A Seattle based startup called Arrived Homes, just raised another $25 Million from some big name investors to help regular people invest in single-family rental properties through fractional ownership for as little as $100.

The new Series A funding is meant to continue their growth goals and included investors Forerunner Ventures, Bezos Expeditions (Jeff Bezos personal investment firm), Uber CEO Dara Khosrowshahi, former Zillow CEO Spencer Rascoff, and others. Proceeds of the new funding are intended to continue growing its team, add new asset types such as short term rentals, and expand into new markets such as Florida, Texas, Nevada and Indiana.

The startup was launched in 2020 by tech veterans CEO Ryan Frazier, CTO Kenny Cason, and COO Alejandro Chouza. To date, Arrived has fully funded more than 102 properties in 17 cities across Alabama, Arizona, Arkansas, Colorado, Georgia, North Carolina and South Carolina, for a total of over $40 million invested. Homes on the platform are typically turnkey properties that range in price from $165,000 to $650,000. Each property has had an average of 100 to 200 investors; many of those being first-time rental property owners.

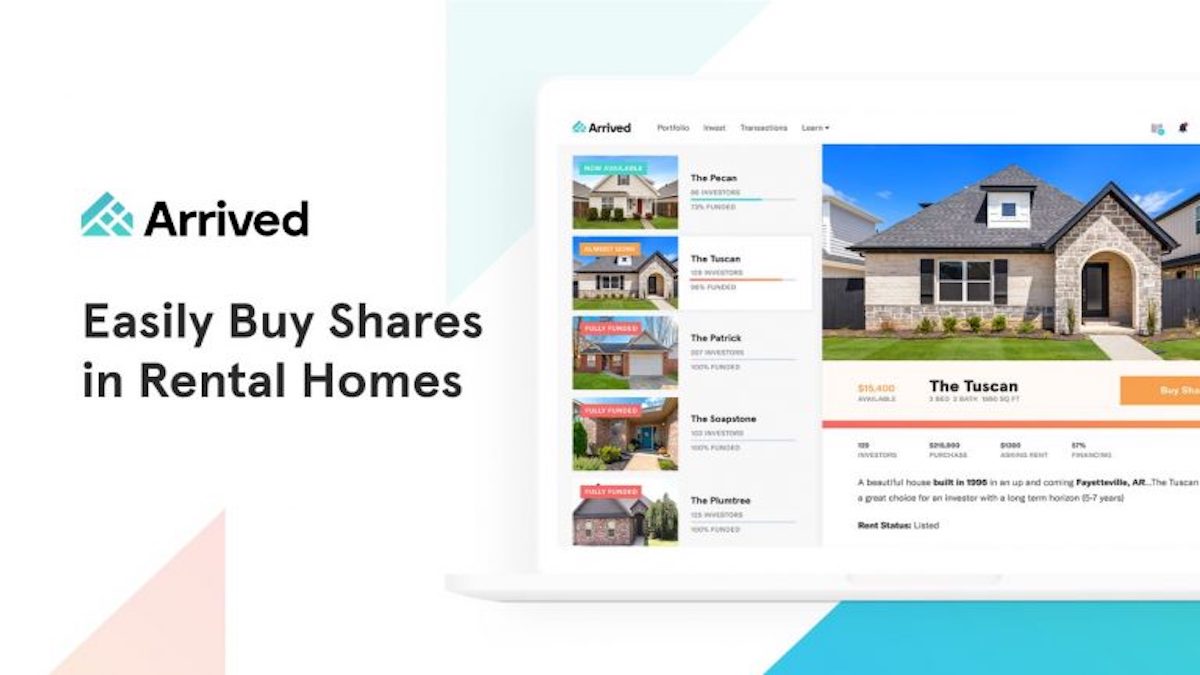

Arrived works by allowing anyone to invest in a rental property in amounts that start at as low as $100 per house. Arrived then acts as the asset manager and partners with local property management companies to find renters and manage the day-to-day rental operations.

Ownership of each house is structured as its own limited liability company (LLC), and all investments are structured as REITS (real estate investment trusts). This means that when a property (i.e. the LLC) enters into a loan agreement, that loan is not in the name of the investors and they do not have to go through a credit check process or be personally liability for the loan. Investors receive their share of rental income through quarterly dividends. After a target hold period, the property is sold and equity is distributed to each investor according to the number of shares they own.

Arrived makes money by charging a sourcing fee in the amount of 3-3.5% for acting as an agent on behalf of the investors. It also charges 1% per year of the equity that’s invested as an asset management fee that gets paid out of rental income.

While several other rental real estate fractional ownership startups are gaining traction, Arrived claims that it is different from others as it is SEC-qualified – See Arrived Homes, LLC SEC Filings.

About the Author

Ryan Nelson

I’m an investor, real estate developer, and property manager with hands-on experience in all types of real estate from single family homes up to hundreds of thousands of square feet of commercial real estate. RentalRealEstate is my mission to create the ultimate real estate investor platform for expert resources, reviews and tools. Learn more about my story.