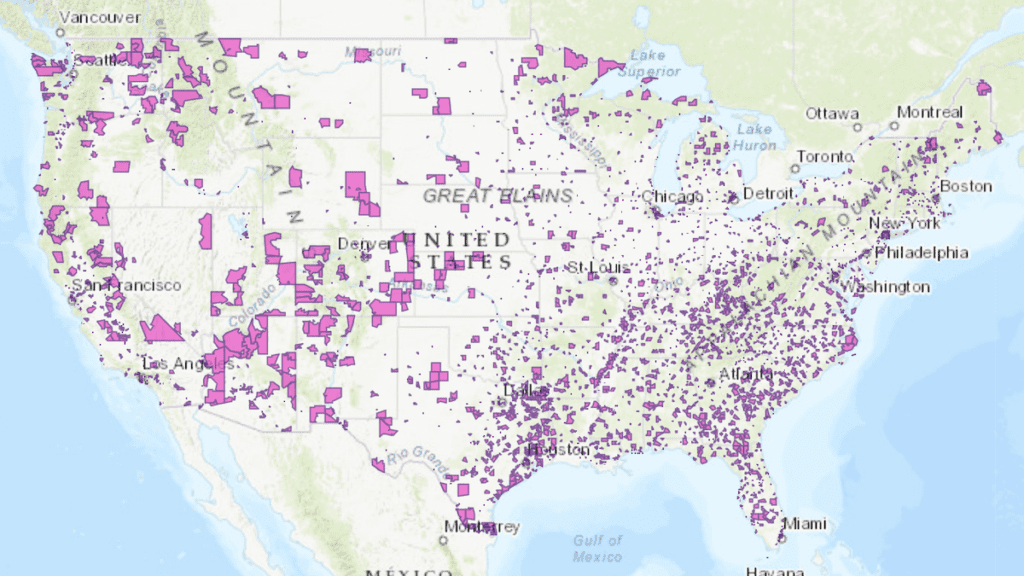

Where are Opportunity Zones Located?

With over 8,700 Opportunity Zones located throughout the United States, there are bound to be opportunities within your local areas. These zones were selected by each state and certified by the U.S. Department of the Treasury. They can be found in urban, suburban, and rural regions across the country.

The exact locations of Opportunity Zones and their respective property tax rates vary, and investors can find them through official maps or consult with local authorities and real estate professionals to identify specific zones within their target areas.

Are Opportunity Zone Rental Properties Good Investments?

Determining whether Opportunity Zones are good investments depends on many factors specific to each individual opportunity and investor goals. While Opportunity Zones can offer potential tax advantages and the opportunity to contribute to community development in economically distressed areas, each project’s success hinges on careful evaluation, thorough due diligence, and selecting projects with strong potential for growth and profitability. Real estate investors must consider factors such as location, type of investment property, market demand, property quality, and the ability to generate rental income or appreciation.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.

More Rental Real Estate Tax Guides

Disclaimer: The information provided on this website does not, and is not intended to, constitute financial advice. As such, all information, content, and materials available on this site are for general informational purposes only. Please review our Editorial Standards for more info.