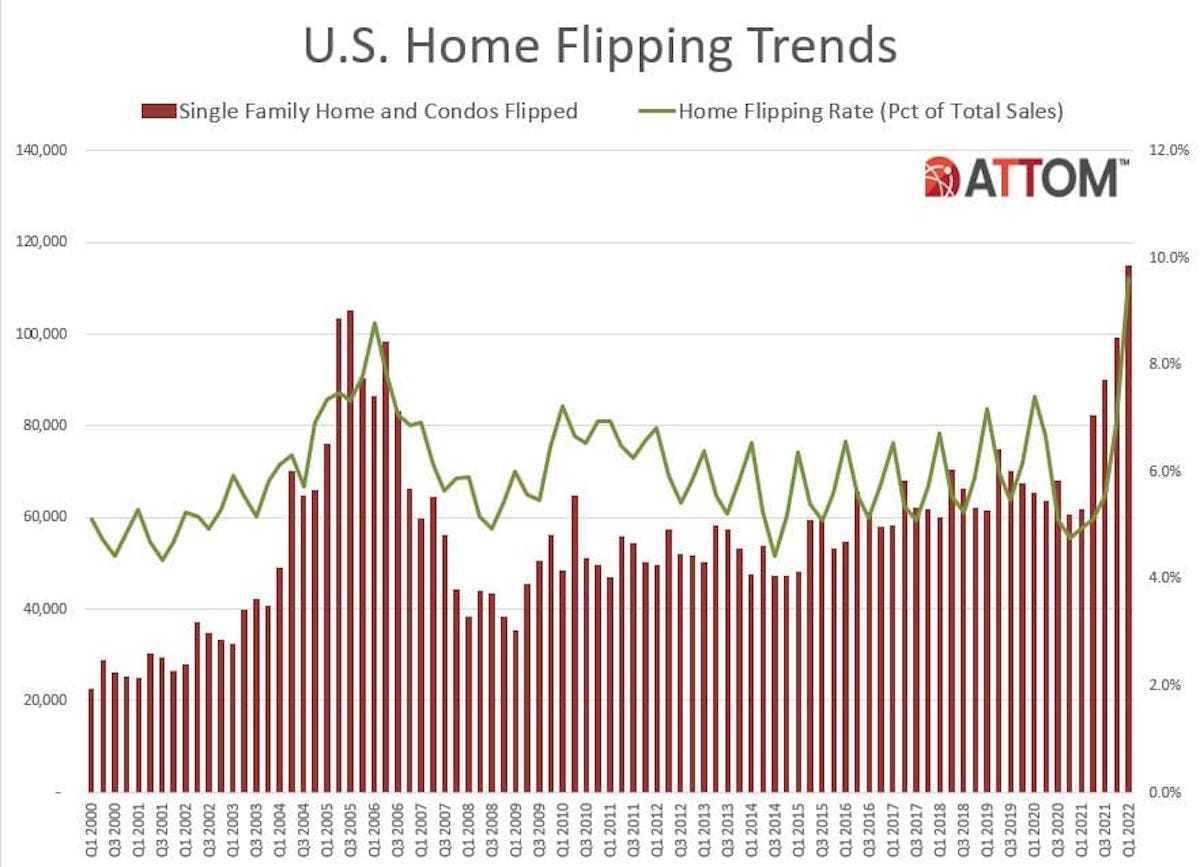

The popular concept of buying a house, fixing it up and reselling it for a profit has grown so much that it apparently now accounts for almost 10% of all home sales in the United States, according to a report by Attom Research.

What is House Flipping?

House Flipping (also called Fix and Flip) is when an investor purchases a distressed property and then rehabs it to sell for a profit. Investors first target and acquire properties that are either priced below market valuations or need substantial updating. From there, an investor will invest in renovating the property to force increased resale value to attract potential buyers. Once rehabbed, the investor lists and markets the property for sale at a premium price that generates a healthy profit for the investor.

How Much Has Flipping Recently Grown?

Flipping has been around for decades but came to immense popularity with hit Television series such as A&E’s Flip This House and other DIY series. As of Q4 2020, the number of estimated home flips was at 4.9%, or 1 in every 20 home sales in the United States. As of Q4 2021, the number of estimated home flips ticked up to 6.9%, or 1 in every 14 home sales in the United States. As of Q1 2022, flips of single family houses and condominiums in the United States were estimated to be 114,706, or 9.6%, or approximately 1 in 10 of all home sales that took place in 2022. When compared to previous years, the rate of house flips represents the greatest jump since the year 2000.

How Much Did Flippers Make?

The report shows that although the amount of flips were up, profits on them remained below where they were a year ago, and profit margins have been steadily decreasing. Among all flips nationwide, the gross profit on typical transactions is estimated to be at $67,000 in Q1 2022. This number is up from $63,500 in Q4 in 2021, but down from $70,000 in Q1 2021. Part of this downward trend can likely be attributed to cooling off resale prices and increased construction materials and labor costs.

“The good news for fix-and-flip investors is that demand remains strong from prospective homebuyers, as evidenced by this quarter’s report, which shows that one of every 10 homes sold during Q1 was a flip,”

Rick Sharga, Executive Vice President of Market Intelligence

Sharga went on the expand with the following “The bad news is that rising mortgage interest rates are beginning to slow down home price appreciation rates, and buyers have become more selective – and less willing to outbid other buyers for properties they’re interested in. This is having a predictable impact on profit margins for investors.”

Where Are The Flips Happening?

Home flipping can take place virtually anywhere, but generally sees the most activity where there are stabilized real estate markets made up primarily of single family houses and large pools of active buyers. These two components can normally be found in major metropolitan areas. The highest number of flipping in major metropolitan areas during Q1 2022 were found to take place in the following areas:

- Phoenix, AZ – 18.7% of all home sales

- Charlotte, NC – 18% of all home sales

- Tucson, AZ – 16.2% of all home sales

- Atlanta, GA – 16.1% of all home sales

- Jacksonville, FL – 16% of all home sales

- Durham, NC – 15.3% of all home sales

- Gainesville, FL – 14.9% of all home sales

- Ogden, UT – 13.9% of all home sales

- Clarksville, TN – 13.4% of all home sales

- Winston-Salem, NC – 13.4% of all home sales

What’s Next For The Future of The Flipping Market?

Flipping real estate has an indefinite future as long as home buyers prefer nice and new homes, and investors are comfortable capitalizing on the opportunities of distressed properties. Recent macroeconomic events and market behavior is showing mixed signals for flip investors and homebuyers. On one hand, real estate prices have flattened out and remained stable, even in light of steep jumps in interest rates. On the other hand, mortgage rate hikes, tight-supply labor market, and skyrocketing material prices from building supply vendors such as Home Depot, all signal that the fix-and-flip market should cool off due to so many economic headwinds. Regardless of what will play out, the broader real estate is set to continue seeing change throughout the rest of 2022 and into 2023.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.